3 Ways to Fight Fraudulent Chargebacks

We haven’t written anything about fraudulent chargebacks in a long time, even though this is an issue that we know full well is very difficult to deal with. What is particularly pernicious about it is that it plagues mostly businesses that are classified as high-risk anyway, making the status of their credit card processing accounts even more precarious than they already are.

I was reminded of the issue this past week when I had a phone conversation with a merchant providing escort services. (Full disclosure, this is a merchant category that we are unable to service at present). She told me that “one-time clients with no intention of ever booking a second time occasionally exploit the chargeback process,” by filing disputes for “item not received and so forth.” The worst part, however, was that her company’s “privacy policy and discrete billing” made it very difficult to fight these chargebacks. Now, this may be an extreme example, because the merchant is about as high risk as they get, but the principle fully applies to many lower-risk business types.

What Is a Fraudulent Chargeback?

So let’s define what a fraudulent chargeback is, before we move on to the possible ways for fighting them. As the example above suggests, a fraudulent chargeback results from a successful customer dispute of a legitimate transaction, one in which he or she knowingly and purposely participated and for which the customer is fully responsible.

In short, fraudulent chargebacks are initiated by consumers attempting to game the system designed to protect them from fraud and processing errors.

How to Fight Fraudulent Chargebacks?

There used to be a website, called BadCustomer.com, which enabled merchants to list customers filing fraudulent chargebacks in its database. The idea was that merchants could check a new transaction against the BadCustomer.com database and possibly decline orders placed by consumers listed in there. I liked the idea, but I now see that the website is no longer active. If anyone knows what happened to it, please let me know.

So what other tools do you have at your disposal for fighting fraudulent chargebacks? Well, as it usually is the case, it is mostly a matter of designing and implementing a set of best practices. Following is a short list of what you should be doing:

- Keep detailed records of your transactions. This one is critical. You will be getting disputes for totally legitimate transactions. There is no way around that. When you do, you need to be able to re-present the transaction, through your processor, with enough supporting information to leave no doubt of its authenticity. Now, as the example with the escort services merchant clearly indicates, some merchants feel that, in order to be able to attract customers, they need to make the billing process more “discrete,” meaning to collect less information. You should not be doing that. I would argue that, in the long run, you would be better off losing some customers who are not willing to go through the regular checkout process, rather than leaving yourself vulnerable to fraudulent chargebacks by compromising your billing process.

- Call your customer. You just may be able to shame your customer into retracting his dispute. It is worth a shot.

- Use collection efforts. No one likes collection agencies. Consumers dislike them for obvious reasons, while many businesses see them as a sure way to create a public relations disaster. Well, you will have to make a choice. Worse, you may not have a choice. Remember, Visa and MasterCard will suspend your agreement, if your chargeback ratio for any given month exceeds one percent of your total transaction count. However, your processing bank will suspend it way before that. If you decide to use a third-party collection agency, which is probably the better way to go, make sure it is a reputable one, as any customer complaints, resulting from third-party collection efforts, will eventually reflect on your business.

There are limits on how vigorously you can fight fraudulent chargebacks, but you just can’t afford to do nothing. The above suggestions should get you started and if there is something else that has worked particularly well for you, please share it with the rest of us.

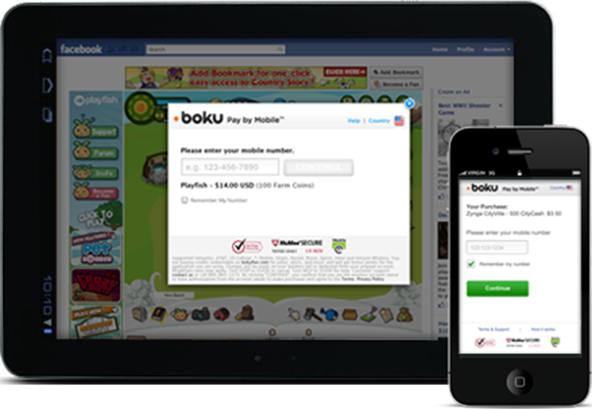

Image credit: Switchcommerce.com.

I have to respectfully disagree with these recommendations. Though there is nothing wrong with them per se, what is listed here is “a pound of cure.”

What is needed is “a penny of prevention.”

1) Dont have your agents handled the credit card information…ever. Have the customer enter it right into your CRM…or better yet right into the payment gateway…using their phone. Customers will know you didn’t take their number and are less likely to submit a fraudulent claim. If they do try to claim they never ordered the product, your process documentation shows that you never had the number and still don’t (if it went right into the payment gateway), so you could not have fraudulently entered it on their behalf. This alone should close the case without you having to call the customer and try to embarrass them.

2) Get the customer to verbally confirm the charges before submitting them and store that recording with the order in the CRM. Again, the customer is deterred from submitting a claim. And again, if the customer questions the charge, send the recording of the recap and the recording of the customer approving the charge to the issuing bank. If the fact that you didn’t have the customer’s CC number and still don’t, their verbal approval of the order should be the coup de grace on this fraudulent claim.

As another ounce of prevention, when you send an email confirmation to the customer of their order, attach the recording of their verbal signature approving the charge. This makes the customer think twice about submitting a fraudulent chargeback when they hear a recording of their voice approving the transaction.

Chargebacks take a huge chunk out of merchant profitability: there is the cost of the goods, the lost revenue and all the effort fighting it. It is high-time to stop being passive about this. Coming up with better ways to fight chargebacks is like coming up with better ways to scrape burnt toast. It is far more effective to figure out a way to stop the toast from burning in the first place.

Dennis Adsit

VP, Continuous Improvement Consulting

KomBea Corporation

As a small merchant selling hand made items that take many days to build, fraudulent chargebacks are really a HUGE thing to deal with. The things mentioned in this blog are really not helpful to be honest. I have had customers who give voice authorization, I ship to the billing address, and they sign paperwork with an attached copy of their drivers license matching their card and billing who have called their bank claiming they never made purchase. In reality, anyone can order anything with their credit card and once they receive the item call their bank and claim it was fraudulent. The bank will immediately refund the customer without question. My only option is to threaten legal action against customer. You can change your phone number so that it looks like a detective is calling the customer. Usually that scares them into not going through with their fraudulent charge back.