The Private Student Loan Market Is Small but Healthy

Few students are taking out private educational loans and their share of the total has been steadily declining since the 2007 / 2008 academic year, according to a new study just released by MeasureOne, a provider of student loan data and analysis. Private loans make up only a small fraction — an even smaller one than previously thought — of the overall student loan market, with federal loans accounting for the bulk of the loans originated today.

But size is not the only differentiator between the two components of the student loan total. The study reports that, even as federal student debt is getting out of control, with delinquencies and defaults at record-high levels and rising, the private student loan market is, in stark contrast, very healthy, with low and improving rates of late payments and charge-offs. This healthy state of private-loan affairs is, according to the authors, the result of a multitude of factors, such as changes in loan products and terms, rigorous underwriting, a wide use of cosigners, universal adoption of school certification and a documented ability to repay the debt. Let’s take a closer look at the study.

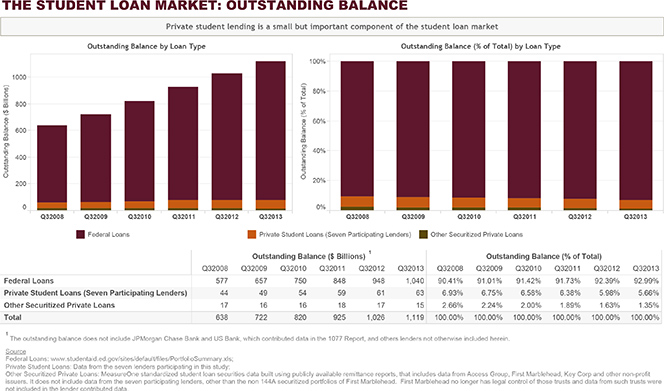

The Private Student Loan Market Is Tiny

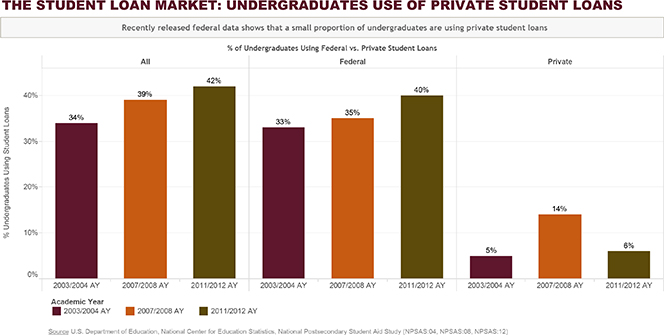

The size of the private student loan market is even smaller than previously reported, the study finds. The total outstanding debt reported by the seven largest active lenders is about $63 billion — less than 6 percent of the total outstanding student debt. Citing data from the Department of Education, the study tells us that the share of students who took out private loans has declined from 14 percent in the 2007 / 2008 academic year to 6 percent in 2011 / 2012 academic year. In contrast, during the same period, the ratio of students who took out federal loans increased from 35 percent to 40 percent.

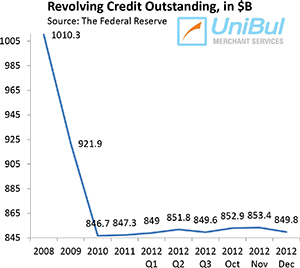

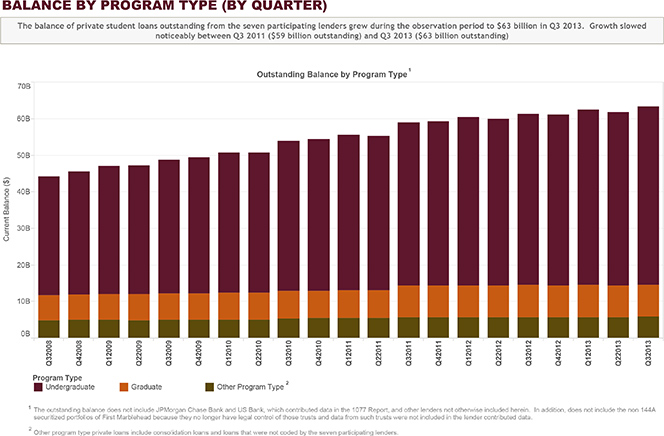

As you can see in the charts above, whereas private student loan balances have leveled off in recent years, the federal student loan total has climbed dramatically. As a result, as everyone keeps repeating, student loan balances have now surpassed credit card balances and, at more than $1 trillion, trail only mortgages in the ranking of consumer debt categories. The study cites several factors, which have contributed to this trend:

- Stafford loan limits increased in 2008 and 2009.

- College tuitions have continued to rise.

- While some lenders have significantly tightened their underwriting standards on private student loans during the financial crisis, others have continued to follow long-standing rigorous underwriting practices. That has pushed students away from the private market and toward the federal one.

- Better disclosure practices have educated students and families about the availability of federal student loans, making them less likely to take out private student loans.

In any case, the discrepancy between the federal and private trends is really quite striking.

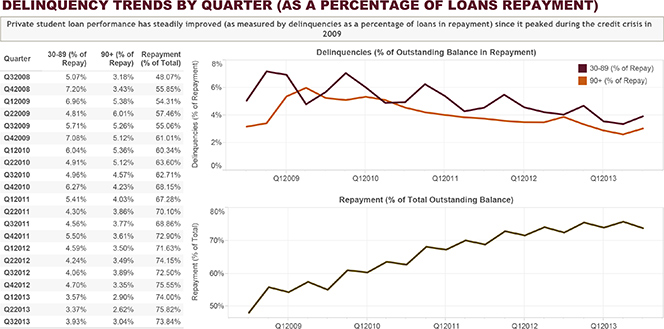

Private Student Loan Delinquencies at 3.89%

Private student loans with serious delinquencies (payments late by 90 days or more) peaked at the height of the recession in 2008-2009, we learn, but have since then declined by 49 percent, even as the ratio of loans in repayment has almost doubled.

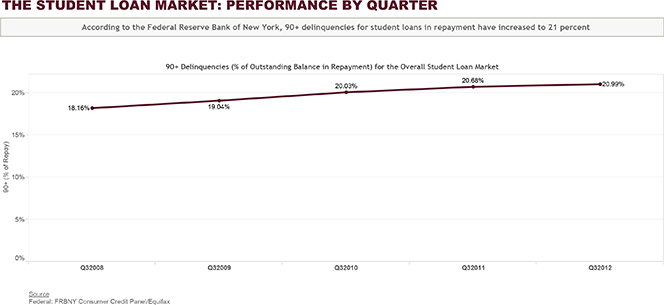

Measured as a share ofthe loans in repayment, only 3.89 percent of all private student loans were seriously delinquent at the end of 2012 Q3 and have then declined further to 3 percent at the end of 2013 Q3. For perspective, as seen in the chart below, the Federal Reserve Bank of New York estimated that, as of 2012 Q3, 21 percent of all student loans — the sum of federal and private ones — were seriously delinquent. Clearly, federal student loan programs statistically account for the overall student loan delinquency rates reported by the New York Fed.

The New York Fed defines 90+ delinquencies as loans that are 90 days or more past due prior to charge-off. Federal student loans are considered defaulted anywhere from 270 to 360 days past due, while private loans are typically charged-off at either 120 or 180 days past due. The longer time-frame for federal loans will cause a higher share of federal loans to be delinquent by 90 days or more, compared to private loans. Nevertheless, The New York Fed data, which is largely comprised of federal student loans, show steady rise in the overall delinquency rate, from 18.16 percent in 2008 Q3 to 20.99 percent in 2012 Q3.

80% of Private Student Loans Go to Undergraduates

The chart below shows how small the market for undergraduate private loans is, compared to the one for federal loans:

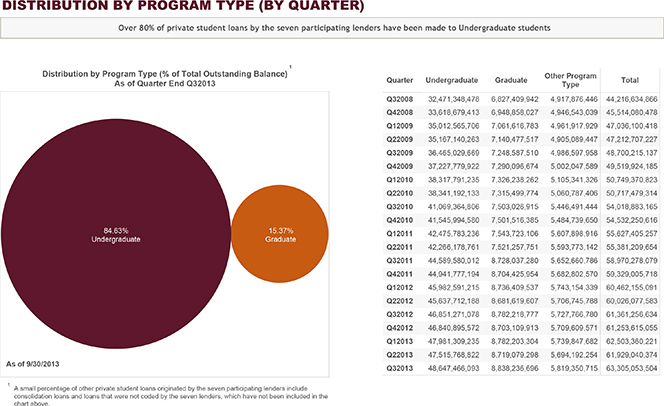

Yet, small as it is, the undergraduate private loan market accounts for four-fifths of the overall private loan total, as seen in the chart below.

Measured by outstanding balance amount, private student loans from the seven lenders participating in MeasureOne’s study grew from $59 billion in 2011 Q3 to $63 billion in 2013 Q3. Here is a quarterly breakdown of the outstanding volumes by program type.

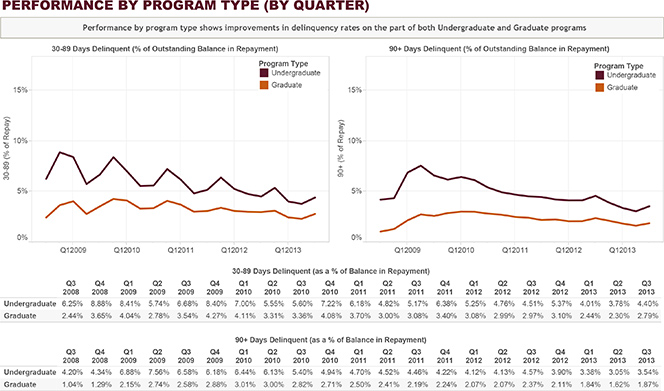

Undergraduate student loans have consistently had higher delinquency rates, although the gap has narrowed as of late, as seen below:

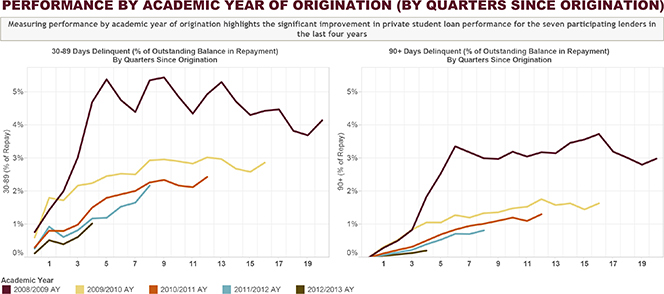

Finally, there has been a continual improvement in delinquencies, measured by academic year of origination:

Charge-offs Are Down to 3%

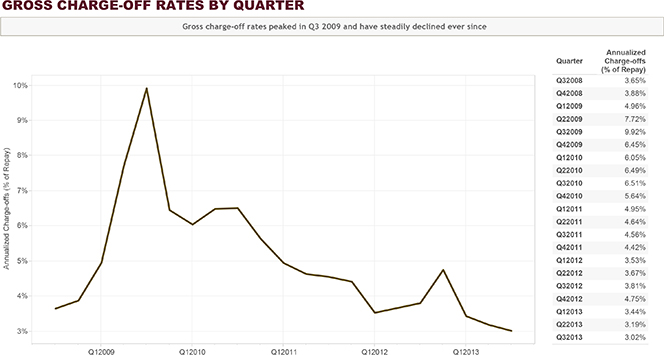

Gross private loan charge-offs — defined here as the total dollar amount of the loan at the time of the charge-off during the quarter divided by the total balance in repayment at the end of the quarter — have fallen dramatically. To get annualized charge-offs as a percent of repayment, the authors multiply the quarterly charge-off rate by 4. Here is what they get:

As you see, charge-offs have fallen from a high of 9.92 percent in 2009 Q3 to 3.02 percent in 2013 Q3.

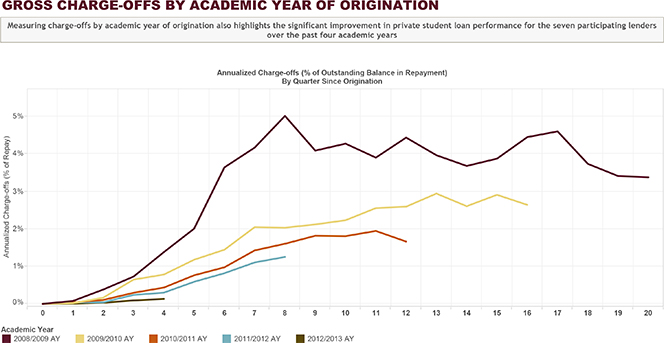

As was the case with the delinquency rate, when measured by academic year of origination, charge-offs have been steadily declining, as seen in the chart below:

The study finds that the 2012 / 2013 academic year is performing 30 percent better than the 2011 / 2012 academic year.

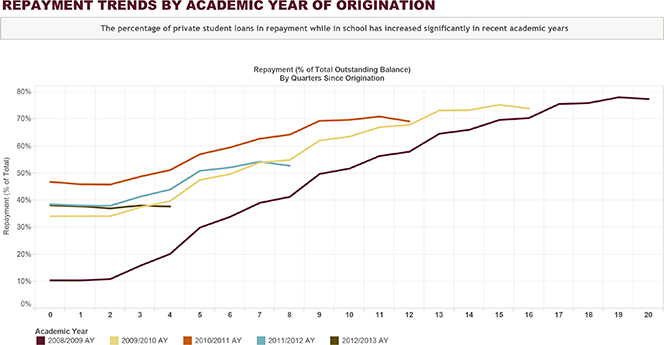

The data on repayment trends by years of origination is more mixed, but each vintage’s performance tends to improve over time, as seen below:

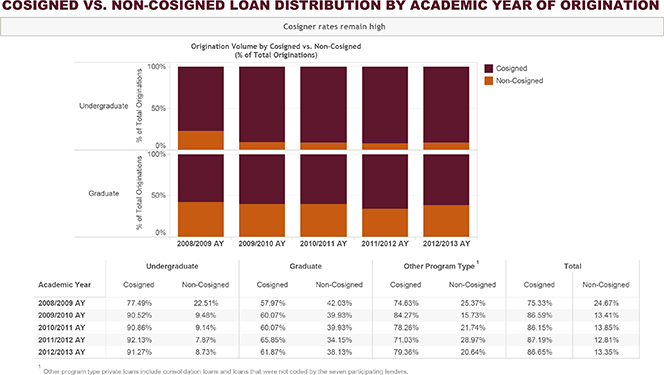

Close to 90% of Private Student Loans Are Cosigned

Beginning with the 2009 / 2010 academic year, and in each year since then, more than 90 percent of the loans extended by the seven participating lenders to undergraduate students included a cosigner and the share of graduate private student loans with a cosigner was hovering around 60 percent.

As you can see, the overall share of private student loans with a cosigner, extended in the 2012 / 2013 academic year, was 86.65 percent.

The Takeaway

Clearly, the market for private student loans is much healthier than the one for federal loans. But that was always going to be the case, for the objectives of these two types of lenders are quite different. Whereas private lenders are in it to make a profit, the federal government’s aim is to ensure that everyone who wants to go to college is able to do that — and pay for it, irrespective of his or her ability to pay the loan back. However, it is increasingly becoming clear that the federal government’s approach to lending is unsustainable and something will eventually have to be done about it — preferably before the crisis strikes.

Image credit: Flickr / dailymatador.