Why Dwolla’s E-Cash Business Model Will Not Work

When I was browsing the news this morning, I came across a press release and a bunch of blog posts about Dwolla, a mobile payments start-up out of Des Moines, IA, which has just reached $1 million in daily transaction volume. Dwolla is rightly proud with the achievement, especially considering, as many have already pointed out, that it had taken them a shorter amount of time to get there than it took the vastly better publicized and capitalized Square.

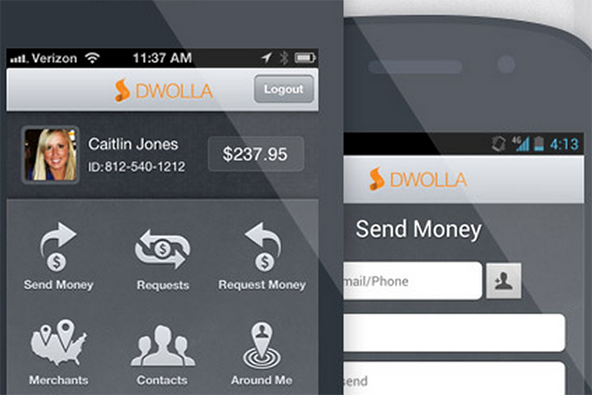

Dwolla is different from the Squares of the (mobile payments) world in that it facilitates electronic cash payments, rather than credit and debit card transactions and I wanted to take a look at how viable its business model is.

How Dwolla Works

Before I get going, I have to say that it was really difficult to get a clear picture of exactly how Dwolla works from visiting the start-up’s website. It could just be me, but I think that the company could do a much better job, and a favor to people like me, if they created a “How Dwolla Works” page and placed a link to it on their home page.

Still, after some digging through the website, I was able to paint a somewhat complete picture (I think) and here it is. Dwolla provides its users with the ability to make e-commerce and person-to-person (P2P) payments directly from their bank accounts.

Online payments can be made to merchants who have signed up for Dwolla and P2P money transfers can be completed only after the recipient creates a Dwolla account (this was something that I never saw explicitly stated on the website), much like how PayPal works. You can link Dwolla to your Facebook and Twitter accounts and send money to your friends there. Dwolla transactions cost $0.25, paid by the recipient.

Dwolla’s Challenges

Most, if not all, of the articles I’ve read about Dwolla praise the start-up as one offering an innovative service and predict a bright future for it. I regret to say that I disagree with both of these assessments. Let me explain.

On the innovation claim there are two aspects of Dwolla’s service that need to be addressed separately. Firstly, online payments using one’s checking account have been available pretty much since the dawn of the e-commerce. All you have to do is provide your debit card information at the checkout and the payment is done. Moreover, with the new limit on debit interchange fees, direct debit card acceptance would cost merchants about the same as what Dwolla charges. So why integrate yet another payment service into your merchant account, if you already have the capability it offers?

Secondly, P2P money transfers have long been provided to consumers by the likes of PayPal, admittedly at a higher cost than Dwolla. However, Bank of America allows me to make money transfers to other BofA customers and make payments for free. Most other banks offer the same service. Moreover, JPMorgan Chase, Bank of America and Wells Fargo have opened up their systems by creating a joint venture, called clearXchange, that will make interbank P2P transfers easier and faster. I think Dwolla will have a very hard time competing with such platforms, as they evolve.

But it is something else that makes me really question the future of Dwolla and similar services and curiously I haven’t read about it anywhere — the fees they charge. At $0.25 per transaction, you would need many millions of them to make any kind of profit that would justify the effort. A million transactions, which could be what the start-up is currently processing monthly, only translate into $250,000 in revenues. The problem is that Dwolla cannot charge more than that; banks are doing it for free!

The Takeaway

I am quite skeptical about Dwolla’s prospects. I just don’t think that its business model, in its present form, would allow the start-up to achieve any significant scale. Their only chance, as I see it, is to quickly sign up as many banks as they can (Dwolla says they have currently signed up 15) and let them use their technology. The problem is that banks are already developing their own system and JPMorgan Chase, Bank of America and Wells Fargo have said that clearXchange will be open to other banks. To make matters worse for Dwolla, PayPal is spending heavily on its own P2P platform and it already has built a huge customer base and online presence.

So I think that the start-up should prepare itself for a long, hard slog.

Image credit: Dwolla.com.

You completely skipped over the key ingredient. Funds received are available for spending instantaneously.

Not “next day”, not “same day”, not “within minutes’ — but instead “instantaneous”.

If ClearXChange will provide that, then they might make a formidable competitor.

The other two ingredients are low cost ($0.25) and non-reversible (albeit that was just clarified to say that in cases of fraud, chargebacks may occur).

Hello,

Yes, I have no doubt that Dwolla’s service works as advertised (although the start-up should do a better job in explaining it on their website). Otherwise people would not be using it. However, that does not take anything away from the points I made.

The pricing argument is well covered in the article. As far as the non-reversible part is concerned, as you say, fraud and chargebacks does get in the way, just as with credit cards. Moreover, with time Dwolla will learn, if it hasn’t already, that when a consumer requests a refund for a purchase, the request should be seriously considered.

“The other two ingredients are low cost ($0.25) and non-reversible (albeit that was just clarified to say that in cases of fraud, chargebacks may occur).”

Dwolla has specifically not limited chargebacks to only cases where there is fraud. For example, when the sender’s bank recalls the transfer due to insufficient funds. Or when Dwolla’s arbitration service determines a chargeback is appropriate, such as if a merchant cannot provide a service even if there was no fraud. In fact, Dwolla now has a long list of circumstances under which a payment to a merchant can be reversed. Fraud is only one of them.

Dwolla payments are reversible. Period.

Well, if that is the case, Dwolla has already implemented the refund procedures followed by credit card processors, which doesn’t surprise me. You just can’t ignore customer refund requests offhand; otherwise you’d be inviting legal trouble.

I don’t want to be bashing the start-up too much, though. I hope they do well, but their business model needs to be seriously rethought.

More important is the key point you have all missed! Dwolla does indeed process chargebacks(even after stating before that they didn’t). Talk about FRAUD my friends!

I just tried to set up a Dwolla account. They get your name, email, address and phone number. Then they do the email verification thing. Then you’re at the login page. Then they say send us a photo id! Apparently they think I have an electronic photo id – something I’ve never even heard of… I do my banking online – direct deposits, online bill payments, borrowing and repaying money. The bank has never asked me to upload a photo id to them. Neither has any merchant I’ve ever dealt with. Dwolla is indeed an epic fail.

Part of this comment has been removed. Please respect other readers and keep comments clean, so that we don’t have to do it again.

I’ve recently setup a websites to process league registrations fees which Dwolla as an option (along with Paypal or offline via check. PalPal fees? 2.9% + $0.30 per transaction which = $8.50 per person. Dwolla fees? $0.25. Awesome. Go Dwolla.

The article mentions that paying via Debit is the same as Dwolla??? Incorrect, Debit cards are not the same as paying via Dwolla. When you use a debit card it still gets processed by the Visa network (or a competitor) and the merchant pays those fees (which means YOU pay those fees). Dwolla short circuits this process and does a bank-acccount-to-bank-account transaction (“ACH”) which is the same as your direct deposit payroll “check.” Again, awesome job Dwolla.

Another comment on the articles assessment that needs to be addressed…”At $0.25 per transaction, you would need many millions of them to make any kind of profit that would justify the effort. A million transactions, which could be what the start-up is currently processing monthly, only translate into $250,000 in revenues. The problem is that Dwolla cannot charge more than that; banks are doing it for free!” Ummm, so Dwolla isn’t viable because it offers exceptional value to the customer??? $250K per month for a handful of geeks? More than enough to buy a new MacBook Air weekly and bottomless mountain dew. And Dwolla isn’t viable because banks are already doing “this” for free??? Not sure what “it” means – banks don’t do anything for free which is why Dwolla was created. Again, awesome job Dwolla.

You wrote: “I have to say that it was really difficult to get a clear picture of exactly how Dwolla works from visiting the start- up’s website.”

I was hoping for a clear explanation of the inner workings myself. I highly suspect they are being very cautious as to not reveal too much, out of fear that others will steal their idea, their architecture and their business model. I don’t think their idea is something that could be patented or copy-righted.

And admittedly the first thing that went trough my head as I started reading the article was- “Is there any way I could steal this idea or do something similar.” I have a long thought about launching a start-up that would take on Western Union and the money x-fer industry. I’m curious if they are also considering this market.

Great article, but I think you could be missing something.

Visa/MC/Amex/Discover and the whole Merchant Processing Industry have been tucking retailers and other businesses for years. Collectively, this payment enterprise has engendered an enormous amount of ill will and discontent from merchants.

When the business community realizes they are no longer beholden to these payment gangs, they will run to providers like Dwolla in an instant.

What is not to love?

Cheaper and faster payment processing and you can stick it to the merchant companies too?

That is a no brainer!

Save your Dollars, Go for Dwolla! Dwolla! Dwolla!!

There is so much pent-up frustration because most business people think that a customer’s purchase money belongs to them…they resent feeling like their money is being skimmed.

As a business owner, I would gladly accept Dwolla all day long and would be thrilled to kiss the other providers goodbye!

Go Dwolla!

The angle they need to creatively exploit is for merchants to stop being ripped off, but getting consumers to want to pay with Dwolla will be a bigger challenge…Why pay with Dwolla when I can more safely pay with a credit card? — will be the question on most consumer’s minds.

Of course, if the ACH system raises fees…that could be a big problem for Dwolla, no?

I do not understand how they transfer funds between banks? Is the Dwolla platform directly connected to 15 banks booking systems so Dwolla can book the transactions directly in realtime? What about clearing and settlement in central bank money which the regulators strongly recommend?

How are they going to comply with the patriot act regarding bsa/aml? I am sure their little banks and credit unions are having difficulty understanding the complexity of the patriot act and once the regulator comes and looks at this it will be the end of dwolla.

competing against the big banks is going to be impossible. None of the top banks in the us will sign up for this service. it may exist, but it will never be a real player.

Eh, they talked directly with the Federal Reserve before they even started building their network. It wasn’t legal before they built what they did. They also have investors and mentors involved inside the company like the Members Group that make sure they’re following all guidelines.

Sure banks will sign up! FiSync (INSTANT money transfers between banks) is free to them. Once more people become aware of how revolutionary FiSync is, then they will want to switch to banks that offer it. Banks will be losing customers if they don’t offer FiSync, so they will give in.

Dwolla has endless possibilities. A lot of the advantages are for the merchant rather than the end consumer right now. The key to their business is to get buy in from the consumer, I think that alone comes down to a merchant’s marketing ability. With large credit card transaction fees many merchants try to offer some sort of bonus for paying with cash, I’m sure they could do the same with Dwolla. There is a huge B2B aspect here being lost as well, when that merchant has to pay someone else, they can get them to sign up for dwolla and send the cash to their account and that person is still only paying the 25 cent transaction cost compared to something that would be considerably higher via credit card or if they wired the money. It definitely has a payroll – direct deposit aspect that is much cheaper than any bank offers a company.

One last thing this article neglects is that it Dwolla may have competition from banks with their transferring money to outside bank accounts, however is that ever going to be integrated from a business standpoint? Dwolla has the merchant, P2P, B2B and end consumer all in mind. The Banks and credit card companies (including paypal) only have themselves in mind.

Seems like the author of this article doesn’t fully understand Dwolla vs. debit cards. For a better explanation, read Business Insider interview with Dwolla founder Ben Milne: http://www.businessinsider.com/this-28-year-old-is-making-sure-credit-cards-wont-exist-in-the-next-few-years-2011-11

Also, I have a BoA acct too, but free money transfers are only available to other BoA clients, as you mentioned. What happens when I want to send money to my uncle in Texas who only has a credit union account or a family friend in Cairo, Egypt? These are my real life scenarios. These are the reasons I’ve started using Dwolla.

Just a few updated facts on Dwolla…you make the connection to the original post’s validity/accuracy/vision:

Dwolla’s fee has now gone to zero if a transaction is under $10, and the fee remains only 25 cents if a transaction is over $10. Dwolla is a “Top 10 Tech Company” rated by http://www.readwriteweb. Ben Milne is a finance “30 Under 30” as rated by Forbes. They are rumored to have just closed a $10 million round by Union Square. Ben’s turned down over 700 other investors. Milne has publicly stated that he has Visa as his disruption candidate of choice. Dwolla also offers a credit line up to $500…how long until it goes up to $5,000? Visa’s Debit and Credit transactions for 2011 were about $1.8 trillion. The Credit Card industry had $48 billion in revenues in 2011.

Troy,

This is a thoughtful comment and similar points have been made both here and in a torrent of tweets coming our way. However, it is also somewhat tangential to the issue at hand. I thought I’d made this clear, but evidently I’ve failed, so let me try it again. This post is about the viability of Dwolla’s business model (as stated in the post’s title) and not about the quality of the service provided or anything else. That is not to say that comments on these issues or any other Dwolla-related topic are not welcome, on the contrary. However, you are giving me nothing that could cause me to reconsider my original analysis, which is what you are asking of me.

I recall when PayPal was free. Heck, they even sent me $5 to simply USE it. Their business plan was to cash in on interest they held until you decided to pull it out of your Paypal account. That didn’t last long. To the author’s point, there is insufficient revenue being generated here to sustain this kind of model without some sort of advertising revenue or increase in fees.

Cameron,

That is precisely my point and I think that advertising is a no more plausible revenue source than charging higher fees is.

This article does not hold up anymore. Dwolla was recently given an additional $5 million dollars by their investment group. Still think their business model is a failure? Apparently the group of investors that shelled out 5 mil don?ÇÖt. In fact, this company is quite successful and a great way to break the chains of PayPal and their horrific policies that serve no one but PayPal. As an investor for more than 15 years I fail to see how Dwolla?ÇÖs business model sets them up to lose. Anyhow, it?ÇÖs kind of a moot point anymore. You don?ÇÖt get an additional 5 million if your business is a failure.

Big Rich,

I do hope that the Dwolla investors will at the end make profit on their investment. But I just don?ÇÖt see how the fact that a company has managed to get funding proves by itself that its business model is viable. I think you would agree that there have been plenty of examples proving otherwise. Anyway, read our latest post on the subject at http://blog.unibulmerchantservices.com/barclays-pingit-shows-why-dwolla-like-start-ups-stand-no-chance and let us know what you think.

As a small merchant the era of a dedicated merchant processing machine is over. There are two technologies that are pinning down the old vs the new world. Or maybe better the transition from the old world Transitional=SquareUp.com to the New=Dwolla.com . SquareUp bridges the creditCard/debitCard old world with a slick reader that works on iOS and Android platforms. And with SquareUp wallet the consumer does not have get out the plastic. For small merchants that are even more sensitive to interchange fees, Dwolla anchors the future, 25cents flat rate. For customers that need the ability borrow money at credit card rates then SquareUp is the solution. SquareUp and Dwolla are excellent anchor platforms for small merchants. For consumers you will still need to carry plastic as many merchants for the foreseeable future will still be swiping plastic. Both Dwolla and SquareUp need to have decals for the doors and the point-of-sale counter, this will trigger many consumers to leave the plastic in their wallet and use the smartPhone they have in their hands.

As for the consumer they are already in payment fatigue with everyone trying to get them to install an app, which will facilitate payment. Will consumers load SquareUp wallet because their favorite coffee shop takes it, likely. Ditto for Dwolla. Or any of the big boy solutions. This is merchant frequency payment loyalty. But a consumer will need to frequent that merchant to go through the friction of loading the App, learning it, learning how to process a payment, etc. But the big boys are making a mess of touchless swiping with the likes of MasterCard PayPass, Visa Vivopay, Google Wallet, and the what ever Verizon solution, all these competing solutions will vex any large or small retailer with a myriad of hardware and technologies as each tries to be the solution, with the one point-of-sale machine that inter-operates with all vendors years off.

I’ve no idea what the future holds for Dwolla and you may be right that its business model is not viable in the long run, but as a user I like it a lot. It’s simple, it’s cheap and it’s reliable.

How are they gonna make money???? $1,000,000 per month. lets just say each transaction is $100. That’s only 10,000 transactions a month X .25 is a whopping $2,500 dollars a month.

I should have done more research, I found an article that said Dwolla is on pace to do $350 million this year which is pretty decent, but it really depends on how many transactions are going through.

How are they gonna make money???? $1,000,000 per month. lets just say each transaction is $100. That?ÇÖs only 10,000 transactions a month X .25 is a whopping $2,500 dollars a month.

Yes because I and the rest of the world spend $100 for each purchase at a small business.

One thing you missed is the micropayment angle. The fact that Dwolla charges nothing for transactions under $10 makes it quite attractive to site owners. Say I write a blog post, then put a “Tip me a Dwolla” button on it so that if someone finds it helpful, and they have a dwolla account, tipping a dollar costs me nothing, and the tipper nothing.

Something to be said for that.

I think you underestimated Dwolla… “This past fall, Dwolla partnered with one of the leading mobile banking service providers, mFoundry, and their mobile banking product, Fin.X. ”

http://blog.dwolla.com/p2p-the-next-big-revenue-opportunity-for-banks/

Dwolla provides a layer of protection for both the seller and buyer. Neither of them have to disclose their bank name or account number. When selling something to someone in another country that can be helpful. Would you agree?

Allan,

How does your observation bear on anything my piece is about?

Dwolla has evolved quite a bit since this post has been published. I think that you should revisit the issue and if you did so you would probably change your mind about their prospects. They’ve done quite well for themselves.

The generic “p2p” idea of sending money to your friends, is stupid from Dwolla’s perspective. Paypal does this for free if you link your bank account to your paypal account (extremely similar process to Dwolla, just a little easier on Paypal. I recently found a good deal on DealsCube, and had to pay via Dwolla. Now THAT, makes sense. Buyers, sellers, and ebay-wannabes like DealsCube can all save money.

Could be worth a revisit on this post..

When was this posted? I don’t see a date on the article or when the comments were made. Serious blog post fail (unless I’m just missing it). Would like to see an update because I might agree with the analysis, especially since the rise of Zelle seems to be a formidable opponent.

I suspect they initiate ACH transactions via their partners: BBVA USA and Veridian. But that brings up another cost: ACH origination fees that the banks would be charging Dwolla. That’s another cut into that $.25 per transaction.