U.S. Credit Card Delinquencies, Debt Remain at Record-Lows

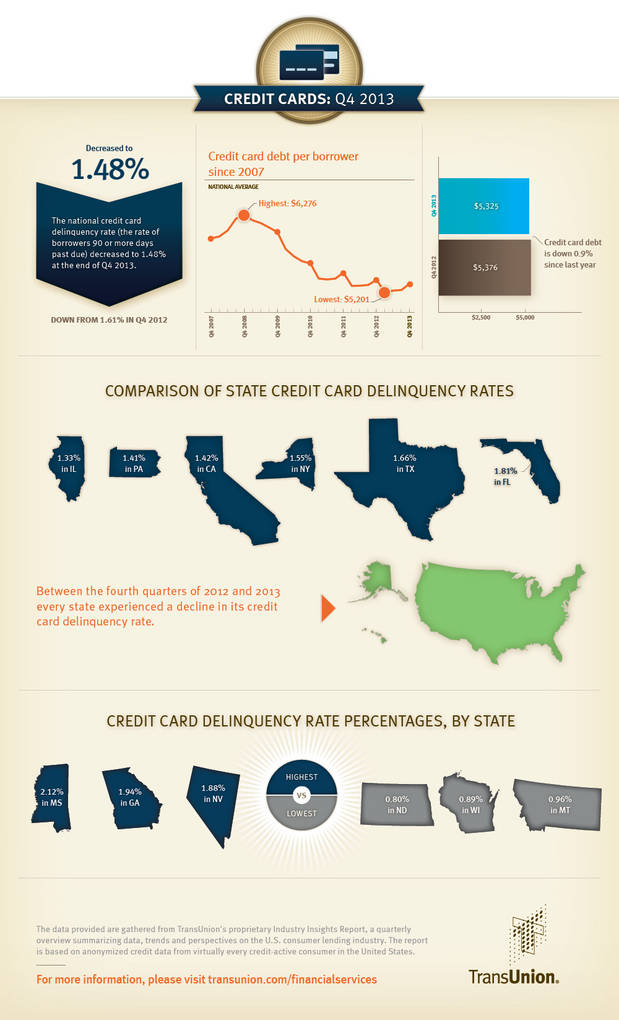

Both the very late-stage credit card delinquency rate (payments late by 90 days or more) and the average credit card debt burden of U.S. borrowers fell on an annual basis during the fourth quarter of 2013, credit reporting agency TransUnion tells us in its latest quarterly analysis of credit-active U.S. consumers. Furthermore, the late payments rate has declined in each one of the 50 states and only seven states have seen a negligible increase in their residents’ average debt load, the agency tells us. On a quarterly basis, however, both the delinquency rate and the average debt level have risen, which TransUnion explains with the holiday season.

As TransUnion likes to remind us, what makes its Industry Insights Report valuable is the fact that it gives us a quarterly overview of (anonymized) credit data from practically every credit-active consumer in the United States. The agency proudly tells us that, as of 2013 Q4, it had 341.40 million credit card accounts in its database, up from 334.23 million in the previous quarter and 329.48 million in 2012 Q4. However, we should keep this in perspective. Whereas this is a huge number, it is way down from the record-high of 408.39 million, recorded in 2008 Q3, at the end of which the collapse of Lehman Brothers set off the financial meltdown and initiated the debt deleveraging process.

But there are now strong indications, or at least the strongest ones we’ve seen since the crisis began, that the credit card debt deleveraging process may have finally run its course. The latest Consumer Credit report from the Federal Reserve showed us earlier this month that the total amount of outstanding credit card debt increased by the biggest amount in seven months and it is now on a clear upward trajectory. But let’s take a closer look at the latest TransUnion data.

Credit Card Debt Falls in Every State but Seven

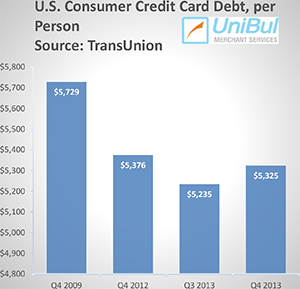

The average amount of credit card debt owed by U.S. consumers in the fourth quarter of 2013 was $5,325, down slightly from the $5,376 total of Q4 2012, but up by 1.7 percent from the previous quarter’s level of $5,235. The current total is still much lower — by $404 or 7.1 percent — than the peak of $5,729, recorded in 2009 Q4.

The average amount of credit card debt owed by U.S. consumers in the fourth quarter of 2013 was $5,325, down slightly from the $5,376 total of Q4 2012, but up by 1.7 percent from the previous quarter’s level of $5,235. The current total is still much lower — by $404 or 7.1 percent — than the peak of $5,729, recorded in 2009 Q4.

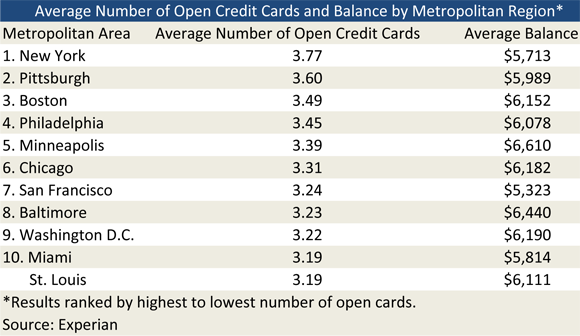

Once again, TransUnion is not giving us the rankings of the U.S. states whose residents have the highest and lowest credit card debt loads. I cannot be certain, but my strong suspicion is that the authors have gotten tired of Alaska leading the table every single quarter. What we’ve got instead, once again, is the numbers for “selected states”, which just happen to be the most populous ones in the country. Here they are:

- California — $5,410, up from $5,332 in 2013 Q3.

- Florida — $5,349, up from $5,265 in 2013 Q3.

- Illinois — $5,389, up from $5,295 in 2013 Q3.

- New York — $5,496, up from $5,386 in 2013 Q3.

- Texas — $5,551, up from $5,478 in 2013 Q3.

The biggest annual declines, TransUnion tells us, were measured in the following states:

- Arizona — 2.5 percent (down from $5,511 to $5,374).

- California — 2.2 percent (down from $5,531 to $5,410).

- Colorado — 2.0 percent (down from $5,865 to $5,747).

As already mentioned, only seven states saw increases in their residents’ average credit card debt levels and the largest ones are listed below:

- West Virginia — 0.6 percent (up from $4,681 $4,708).

- Vermont — 0.5 percent (up from $4,982 $5,006).

- Rhode Island — 0.4 percent (up from $5,355 $5,377).

As you see, these are all negligible increases.

Credit Card Delinquencies Fall in Every State

TransUnion reports that the national credit card delinquency rate fell from 1.61 percent in 2012 Q4 to 1.48 percent in 2013 Q4, but it was up by 12 basis points from the 1.36-percent level recorded in the previous quarter. Every single state registered a decrease in its residents’ credit card delinquency rate between 2012 Q4 and 2013 Q4.

TransUnion’s quarterly report gives us a different look at the U.S. credit card delinquency picture than what we get from the big issuers’ monthly regulatory filings, because the credit agency monitors the debt repayment behavior of American consumers’ entire portfolios, rather than changes in their individual credit card accounts, which is what the issuers do. As some consumers are late on more than one of their credit card accounts at any given time (in fact, among delinquent borrowers, this is typically the norm), the average rates reported by the issuers are higher than the one reported by TransUnion. Furthermore, unlike the issuers, the agency’s own database contains data for all of each consumer’s credit accounts, which enables it to measure the share of borrowers who are late on a payment to any one (or more than one) of their credit cards.

Additionally, whereas TransUnion defines a credit account as delinquent if a payment on it is late by 90 days or more, the issuers use two shorter time scales: early-stage delinquencies for payments late by 30-59 days and late-stage delinquencies for the ones overdue by 60 days or more. The end result is that the agency’s delinquency rate falls somewhere in-between the card issuers’ delinquency and charge-off rates (credit accounts are typically charged off as losses at 180 days after the last payment on the account was received).

Now here are the delinquency rates disclosed, once again, for “selected states” in 2013 Q4:

- California — 1.42 percent — up from 1.32 percent in 2013 Q3.

- Florida — 1.81 percent — up from 1.65 percent in 2013 Q3.

- Illinois — 1.33 percent — up from 1.19 percent in 2013 Q3.

- New York — 1.55 percent — up from 1.40 percent in 2013 Q3.

- Texas — 1.66 percent — up from 1.49 percent in 2013 Q3.

The biggest annual declines, TransUnion tells us, were recorded in the following states:

- Massachusetts — 17.8 percent (down from 1.63 percent to 1.34 percent).

- Rhode Island — 12.4 percent (down from 1.77 percent to 1.55 percent).

- Wisconsin — 11.9 percent (down from 1.01 percent to 0.89 percent).

The smallest annual declines were measured in the following states:

- North Dakota — 2.4 percent (down from 0.82 percent to 0.80 percent).

- Alaska — 2.5 percent (down from 1.19 percent to 1.16 percent).

- Arkansas — 2.7 percent (down from 1.87 percent to 1.82 percent).

TransUnion expects consumer delinquencies to rise to approximately 1.57 percent by the end of the first quarter — still a very low level.

Americans Get More New Credit Cards

TransUnion reports that originations of new credit card accounts increased to 11.96 million in the third quarter of 2013, up from 11.05 million in the previous quarter and from 10.75 million in 2012 Q3 (they’ve looked one quarter in arrears “to ensure all accounts are included in the data”). Yet, even with this latest increase, originations are nowhere near the highs of six years ago when there were 17.74 million new credit card originations in a single quarter.

Furthermore, TransUnion finds that the non-prime U.S. population (defined as consumers with a VantageScore credit score lower than 700) continues to account for a much smaller, and declining, share of all credit card loans. At 30.13 percent in 2013 Q3, that ratio was down from the 30.23-percent level recorded in the same period a year earlier. In stark contrast, in 2007 Q3, the non-prime population accounted for 44.03 percent of all credit card loans, we learn.

Here is how Ezra Becker, the vice president of research and consulting in TransUnion’s financial services business unit, interprets the current origination landscape:

With relatively fewer subprime credit cards in the marketplace, delinquencies should remain low.

At first glance, the increased number of credit card accounts and new account originations appear to be quite positive. However, there are still at least 40 million fewer credit card accounts active in the marketplace than what we observed just five years ago… While there are more than one million more new account originations from one year ago, the non-prime percentage of this group has actually declined. Competition in the prime score ranges is fierce, and those consumers don’t seem to need more card credit. With the economy improving and delinquency rates remaining so low, we may see lenders shifting their acquisition activities to somewhat higher-risk market segments.

That, it seems to me, is quite a reasonable expectation.

The Takeaway

Here is how Becker sees his report’s findings:

Credit card delinquencies continue to remain much lower than historical norms. We also believe that there is a continuing reduced demand for new credit in the prime credit ranges. While industry reports show that direct mail has increased by about 30% in the last year, we have seen originations only rise about 11% in that same timeframe. In short, consumers are managing the cards they have in their wallets effectively and do not seem to be seeking additional card credit at this point. This also speaks to the need for lenders to examine alternative channels for account acquisition beyond traditional direct mail campaigns.

Yet, there is no indication that the issuers are about to adopt any new strategies for acquiring new customers and that is not exactly surprising — they are a conservative lot. The lenders’ decisions about the numbers of credit card offers they send out are mostly dependent on the cost of sending these offer, Daniel Grodzicki, an economist at Stanford University, told us last month. It’s worked for them in the past, so they are unlikely to change it.

Here are TransUnion’s findings presented in an infographic:

Image credit: MasterCard.