CARD Act Pushes Credit Card Interest Rates Further Down

That is one of the conclusions of a recent Federal Reserve report on the profitability of credit card operations. One of the interesting findings of the study is that credit card interest rates have been following a downward trajectory long before the first provisions of the CARD Act went into effect in February 2010.

Credit Card Interest Rates Going Down

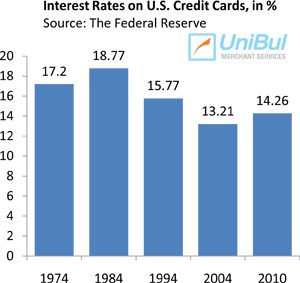

The Fed study provides data on credit card interest rates going back to 1974, when the reported APR is 17.20%. At the end of 2010, the last quarter for which data are available, the rate was 13.67%.

Rates have been fluctuating in the intervening years, but the overall trajectory has been trending downwards. Here is what the Fed researchers have to say on the subject:

Although not precisely comparable from period-to-period because of changes in the sample of reporters, this statistical series reveals a general decline in credit card interest rates in recent years. For example, only 11 percent of the respondents reported interest rates below 16 percent on their largest credit card plan as of September 1991, but 80 percent did so as of January 2011 (the most recent report available). In addition, the proportion of card issuers reporting that they utilize variable-rate pricing has also increased substantially since September 1991. As of September 1991, 23 percent of issuers used variable-rate pricing; as of January 2011, the proportion was 69 percent.

Now, the rise in variable interest rate pricing is not an unexpected phenomenon. In periods of very low interest rates, as the current one, variable-rate card offers look very appealing to consumers, simply because the variable rate is tied to the prime rate, which is loosely calculated using the following rule of thumb:

Now, the rise in variable interest rate pricing is not an unexpected phenomenon. In periods of very low interest rates, as the current one, variable-rate card offers look very appealing to consumers, simply because the variable rate is tied to the prime rate, which is loosely calculated using the following rule of thumb:

U.S. Prime Rate = (The Fed Funds Target Rate + 3).

As the Fed Funds Target Rate is currently at 0% – 0.25%, the prime rate is only 3.25%. However, when the Fed eventually begins to raise its rate, the prime rate and the credit card variable interest rates will be adjusted automatically. So users of such cards can only expect their rates to increase in the future, as the Fed rate cannot go any lower.

The CARD Act Effect

The CARD Act has also contributed to the shift to variable rate pricing and to the falling — at least in the short run — interest rates by introducing restrictions on the way issuers adjust the interest rates on existing balances. As the Fed puts it:

One consequence of the shift to variable-rate pricing is that credit card rates respond more quickly to changes in market interest rates. New regulations limiting the circumstances in which card issuers may reprice outstanding balances create incentives for issuers to continue to migrate to variable-rate pricing… Data from the?áSurvey of Terms of Credit Card Plans finds that the proportion of issuers reporting variable-rate pricing increased from 61 percent in January 2009 to 67 percent in January 2010.

The Takeaway

So the new regulations did influence the issuers’ choice of interest rate type offered on new cards and, as a side effect, as long as the Fed Funds Target Rate is at zero, consumers will benefit from that as well.

Perhaps the biggest impact on credit card interest rates, however, is made by the promotional 0% APR grace periods offered primarily to consumers with high credit scores. For example, I just received an offer from Citibank with a 0% interest for 18 months! If you could get that, you wouldn’t much care about the card’s regular rate. Of course you would have to be careful not to go overboard with your spending, but that’s an entirely separate issue.

Image credit: Mybanktracker.com.