The Issues with Private Student Loans

The Consumer Financial Protection Bureau (CFPB) has released its second annual report, which analyzes the student loan complaints submitted by consumers for the year from October 1, 2012 through September 30, 2013. The report is focused exclusively on complaints with private student loans — about 3,800 of them — as opposed to governmental ones, which comprise a much larger proportion of the total.

There are several main causes of complaint, but the one that stands out the most, and which accounts for about half of the total number, has to do with difficulties borrowers have faced when attempting to modify the terms of their student loans. Typically, students seek loan modification to reduce their monthly payments, but there have also been issues with borrowers seeking to pay off their loans faster by making larger-than-agreed payments. Borrowers are also facing obstacles when repaying their loans, including challenges in obtaining account information and difficulties in working with student loan servicers to correct payment application and other processing errors. Let’s take a look at the report.

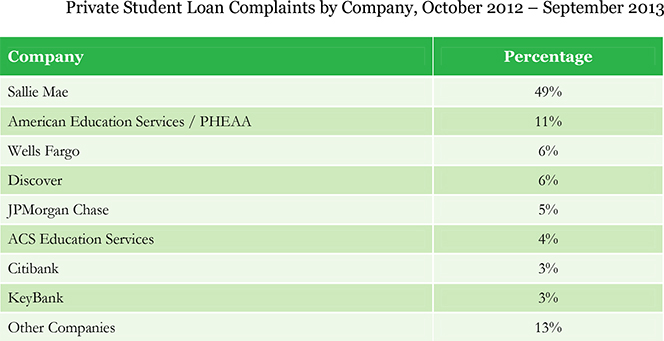

Sallie Mae Is Most Complained About

Eighty-seven percent of all complaints were directed at eight companies, with Sallie Mae accounting for half of the total. Given that the private student lending and servicing markets are highly concentrated, these statistics should not surprise us, the authors note. The distribution of complaints is generally consistent with the companies’ relative market shares, we are told. Here is the list of the most complained-about lenders:

Loan Modification Is the Biggest Cause of Complaints

Complaints from consumers looking for a loan modification made up just under half of the total number. A majority of these complaints are filed by consumers who are struggling to make their monthly student loan payments, but many borrowers are in a stable financial position and attempt to pay off their loans early. As refinance options are limited, the authors tell us, the only way to escape high interest rates or poor customer service is to pay off the loans more quickly.

However, many borrowers face stumbling blocks and unpleasant surprises when it comes to payment processing practices. Many consumers have been unable to verify whether their payments were appropriately applied when they made additional payments in order to pay off their loans more quickly. Typically, lenders will first apply payments to cover outstanding fees and interest and then allocate any additional funds to the principal. Generally, interest on student loans accrues daily, and therefore the amount of the payment that is applied to the principal depends on the timing of the payment.

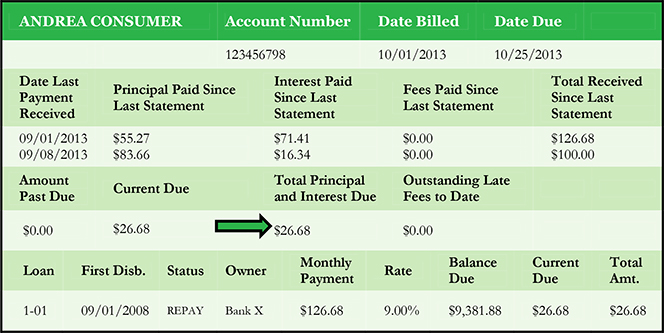

Borrowers told the CFPB that after submitting additional payments, they were placed in “paid ahead” or “advanced payment” status, which made it unclear whether the funds were held in order to satisfy a future payment or whether the loan servicer had actually applied the payment toward the principal balance. If the additional payment amount was enough to satisfy only a portion of the next installment, the “total amount due” on the next month’s statement would reflect the additional payment by reducing the next monthly installment due.

However, if the payment amount was large enough to satisfy a full future installment, the next statement might reflect a $0.00 minimum payment due, as seen below. And when borrowers received a $0 bill, they were unsure as to whether their automatic debit payment would be processed or if they needed to make a payment for the following month. Moreover, many consumers did not know if their additional payment was actually applied to the principal or it was used to satisfy a future installment. Many loan servicers use the “paid ahead” status as a payment processing policy in order to help borrowers to avoid default or delinquency in the event of a future missed payment, but billing statements do not make that clear.

Furthermore, many borrowers reported problems when submitting a single payment to cover several loans associated with the same servicer. The biggest complaint was that, even when a borrower gave an explicit instruction as to how a payment should be applied to her different accounts, the servicer might still apply it as they saw fit — and not necessarily to the borrower’s advantage. And, as the report shows, the wrong payment prioritization can cost borrowers thousands.

Other Issues

Prioritization is also an issue with the so-called “good faith” payments — the situation that arises when the payment amount is not enough to cover the due amount of each of a borrower’s accounts with a single servicer. When that happens, the servicer could elect to pro-rate the payment and apply it across all loans in the billing group. However, doing so would fail to satisfy any of the outstanding accounts and would cause the borrower to be charged a late fee for each one of them. The other option is for the servicer to satisfy in full as many accounts as possible by paying first the loan with the smallest balance due and then working upwards. This would minimize both the number of past due accounts and the number of late fees charged to the borrower.

Another complaint has been that borrowers were charged late fees, even when they submitted a payment before the due date. Consumers told the CFPB that there was a delay between the time at which they initiated an online payment and when it was actually posted to their account. They reported that payments could take up to ten days to clear their bank and post to their account, causing them to miss the due date and incur a late fee.

Access to payment history has also been a cause for complaints. More specifically, borrowers have told the CFPB that information about payments made over the phone or through the mail was not accessible through their online account and was not recorded in their payment history on their loan servicer’s website.

Consumers have also reported that paper checks have failed to post to their accounts, leading to missed payments and late fees. Difficulties in obtaining accurate payoff information were another source of complaints, as were changes in the companies servicing a borrower’s student loans.

The Takeaway

The total amount of outstanding student loan debt now approaches $1.2 trillion, with federal student loans accounting for $1 trillion of that total. The CFPB report’s authors repeatedly make parallels with the problems in the mortgage market, which led to the financial crisis of 2008 and subsequent economic collapse, and warn that if the problems in the student loan servicing market are not corrected, we should brace ourselves for further hits to the economy. A shock caused by a student loan debacle is unlikely to be of the same magnitude as the burst of the housing bubble, but it would still be large enough to do a great deal of damage. However, for the time being at least, the problem continues to deteriorate.

Image credit: Flickr / Michael Fleshman.