U.S. Wins Credit Card Dispute with China, Big Changes Ahead

Acting on a U.S. complaint, the World Trade Organization (WTO) has ruled that China is discriminating against foreign providers of credit and debit card payments. It is a big win for the U.S. and the decision may force the Chinese authorities to finally grant Western credit card companies free access to a huge and very fast-growing market.

China has 60 days to appeal the decision and may well do so, but the government had already taken steps to make it easier for foreign issuers to operate in their country. The most significant such action to date, as we reported back in February, was the decision to allow Citigroup to issue cards in China on its own, without the need to first form a partnership with a domestic company, as was previously required. Citi became only the second non-Chinese bank to be issued such a permit and the other one was Hong Kong-based and so doesn’t really count as foreign. So it seems safe to conclude that the Chinese credit card market is opening up. Let’s take a look at what the implications are.

The WTO Ruling

Firstly, let’s take a look at the WTO’s ruling. Back in February 2011, the U.S. filed a dispute with the WTO over China’s discrimination against foreign credit card companies. In particular, the WTO was to look at the Chinese requirements for:

- Card issuers.

- Acquirers — financial institutions that enter into relationships with merchants for the purpose of accepting, processing, and settlement of bank card transactions.

- Bank card processing equipment, such as point of sale (POS) terminals and ATMs.

On July 16, the WTO ruled in favor of the U.S., finding that China does maintain a monopoly on payment cards denominated in renminbi (yuan), which breaks the organization’s rules. The WTO did not, however, side with U.S. claims that state-controlled China UnionPay was an “across-the-board monopoly supplier” for all renminbi-denominated transactions. Still, the ruling calls on China to end restrictions against foreign credit card issuers, processors and acquirers. That was more than enough for Ron Kirk, the U.S. Trade Representative, to claim full victory:

The WTO panel agrees that China’s pervasive and discriminatory measures deny a level playing field to American service providers, which are world leaders in this sector. The panel also found that China has entrenched the market dominance of its own company, China Union Pay (CUP), and distorted competition in China to the detriment of U.S. providers. Open financial services markets are critical, and China should honor its WTO commitments and eliminate this discrimination.

Well, Kirk is free to take just as much credit as he wishes for the favorable decision.

High Stakes

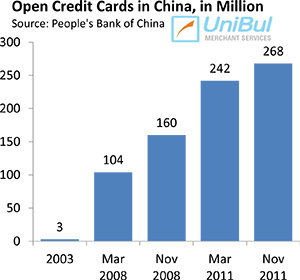

The Chinese bank card market is already huge and very fast-growing. According to official People’s Bank of China (PBC) data, in 2003 there were only 3 million open credit cards. By March of 2008 that number had grown to 104 million and by November of 2008 it had reached 160 million. By the end of March of 2011 there were 242 million open credit cards in China and the latest figure, as of November 2011, is 268 million.

The Chinese bank card market is already huge and very fast-growing. According to official People’s Bank of China (PBC) data, in 2003 there were only 3 million open credit cards. By March of 2008 that number had grown to 104 million and by November of 2008 it had reached 160 million. By the end of March of 2011 there were 242 million open credit cards in China and the latest figure, as of November 2011, is 268 million.

The WSJ cites other PBC data, according to which there were more than 3.1 billion open credit and debit cards at the end of March of this year, with aggregate transaction volume across these cards exceeding 84 trillion yuan ($13 trillion). At present, only one company, China UnionPay, is allowed to process local currency transactions. And yet, the WTO dismissed U.S. claims that UnionPay was operating a monopoly.

The Takeaway

The WTO decision, if it withstands possible challenges, is indeed a huge win for U.S. and all other non-Chinese credit card companies. However, as we’ve argued before, by opening up the Chinese market to foreign competition, such a ruling may be an even bigger victory for the local merchants. I haven’t seen reliable data on Chinese payment processing rates, but I think it would be safe to predict that a break-up of the UnionPay monopoly could only bring them lower.

Image credit: Prnasia.com.

hi i am running technical support service in usa from india for that i need merchant service payment gateway