What Determines Your Payment Choice?

Over the past several decades there has been a wholesale switch among American consumers from paper payment instruments, such as checks and cash, to digital ones, such as debit and credit cards, we are reminded in a new study by Michael Cohen and Marc Rysman from Boston University. Digital payments are superior in many dimensions — they are faster and cheaper to process, easier to track and less vulnerable to crime. Yet, the shift from paper to digital is far from complete, as cash and checks still account for a substantial proportion of consumer payments, especially in some sectors of the economy. So the two economists have poured through available data on 1.6 million grocery purchases by more than 13,500 households to analyze the factors influencing consumer payment choices.

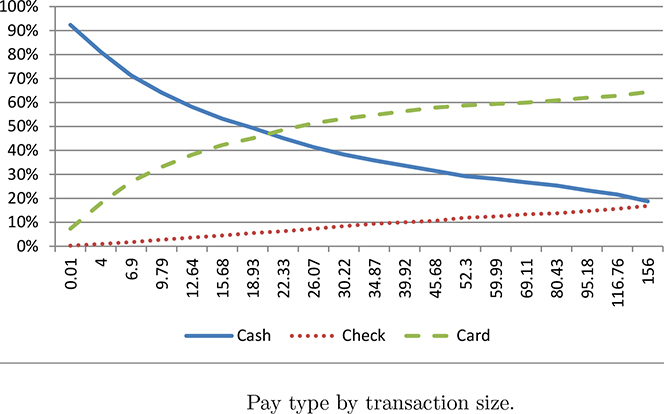

What the researchers have found is that, in choosing among cash, checks and cards, American households focus most of their expenditures on one or at most two of these payment instruments and, once they’ve made their choice, consumers very rarely switch. More importantly, transaction size turns out to be the single biggest determinant of payment choice, with preference being given to cash in small-ticket transactions and to credit cards as the transaction value increases. Let’s take a look at the study.

Payment Cards Account for 57.1% of Transaction Value

Using population weights, the researchers find that cards are used in 45.5 percent of all grocery transactions, cash in 47.9 percent and checks in 6.7 percent. However, cards account for a much greater share of the transaction value total — 57.1 percent, compared to 32.7 for cash and 10.2 for checks. Yet, as shown in the figure below, the usage patterns vary greatly with transaction size. Cash is by far the preferred payment method for small-ticket transactions, accounting for 92 percent of all transactions below $4. For the upper fifth of transactions, however — above $80.43 — cards make up 60 percent of the total number, cash accounts for 25 percent and checks — for the remaining 15 percent.

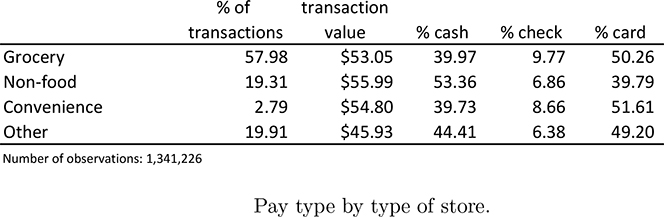

When payments are broken down by type of store — grocery stores, non-food stores, such as gas stations and department stores, convenience stores, such as 7-11, and including drug stores such as CVS, and “other” stores — payment pattern broadly hold, with some notable exceptions. As seen in the table below, average transaction values are very similar, except in the “other” category. Payment methods are very similar at grocery and convenience stores, with cash accounting for about 40 percent of transactions at each and cards — for about 50 percent. Cash use is substantially higher in non-food stores, which the researchers think may be driven by gas stations.

Payment Choice Is Strongly Related to Income…

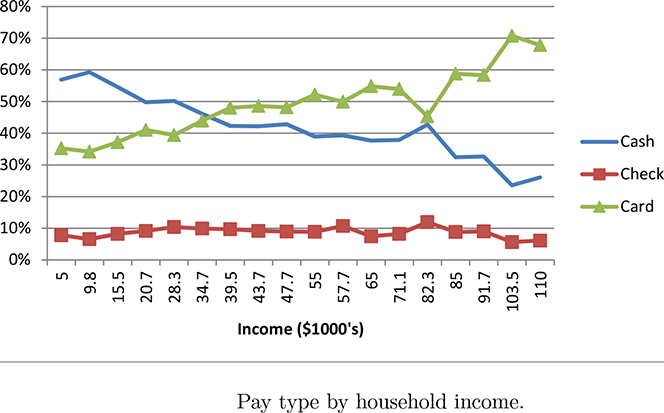

As the figure below clearly illustrates, payment choice is strongly related to income. Cash is the payment of choice for low-income households and its usage gradually declines as income grows. Card use is almost a mirror image of cash use, with the two lines crossing at about $35,000 of income. The wealthiest of consumers use cards for about 70 percent of their payments. Check usage, on the other hand, holds steady for all income levels.

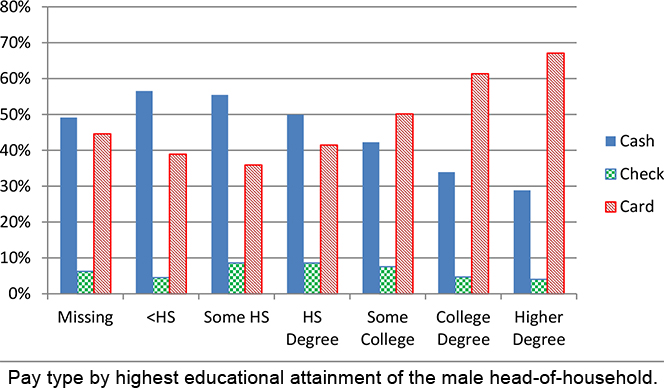

…And to Education

The relationship between a consumer’s level of education and payment choice matches closely the one between income and payment choice, as seen in the chart below. However, the use of checks is not as constant, ranging from 4 percent to 9 percent.

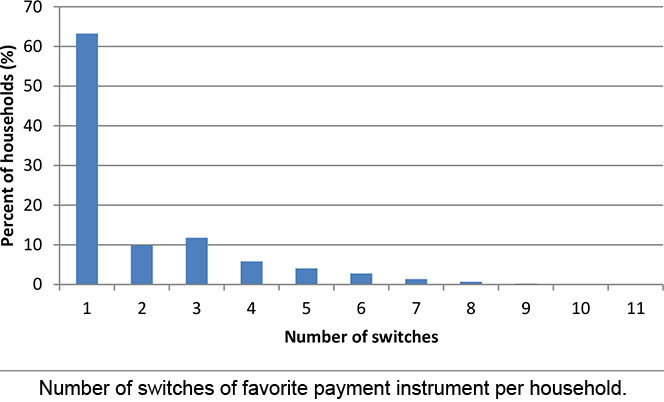

Switching Choices

The study finds that more than 60 percent of households never switch their favorite payment choice.

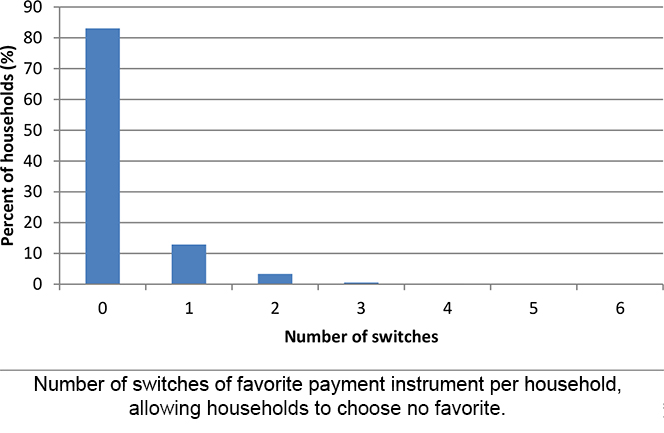

And when the researchers define a payment instrument to be a favorite only if it makes up at least 80 percent of the spending share, the number of switches decline even further, as seen in the chart below.

The Takeaway

So Cohen and Rysman find that the prevalence of cash use is common across the population, even though it is more pronounced among consumers with higher educational and income levels, and is not attributable to a specific consumer segment with particular preferences. It is the transaction size that is the biggest determinant of payment choice, not only across households but also within households.

Image credit: Flickr / 401(K) 2013.