Why You Should Use Credit Cards as Debit Cards

A recent TransUnion study has found that the more you pay of your outstanding credit card balance at the end of each month, the lower the probability of you going delinquent on your account. I suspect that the credit bureau’s findings will surprise few readers, but the researchers have gone further than that. Digging into the agency’s vast database, they have used various credit card payment measures to understand how credit card payment behavior correlates to payments on auto loans and mortgages. Sure enough, they find that, in general, making more than the minimum payment on your credit cards each month significantly reduces the likelihood of being late paying your car or mortgage payment.

What struck me while reviewing TransUnion’s results was that the researchers were, whether they realized it or not, making a case for using a credit card like a debit card — only using it when you have enough funds to fully pay off the sales amount. If you did that, you would of course never have to worry about things like delinquencies and defaults, but there is more to it than that. Your credit score would greatly improve over time, which would ensure that you get loans on the best of terms and at the lowest interest rates, which would in turn further lower the probability of being delinquent on any of these loans and so on. But let’s take a look at TransUnion’s findings.

Full vs. Partial Payments

TransUnion finds that four out of ten consumers pay off their entire credit card balance at the end of each month. A third of those paying less than the full amount pay only the minimum owed. The remaining forty percent fall somewhere in between the two extremes.

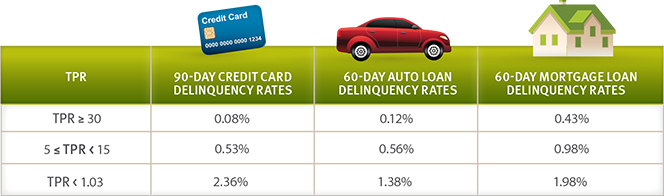

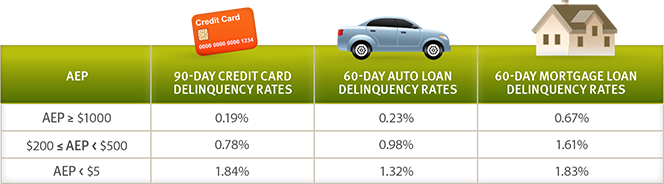

The researchers then proceed to develop a metric — the Total Payment Ratio (TPR) — to enable them to more easily establish the relationship between the amount paid at the end of each month and the delinquency probability on various loan types. The TPR is calculated by dividing a consumer’s payments on all of her credit cards in any time period by the total minimum due in that time period on those cards. So if you paid $1,200 on three credit cards when the aggregate minimum due on those cards was $600, your TPR would be 2.0; if you paid $1,200 when the total minimum due was $200, your TPR would be 6.0. And they find that as the TPR increases, delinquencies decrease on credit cards, auto loans and mortgages.

TransUnion uses another metric — the Aggregate Excess Payment (AEP) — to study the relationship between the payment amount in excess of the minimum due and the delinquency probability on various loan types. AEP is calculated by subtracting the total minimum due on all of a consumer’s cards from the total payments made. As the researchers note, consumers with the same TPR could have very different AEP pro?¡files. For example, if you made $2,000 in payments with a total minimum due of $1,000, your TPR would be 2.0 and your AEP would be $1,000. But if you made $200 in payments when the total minimum due was $100, your TPR would still be 2.0, whereas your AEP would now be only $100. Yet, as seen in the table below, once again there is a strong inverse correlation between the AEP and the delinquency probabilities on the various loan types.

‘Revolvlers’ vs. ‘Transactors’

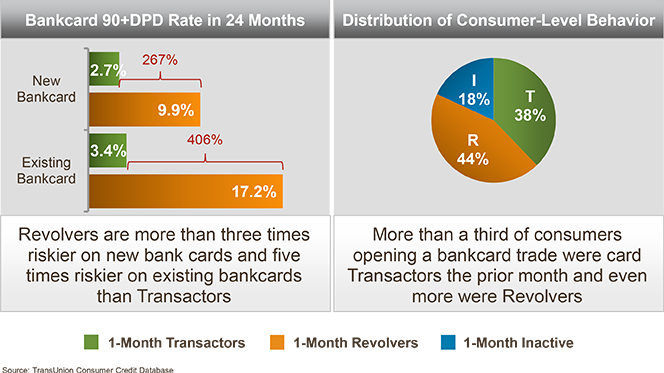

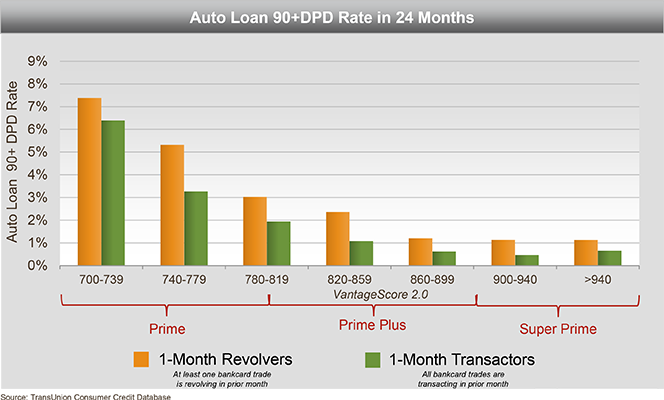

As a co-author of the study notes, “transactors — those consumers who pay off their entire balance each month — are better risks than revolvers, i.e. consumers who only pay a portion of their balance”. The study has quantified just how big of an increase in risk the revolvers represent. As the chart below illustrates, compared to transactors, revolvers are more than three times riskier to be delinquent by 90 days or more on new bank cards and five times riskier to be late with their payments on existing bankcards.

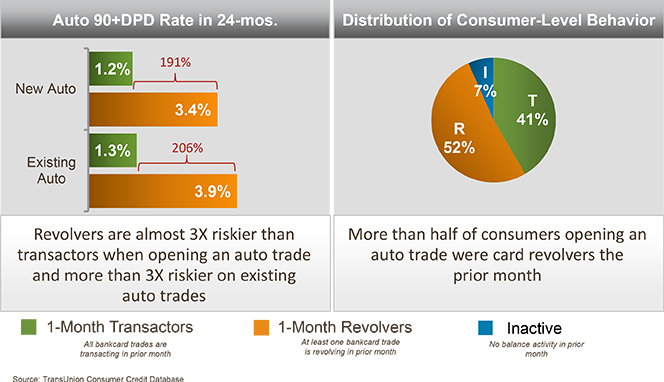

Similarly, revolvers are more than three times riskier to be delinquent by 90 days or more on new autos than transactors, but when it comes to delinquency probability on existing cars, the coefficient is only slightly higher.

Then the researchers have produced a graph to show how their insight about the huge difference in delinquency probability between transactors and revolvers is not captured by traditional credit scores. Here it is:

The Takeaway

Of course, TransUnion’s study is meant to help lenders better estimate the creditworthiness of potential borrowers, but I think that the results are just as useful to the borrowers themselves. If anyone had doubts, the findings should convince him that, in general, paying off credit card balances in full at the end of each month is a much better strategy for consumers than rolling balances from one month to the next. Doing so would be very similar to using a debit card for payment, with the advantage that the funds are not withdrawn from your checking account immediately, but at the end of the month. Moreover, unlike debit card use, your credit card use is a major component of your credit score and by consistently paying off your balances in full each month you will ensure that it is kept high. So why not start doing it?

Image credit: Flickr / Josh Kenzer.