Why Do Americans Like AmEx and Discover Better than MasterCard and Visa?

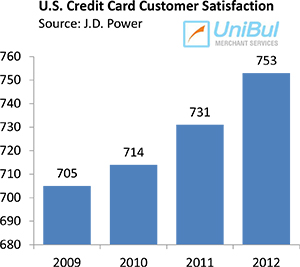

American Express was ranked highest among the biggest credit card companies in J.D. Power and Associates’ Credit Card Customer Satisfaction study for a sixth year in a row, with Discover once again finishing a close second. Overall, American consumers’ satisfaction with their credit cards has improved for a third consecutive year, following a decline in 2009, we learn.

Once again, the study shows that the big banks that are issuing the MasterCard- and Visa-branded credit cards are lagging far behind the two leaders. Last year we mused over the possible causes for the discrepancy and got some help from the study’s author. As data accumulate, evidence is piling up that the simplified transaction process, associated with American Express and Discover payments, as compared to Visa and MasterCard ones, is indeed benefiting these two companies. Let’s take a look at the latest survey.

Once again, AmEx Is Best in Satisfying Customers, HSBC — Worst

J.D. Power and Associates is using six broad factors in measuring consumer satisfaction with credit cards: interaction, credit card terms, billing and payment process, rewards, benefits and services and problem resolution. The average industry score for 2012 was calculated at 753 on a 1,000-point scale, up from 731 in 2011, which itself was an improvement on 2010’s score of 714 and on 2009 score of 705.

J.D. Power and Associates is using six broad factors in measuring consumer satisfaction with credit cards: interaction, credit card terms, billing and payment process, rewards, benefits and services and problem resolution. The average industry score for 2012 was calculated at 753 on a 1,000-point scale, up from 731 in 2011, which itself was an improvement on 2010’s score of 714 and on 2009 score of 705.

American Express topped the list with 807 points, ahead of Discover, which scored 799. Just as was the case last year, Chase and Barclaycard are the only other card companies with an above-average score. GE Capital Retail Bank ranks second to last with a score of 704, marginally ahead of HSBC, which is once again the worst-ranking issuer.

Overall, consumer satisfaction has improved across all measurements, we learn. The biggest improvement — by 31 points — was recorded in the “problem resolution” segment of the survey:

Credit card companies have significantly improved handling customer problems year over year. Issuers have reduced the average length of time to resolve problems in 2012 to four days from five days in 2011. In addition, the study finds that credit card representatives are more likely to provide time frames for resolution, and those time frames are more likely to be met in 2012, compared with 2011.

A majority (84%) of credit card customers had their problems resolved in 2012, up from 82 percent in 2011. In addition, 61 percent of customers had their problems resolved in the first contact.

Looking at these numbers, Jim Miller, senior director of banking services at J.D. Power and Associates, concludes that the issuers have done well:

It is evident in the 2012 study that credit card companies have really done a great job in handling problems and achieving quicker resolution.

I see no reason to disagree with Miller’s assessment.

Why Are AmEx and Discover Doing so much Better?

As we noted last year, at least part of the explanation for American Express’ and Discover’s ability to put such a distance between themselves and the issuers of MasterCard and Visa cards must be the fact that they act as both issuers of their cards and processors of their transactions. In contrast, all other companies in J.D. Power and Associates’ list issue Visa- and MasterCard-branded cards whose transactions can be processed by any other Visa or MasterCard member.

Being able to both issue your cards and process your transactions is significant, because it makes it much easier to address your customers’ inquiries and resolve disputes, as you don’t need to turn to another bank for assistance. The complete control that American Express and Discover have over the whole card payment process would directly affect the interaction, billing and payment process and problem resolution categories in J.D. Power and Associates’ survey and that could be enough to account for the results.

But there is more. Michael Beird, who conducted the study last year, told UniBul that:

In the years I have been running this research, a few other more salient aspects emerge which sets these issuers [American Express and Discover] apart from the VISA/MC crowd:

1) American Express and Discover overcommunicate: AmEx and Discover both leverage multiple communication channels (mail, email, collateral, statements, website, etc.) to inform of changes, new products/services and drive home relatively simple, focused messages on an ongoing basis.

2) Their customers have a better grasp of what they get by being a customer: AmEx customers, for example, state they get over 5 benefits from their card, versus only 3.3 benefits with other cardholders. This is key when it comes time to pay the annual fee.

3) Strong brand image: Both AmEx and Discover excel in JD Power’s assessment of brand image. Measured across 7 attributes, both companies average over .5 points higher (on a 7 point scale) than with VISA/MC. This customer view of the companies of being more customer focused, proactive, friendly AND financial stable is critical to sustaining high marks in overall satisfaction and customer commitment.

So AmEx and Discover seem to outperform Visa and MasterCard issuers across the board.

The Takeaway

So the JD Power data paint a compelling picture of the dominance achieved by American Express and Discover over their rivals, at least in the eyes of consumers. But it’s important to note that all issuers have scored better in this year’s survey than they did last year. The study’s authors put the across-the-board improvement down to the “stability in the credit card industry”, following “several years of dramatic changes due to legislation”. There may be something to that, but I think that at least as big a part has been played by the vast improvement in the performance of the issuers’ portfolios. Over the past few years, credit card delinquency and charge-off rates have been in a free fall and both indices are now in record-low territory. And when fewer people are behind on their payments, there will be fewer stern notices demanding immediate payments and threatening of unpleasant consequences otherwise. Whoever receives such a letter is unlikely to give a positive review of the issuer, whatever the specific questions may be, isn’t she?

Image credit: Flickr / Images_of_Money.