What Is the Most Popular Type of Mobile Payment?

It may not be as glamorous as Square‘s mobile phone-based credit card acceptance service, nor as well-funded as the NFC technology-powered Google Wallet and Isis, but the unimaginatively-named “direct carrier billing” approach to mobile payments beats them handily in market penetration, if not in attracting media attention. And here at UniBul, we are as guilty as anyone in failing to cover the goings-on in the carrier-billing world. In fact, a quick search tells me that, excluding M-Pesa, which is a special case, the last time we wrote on the subject was about two and a half years ago.

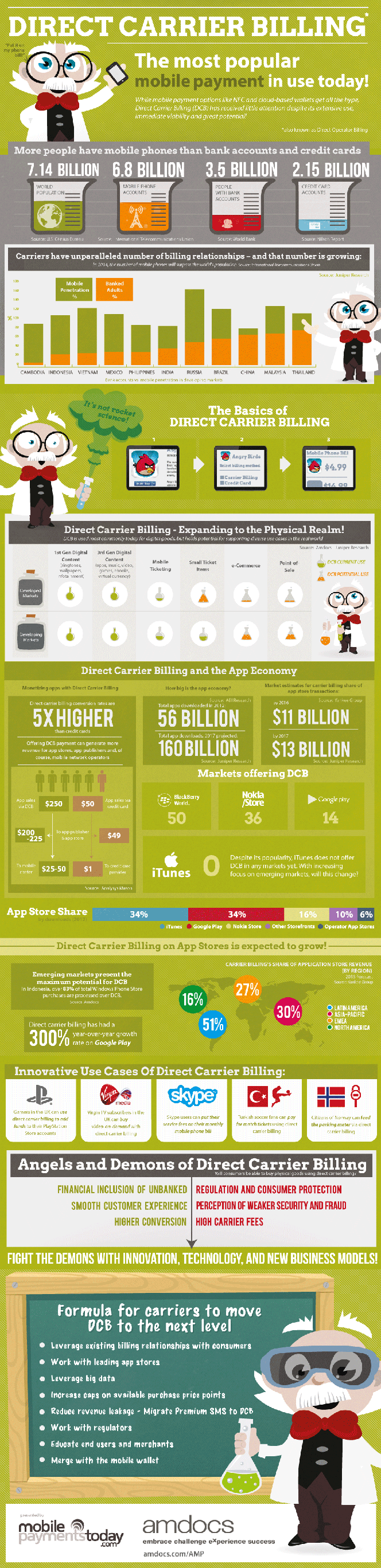

Well, this morning I came upon a recent infographic, produced by Mobile Payments Today, which reminded me that direct carrier billing is still very much around and doing better than ever. The technology offers a convenient way for developers to get paid for their apps, the authors remind us, and its growth is spurred by the fast adoption of smartphones around the world. Furthermore, direct carrier billing is “especially useful to people who lack access to basic financial services, such as consumers in developing markets or younger consumers without bank or credit accounts”. The authors tell us that in some countries carrier billing is used by people to pay for things “such as ticketing and feeding parking meters”. And this blogger can confirm that — I’ve fed a parking meter in a European country with my phone and had the fee charged to my phone bill. But let’s take a look at the graph — it is a beautiful one.

How Direct Carrier Billing Works

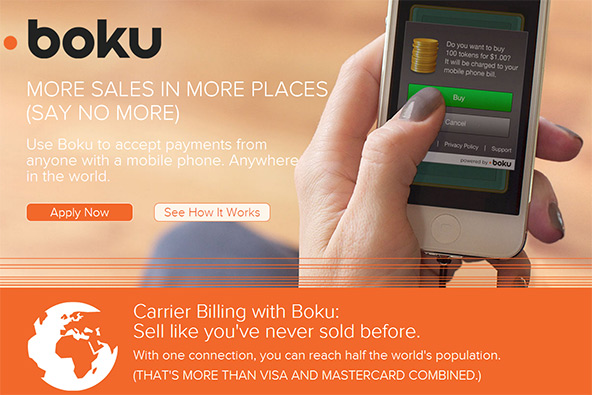

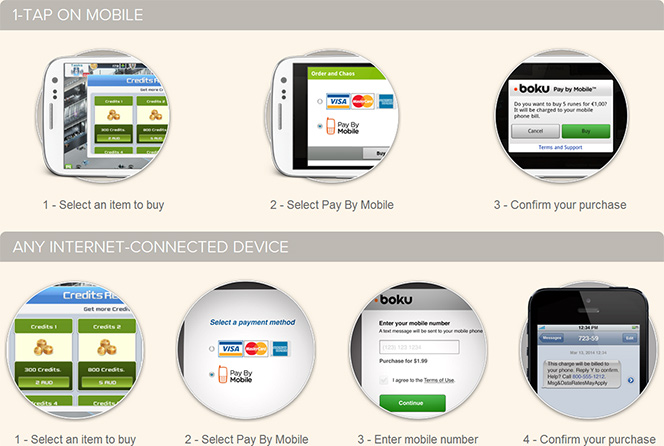

First, though, let’s briefly review how carrier-billing services work. I will use as an example Boku, which is the biggest direct billing specialist. Boku enables users to make payments online, at participating websites, by entering their cell phone numbers at the checkout. Then Boku sends you an SMS, asking you to confirm the transaction. You reply with a “Y” and you are done. The sales amount is then added to your monthly phone bill. Here is Boku’s own visual representation of the transaction process:

By all appearances, Boku seems to be doing well. As early as August 2011, the company was claiming to operate in “60 + countries with more than 220 different carriers”. Now Boku boasts that the number of carriers has increased to 260 and that it is “the only carrier billing company that can offer you the advantage of partnerships with every major global carrier group”.

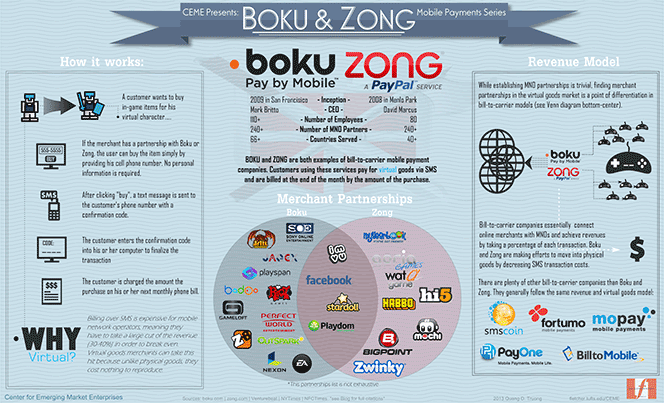

Here is a more detailed representation of the direct carrier (or “bill-to-mobile”, as they call it here) approach, replete with a head-to-head comparison between Boku and its biggest rival — PayPal’s Zong (click on the image to enlarge it).

As we’ve previously noted, there are two big reasons for the direct carrier billers success with selling virtual products. The first is that such products are purchased primarily by young consumers who typically have no other payment options available to them. The other reason is that the very steep fees merchants are charged for accepting Boku payments (around 30 percent, but it could be as high as 40 percent, compared to around 2.5 percent for credit cards) are in this case acceptable, because of the incredibly high gross margins (in excess of 90 percent) on virtual goods and the lack of alternatives.

The Most Popular Mobile Payment Type

Now here are some of the key points made in Mobile Payments Today’s infographic:

1. More than 95 percent of the world’s population have mobile phones, compared to less than 49 percent with bank accounts and just over 30 percent with credit cards. Therein lies the market opportunity for direct carrier billing: for unbanked consumers it is one of the precious few ways to make payments electronically.

2. Apps are more easily monetized with direct billing. The authors tell us that direct carrier billing conversion rates are 5 times higher than credit card conversion rates. That is easy to explain: whereas with direct billing a consumer needs to only enter her phone number at checkout, the credit card checkout process involves entering a name, account number, address, security code and expiration date.

3. Direct billing revenues from app sales alone are expected to reach $11 billion by 2016 and $13B by 2017.

4. Direct carrier billing has had a 300 percent annual growth rate on Google Play.

I should say that I am quite skeptical about the authors’ view that direct carrier billing has potential for expanding into the physical world. With such high processing rates, it is at present virtually impossible for such a feat to be achieved, although I guess things may change, at some point. However, even if processing rates did fall enough to rival credit and debit card rates, it is highly doubtful that the carriers would want to expand their direct billing operations too widely. See, if they did that, the carriers would quickly find themselves deeply involved in the consumer lending business, with all the additional governmental scrutiny and regulation that would entail. The carriers wouldn’t want that — they have enough to deal with as it is.

Anyway, here is the infographic:

Image credit: a screenshot of Boku’s homepage.