Why the AmEx / Foursquare Mobile Coupon Push Is Good for Merchants

Last week we learned that American Express and Foursquare, a location-based social networking service, have decided to expand their partnership, after “a successful pilot at South by Southwest in March.” The two companies enable users to redeem coupons at merchant locations through their smart phones.

The AmEx / Foursquare coupon partnership offers merchants a much better deal than the likes of Groupon do. Although we don’t know the specifics of each merchant participation agreement, my educated guess is that American Express, as part of its strong push to position itself at the forefront of the fast-growing mobile payments industry, is subsidizing a great deal of the coupons’ value. After all, for AmEx this is just another form of a rewards program. This is definitely not the case with the Groupon deals, which typically cost merchants 50 percent of the already heavily discounted coupon’s value. I could never figure out why any merchant would agree to this.

Why Cardholders Should Love It

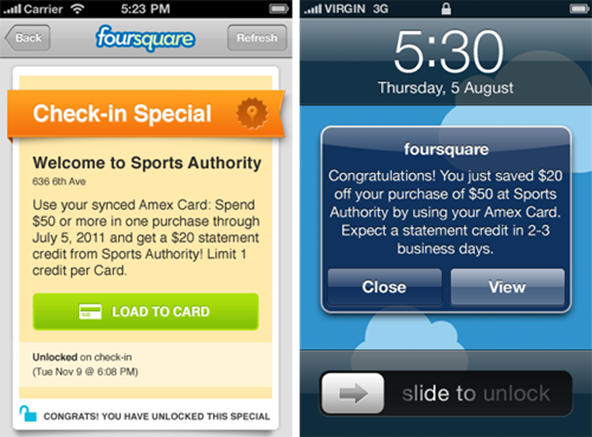

Everyone with an American Express card can sign up for the Foursquare program. Users would need a Foursquare profile, to which to link their cards. Then, whenever there is a deal the user would want to take advantage of, she would “load” the special to her card. After completing the related purchase, the user will receive a credit to her AmEx account.

So, from a cardholder’s point of view, the AmEx / Foursquare deal looks just like a cash-back program, one in which the user can participate on a per-deal basis. What’s more, the deals can be pretty enticing.

For example, AmEx’s current specials include the following:

- $10 off of a $75 purchase at H&M — a 13.3 percent rebate.

- $20 off of a $50 Sports Authority purchase — a 40 percent rebate.

- $15 off of a $100 Union Square Hospitality Group purchase — a 15 percent rebate.

As I said, these are great deals and if I had an AmEx card, I would see no reason not to enroll.

Should Merchants Love It?

The way I see it, merchants should love this program just as much as cardholders should. For example, just yesterday I was in the H&M store on Newbury Street here in Boston and they had a sale going on, with many items discounted by 25 percent or more. I will guess that the AmEx / Foursquare deal will be offered when there is no active sale going on, so that H&M wouldn’t have to add the extra discount on top of the ongoing one. Even if they covered the entire AmEx / Foursquare rebate of 13.3 percent, which I don’t think is the case, that would still be a lower discount than the one offered during their regular sales.

So, by participating in the AmEx / Foursquare program, merchants can potentially get extra traffic to their stores at a lower cost than a traditional sale. Sounds like a good deal to me.

The Takeaway

It seems to me that the jockeying for position in the fledgling mobile commerce and social commerce markets among heavyweights in a range of industries creates opportunities that can and should be exploited by merchants.

American Express, for example, does not want to be seen as lagging behind rivals Visa and MasterCard and will pay way above the odds, if they have to, to appear to be ahead of them. These are companies that have plenty of cash to spend and are not afraid to do it. If I were a merchant with at least some kind of market presence, I would feel good about my bargaining position.

Image credit: Foursquare.com.

One Comment