What Leaky Ducts, Bank Text Alerts and Mobile Payments Have in Common

Well, according to a recent Federal Reserve survey, all of these activities constitute mobile banking. Using your phone to locate the nearest ATM is also banking, we learn. I’ve long had an issue with the prevailing definitions of mobile banking and mobile shopping and they still just don’t make sense to me.

The way I see it, both banking and shopping have to do with moving money from one place to another. It’s really that simple to me. The act of accessing your account (through your phone or otherwise) to check your balance or just because you have nothing better to do is not banking, it’s information gathering. And the same applies to receiving text alerts reminding you that you had scheduled a rent payment for tomorrow. Yes, the text is a service provided by your bank, but it is not a financial one. Let me put it this way: if you had signed up for, say, a Bank of America newsletter, you could learn, among many, many other things, how to stop leaky ducts and how to keep your attic cool. This is incredibly valuable information indeed, but is it banking?

The definition issues aside, the Fed survey does provide plenty of interesting data on how consumers use their mobile phones to interact with their financial institutions and it’s worth a look.

How Americans Use Their Phones to Interact with Banks

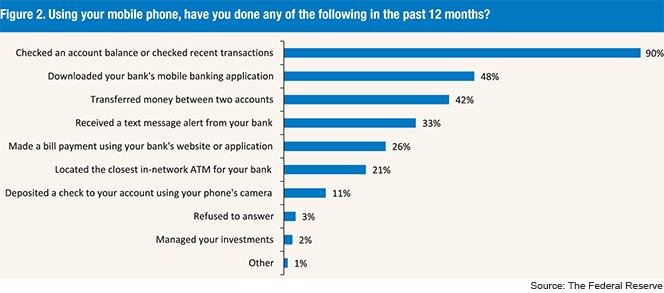

About a fifth (21 percent) of mobile phone users told the researchers that they had used mobile banking in the preceding 12 months. By a very wide margin, the checking of account balances and recent transactions was the most common “mobile banking” activity. Here is the full list:

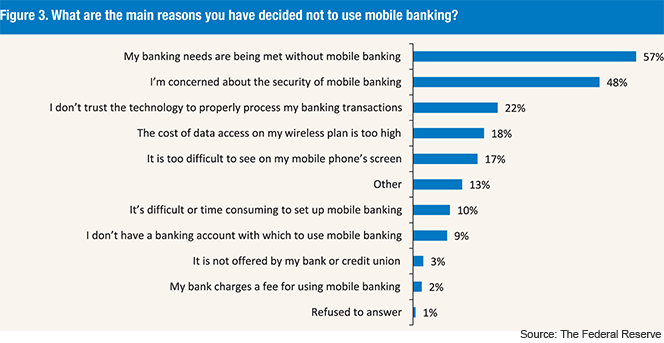

But what kept the other 79 percent of respondents from using “mobile banking”? Well, a majority (57 percent) responded that they had their banking needs met in some other way. Here is the full list:

Unsurprisingly, the researchers found that younger consumers (18 – 29 years old) were the most avid “mobile bankers,” comprising 44 percent of all “mobile banking” users, even as they only make up 22 percent of all mobile phone users.

12% of Americans Have Made a Mobile Payment

The Fed defines mobile payments as

purchases, bill payments, charitable donations, payments to another person, or any other payments made using a mobile phone. Mobile payments can be used by accessing a web page through the web browser on your mobile device, by sending a text message (SMS), or by using a downloadable application on your mobile device. The amount of the payment may be applied to your phone bill (for example, Red Cross text message donation), charged to your credit card, or withdrawn directly from your bank account.

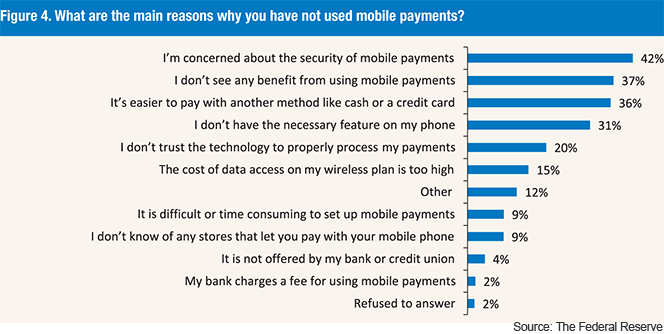

That is a much more sensible definition that the one for mobile banking. Only 12 percent of mobile phone users told the researchers that they had made a mobile payment in the past 12 months. What were the reasons for the low participation? Security turns out to be the biggest issue, but there are many others close behind it:

Close to a half of the consumers (47 percent) who did make at least one mobile payment paid a bill and 36 percent of them made an online purchase. As with “mobile banking,” younger consumers (18 – 29 years old) were by far the most active users of mobile payments, making up 37 percent of the total, while comprising 22 percent of all mobile phone users.

The Takeaway

When evaluating these numbers, one should keep in mind the fact that most mobile payment technologies are still in their infancy. Google Wallet, for example, which relies on near-field communication (NFC) technology to transmit payment information, was only launched in September of last year and there are still only two phones that support it. Its biggest rival – Isis – hasn’t even launched yet. By the end of this year, however, the vast majority, if not all, of the new smart phone models will support NFC. That, coupled with the ever wider adoption of smart phones by Americans, will give a boost to NFC-based and other mobile payment platforms.

At the same time, thanks to Square, Americans have become much more comfortable using their phones to accept credit cards for payment and to swipe their own cards through a reader attached to someone else’s phone. And now that PayPal has launched a very appealing Square-like service of its own, that process will accelerate even further.

So I don’t think I will take a huge gamble by predicting that the rate of adoption of both mobile banking (whatever the definition) and mobile payments will accelerate this year. That will be the case even if the security concerns with some of the technologies prove to be well-founded. We already saw how quickly Google dealt with the PIN vulnerability issue of its Wallet and everyone took the story in stride. So why should we expect that any future security glitches will be treated any differently?

Image credit: Aurigaepayment.se.

I think this study would be better if it covered mobile payment security rather than just polling people. We need to know if mobile banking is safe and what we should do to protect ourselves.

I just don’t see why I would need to have access to my bank information at all time through my phone. I can’t think of anything that can’t wait for a couple of hours or so until I get to my laptop.

Mobile banking platform is simple, secure and efficient, and will allow customers to effortlessly integrate their everyday banking with other daily tasks.Mobile Banking, which allows members to access account information, view transaction history, transfer funds, make bill payments and find branch or ATM locations.