How to Identify Fraud in 2011: 10 Suspicious Card-Present Transaction Characteristics

Having reviewed the typical characteristics of e-commerce credit card fraud and offered a strategy on dealing with suspicious online transactions, we can now turn to the altogether easier task of doing the same for face-to-face payments.

There is a caveat, of course. Identifying and preventing card-present fraud is only easier if you develop a sound fraud prevention strategy, train your staff on implementing it consistently and then monitor the results and make adjustments as necessary, which means constantly.

But first things first. Let’s take a look at the typical features that are present in an average fraudulent face-to-face transaction. Once again, as with e-commerce payments, you will need to account for the fact that each of these transaction characteristics can have a perfectly legitimate explanation. Identifying a suspicious transaction feature should serve as a cause for a more in-depth review of its validity, not for an outright decline of the payment. The presence of multiple suspicious characteristics in a single credit card transaction, on the other hand, should be seen as a strong indication of fraud and your organization should have a clear policy on following up in such situations.

With that in mind, here are 5 features that are typically present in such transactions:

- Buying large amounts of merchandise without much attention to details. This is a very strong indicator of fraud! If your customer is making large purchases, without much care for the item’s size, color, or even price, he or she is likely to be interested much more in its resale value than its utility.

- Trying to rush the cashier into a faster processing of the payment. While your customer may really be in a hurry, as we all often are, bullying the cashier into quickly completing a transaction is not something we see all that often. By doing so, your customer may be hoping to force the cashier into circumvent standard fraud prevention procedures. You would not want to delay a legitimate customer any longer than necessary, however you should never forgo established card acceptance procedures, as this is exactly what a criminal’s goal would be. Explain to your customer that you appreciate the fact that they are short on time, but you are responsible for ensuring that all payments are legitimate and cardholders’ interests are protected.

- Making multiple purchases within a short period of time. This is another strong indicator of fraud! If a customer completes a purchase, leaves your store and then comes right back in, he or she may be doing it because they believe that making multiple fraudulent transactions for smaller amounts is less suspicious than making a single large-amount purchase.

- Shopping either right after the store opens or before it closes. This one is tricky and you should not read too much into it, unless it is accompanied by other suspicious features. While any one of us may be shopping early in the morning or late in the evening, because our work schedule would not allow us to do otherwise, a criminal could do it in the hope that the merchant will not be as attentive then as during other stretches of the day.

- Disregarding a free delivery option (where applicable). Some large-ticket items, like furniture, electronics, etc., require delivery and there is often a free option on offer. If your customer completely ignores a free delivery option in favor of one that offers a quicker, but paid, delivery, this could be a warning sign.

So this is my short list of suspicious card-present transaction characteristics. We’ll take a look at what you could do to mitigate the fraud risk such transactions represent in one of my next posts. Before that, if there is anything you believe should be added to my list, share it in the comments below and I will consider it.

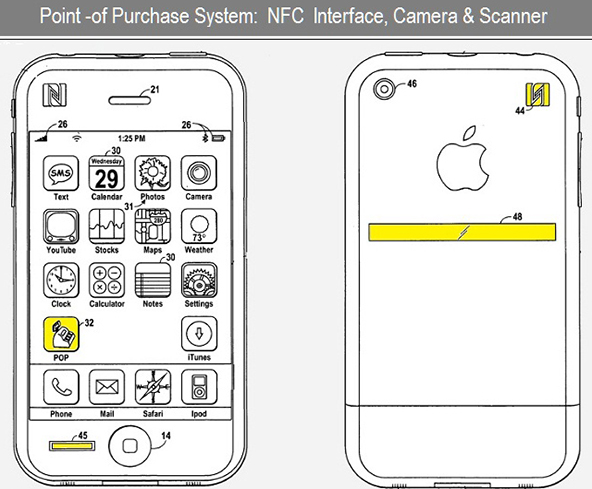

Image credit: Wal-Mart.