Using Mobile Money to Fight Corruption and Raise Salaries in Afghanistan

Kenya’s M-Pesa has been hailed as one of the greatest business success stories to come out of the developing world in recent years, and rightly so — the mobile payments company has given access to basic financial services to just about everyone in Kenya, even in the remotest of rural places. Perhaps the best indication of M-Pesa’s success is the fact that its system now handles transactions worth 31 percent of Kenya’s GDP.

Less well-known is the fact that Vodafone, the telecommunications company behind M-Pesa, launched a similar service in Afghanistan back in 2008. And although M-Paisa, as the Afghan version of the service is known, is yet to achieve anything close to the scale of its Kenyan counterpart, in other respects it has been every bit as successful. This morning, in the first major-media coverage of M-Paisa that I have come across, Time’s Erik Heinrich highlights the company’s track record and his story makes for compelling reading. Not only has M-Paisa enabled money transfers to parts of the country, which previously had been cut off from the financial system, but its implementation as a means to pay the salaries of the country’s policemen has resulted in an effective pay raise by preventing middlemen from getting a cut, which used to be the norm. It’s a subject I’ve wanted to touch on for quite some time and Heinrich has given me the perfect opportunity.

What Does M-Paisa Do?

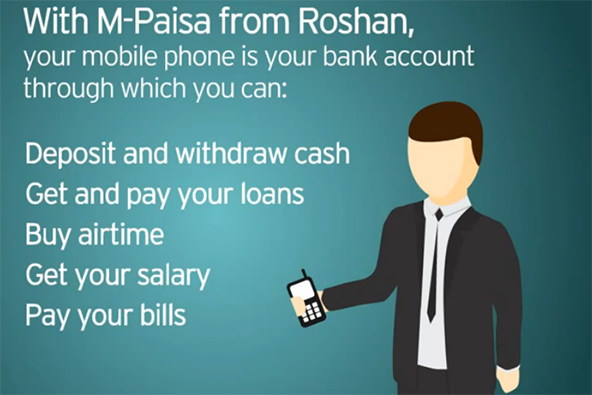

M-Paisa is a joint venture between Vodacom and Roshan, Afghanistan’s biggest mobile carrier, which according to the company’s website, offers financial services “anywhere in Afghanistan”. If true, and it’s impossible to verify this claim, M-Paisa’s omnipresence alone would be quite an achievement in such a dysfunctional and war-torn country.

The services provided by M-Paisa include person-to-person money transfers, disbursement and repayment of microfinance loans, airtime purchases, bill payments, payment of salaries and Western Union money transfers. In addition to text messaging, the service can be operated through an Interactive Voice Response (IVR) system, which, the company tells us, is “an important feature in Afghanistan where 70% of the population is illiterate”.

Similarly to its Kenyan sister-service, M-Paisa relies on a network of agents — typically small store owners — to accept the company’s virtual currency for payment, as well as to convert it into real money to be dispensed to the recipients of money transfers. In effect, an M-Paisa account serves as a bank account and the company’s agents — as bank branches.

Heinrich tells us that at present M-Paisa has more than 1.2 million subscribers and is “growing at double-digit rates on the strength that 40% of Afghans own mobile phones”.

How M-Paisa is Fighting Corruption and Raising Salaries

When M-Paisa was first introduced in Afghanistan in 2008, the service was used to pay policemen’s salaries, which, according to Wikipedia were “set to be competitive with what the Taliban were earning”. It is unclear whether the initial aim was to use the service to fight corruption, but that ended up happening anyway. Here is how Wikipedia explains what took place:

Soon after the product was launched, the Afghan National Police found that under the previous cash model, 10% of their workforce were ghost police officers who did not exist; their salaries had been pocketed by others. When corrected in the new system, many police officers believed that they had received a raise or that there had been a mistake, as their salaries rose significantly. The National Police discovered that there was so much corruption when payments had been made using the previous model that the policemen didn’t know their true salary. The service has been so successful that it has been expanded to include limited merchant payments, peer-to-peer transfers, loan disbursements and payments.

Heinrich tells us that the “pay raises” in question were as big as 30 percent! In a country, which consistently ranks as one of the most corrupt in the world, such successes are quite rare and international charities and aid agencies, among others (perhaps even the American government?), are surely paying close attention. M-Paisa may well turn out to provide a much more efficient channel for moving money from one place to another than anything else that is currently available in Afghanistan.

The Takeaway

Going forward, the biggest challenge facing M-Paisa will be the expansion and strengthening of its agent network, as Heinrich explains:

In addition to a corrupt banking system, it needs to expand its network of retail agents outside the capital Kabul. That’s because if an agent in rural Afghanistan runs out of cash another may be very far away, and Afghan banks cannot pick up the slack because they operate few branches outside city centers.

Yet, this must also be true for Kenya. I don’t know that for sure, but I strongly suspect that in many villages in rural Kenya there would only be one M-Pesa agent, if any. And yet, the service grew like wildfire there and is now flourishing. It seems to me that, as in most other aspects of life in Afghanistan, the biggest hurdle to M-Paisa’s growth must be security — after all if the Taliban decided to outlaw the service in an area under their control, it is unlikely that a store owner would dare disobey the decree. On the other hand, for as long as money is allowed to flow freely between M-Paisa and its agents, there is every reason to expect that the outcome would be similar to the one we are seeing in Kenya.

Image credit: YouTube / M-Paisa.