The Rise of E-Payments

Scott Schuh of the Federal Reserve Bank of Boston has produced a fascinating set of charts tracking the rise of electronic payments in the U.S. over the past few decades. There is much to be learned there and I highly recommend that you read his paper (it’s short and mostly full of graphs). To whet your appetite, I decided to show you some of the most interesting charts.

At the very beginning of his paper, Schuh gives us a short list of “major innovations in history of money” and I thought I should start with it, too. So here is the money evolution chain, as defined by MIT’s David S. Evans and Richard Schmalensee:

- Birth of commodity money (metallic coins).

- Creation of “checks” (promise of future money).

- Creation of paper (fiat) money.

- Emergence of electronic “money” (cards, cyber, cellular, etc….)

Now that we know that things like credit cards, wire transfers and mobile wallets represent the pinnacle of money evolution, we can safely proceed to the charts.

The Rise of E-Payments

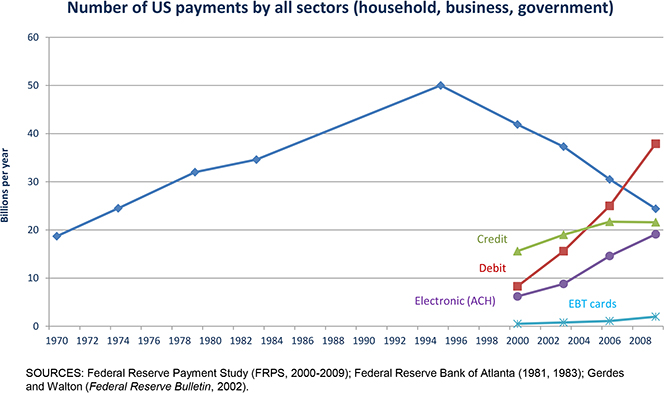

1. E-payments are replacing paper checks. The use of paper checks in the U.S. has been on the decline since the mid-1990s and it’s been a steep fall. By contrast, all forms of electronic payments, including ACH, which in effect is electronic check processing, have been on the rise.

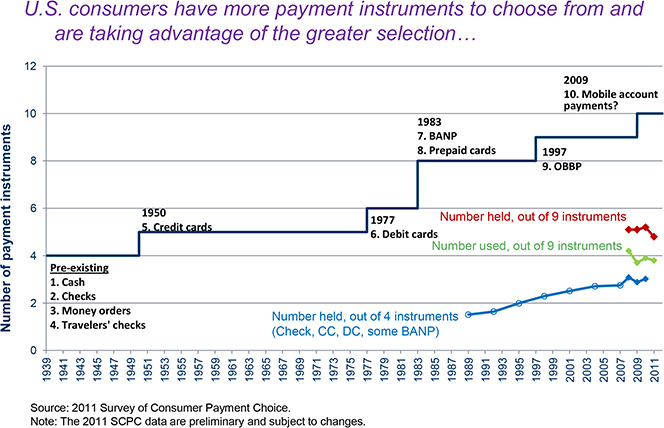

2. Americans have more payment options and are using them. Back in the 1940s Americans had four payment instruments to choose from: cash, checks, money orders and travelers’ checks. Every subsequent decade, with the exception of the 1960s, has added an item to the list. And we have always been quick to adopt the latest one to come along.

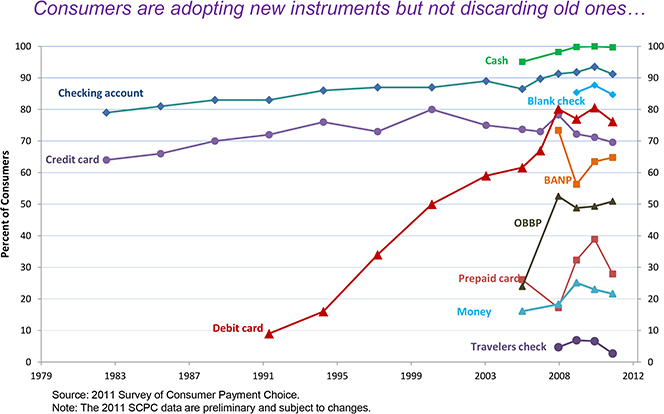

3. Americans are adopting new payment instruments, but cling to old ones as well. As you can see in the chart below, the rise of new payment technologies over the past few decades hasn’t caused the extinction of the old ones.

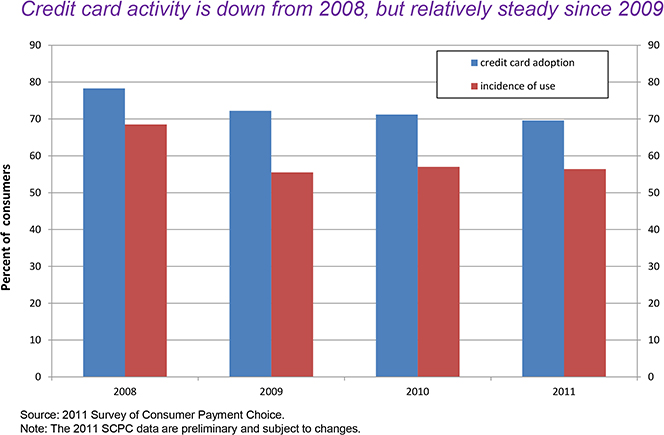

4. Credit card use has declined since 2008. Schuh’s chart shows that from 2008 to 2009 the share of Americans using credit cards has fallen by more than ten percent. Since then, usage has risen, albeit very, very slightly.

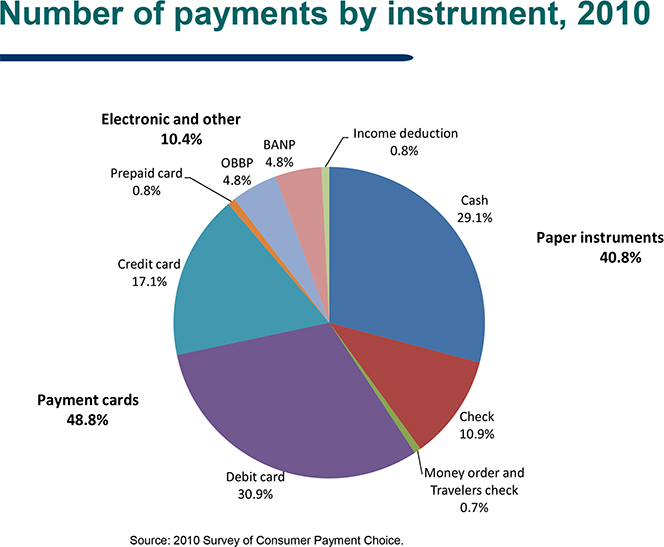

5. Payment cards account for close to half of all payments. Debit cards are the most popular payment instrument in the U.S., used in 30.9 percent of all payment transactions. Cash is a close second and credit cards are a distant third.

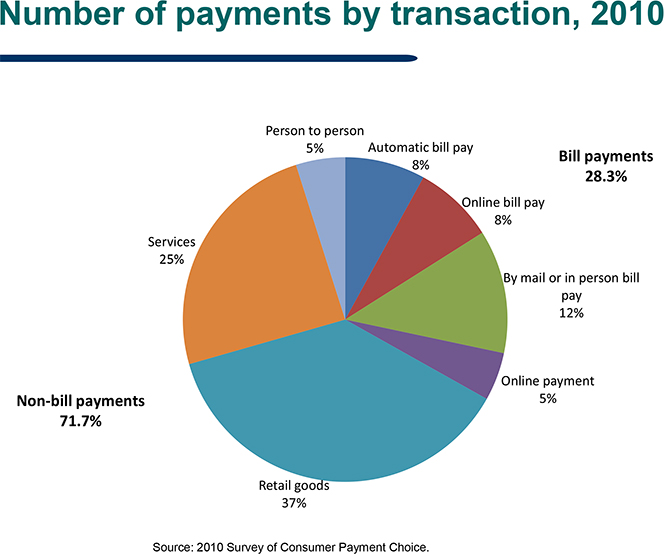

6. More than a third of all payments are for retail goods. A distant second are payments for services. Together, these two groups account for 62 percent of all payments made in the U.S.

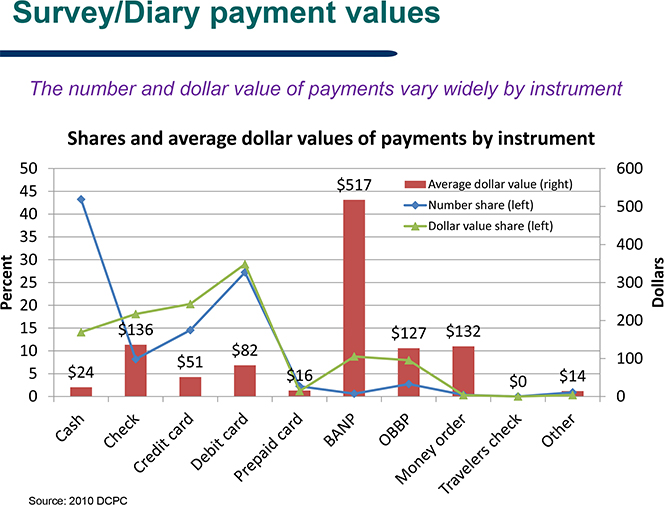

7. Number of payments and transaction value vary widely by instrument. I wish Schuh had spelled out what BANP stand for. OBBP is Online Banking Bill Payments.

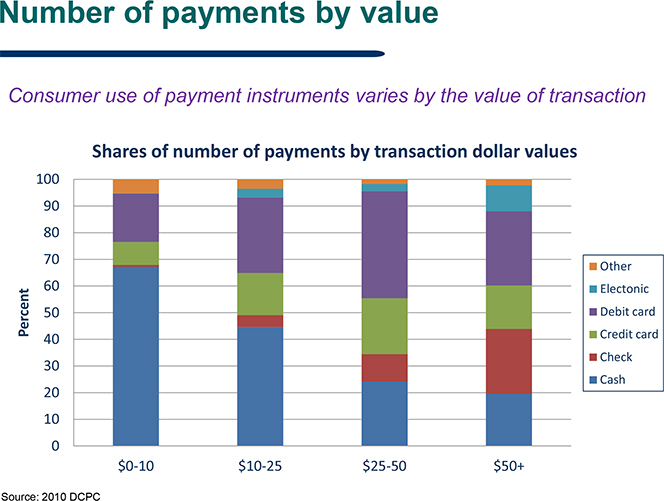

8. Cash is used mostly for small payments, the reverse is true for checks. Interestingly, neither credit nor debit card use is much affected by the transaction value.

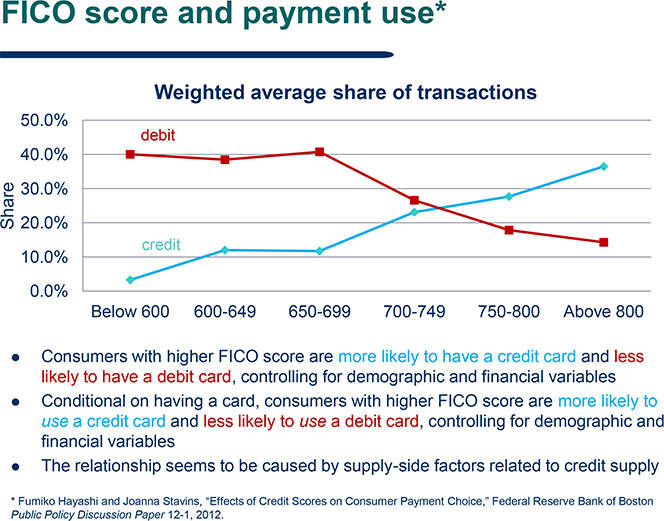

9. The more you use your debit card, the lower your credit score. This chart is based on data from another study by two Boston Fed researchers, which we highlighted earlier this year.

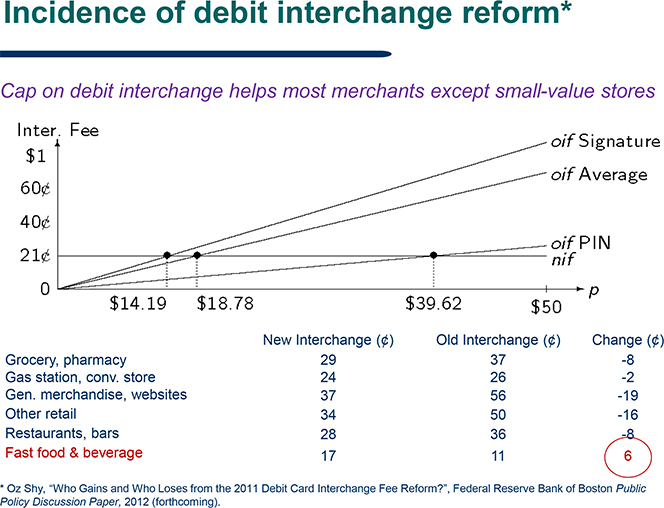

10. Debit interchange limit hurts small-ticket merchants. This is a favorite subject of ours, so it was nice to see some specific data. It turns out that the Durbin Amendment has raised the average debit interchange fee paid by fast food merchants by 55 percent – from $0.11 to $0.17 per transaction. All other merchant types have benefited from the reform.

I wish Schuh had provided some data on how much more expensive consumer banking has become in the wake of the Durbin Amendment, but I’m sure that would be the subject of a number of papers to be published in the coming months.

Image credit: Cycloneco.com.

I have to admit that I use my debit card just about daily. I do this mainly because of the connivence. However, this is all heading toward destruction…Rev. 13 speaks of the mark of the beast (666). That is where this will ALL end up. The FED is needs to be at least audited and really should be done away with. We have a national debt of 16 Trillion with a great amount of this being fake debt. Not only this but we are borrowing money to help other nations that are NEVER going to pay us back…it is the definition of insanity…and yet our govt just keeps on doing it over, and over and over again…EXPECTING DIFFERENT RESULTS!