Surging Credit Card Use in China Boosts GDP

The huge increase in payment card usage in China boosted consumption by 4.89 percent during the five-year period between 2008 and 2012, contributing $375 billion to the country’s GDP total and driving up the growth rate by 1.7 percent in the process, according to a new study by Moody’s Analytics, an economic research company, commissioned by Visa — the world’s biggest payment card company. Impressively, the Chinese contributed 38 percent of the total amount which payment card usage added to the aggregate GDP of the 56 countries studied (which accounted for 93 percent of world GDP from 2008 to 2012).

To get an idea of just how explosive the Chinese growth has been, consider the fact that the rate at which card usage increased consumption in China during the 2008-2012 period was close to four times as high as that in Chile — the country which ranked second in this category — and more than 15 times as high as the U.S. rate. It is a very interesting study and I thought I’d share its findings with you.

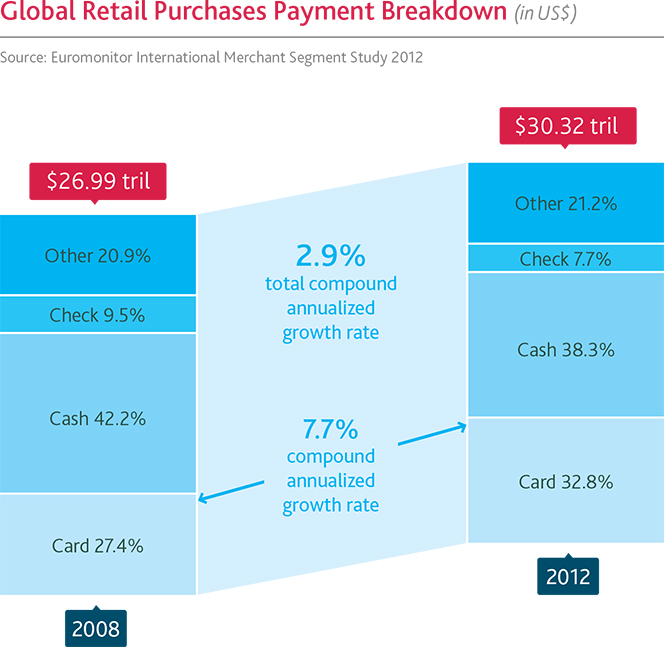

Payment Cards Used in a Third of Global Retail Purchases

The popularity of payment cards continues to grow globally. In 2012, cards accounted for close to 33 percent of the worldwide consumer retail spending, up from 27.4 percent in 2008 — a 7.7 percent compound annualized growth rate, which is more than three times the overall rate of growth. Consumers continue to migrate away from cash and checks and toward payment cards and other electronic methods. Here is the full breakdown:

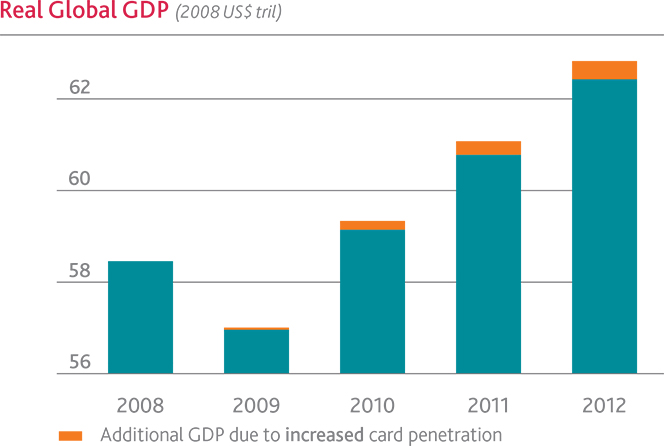

Payment Cards Contribute $983B to Global GDP

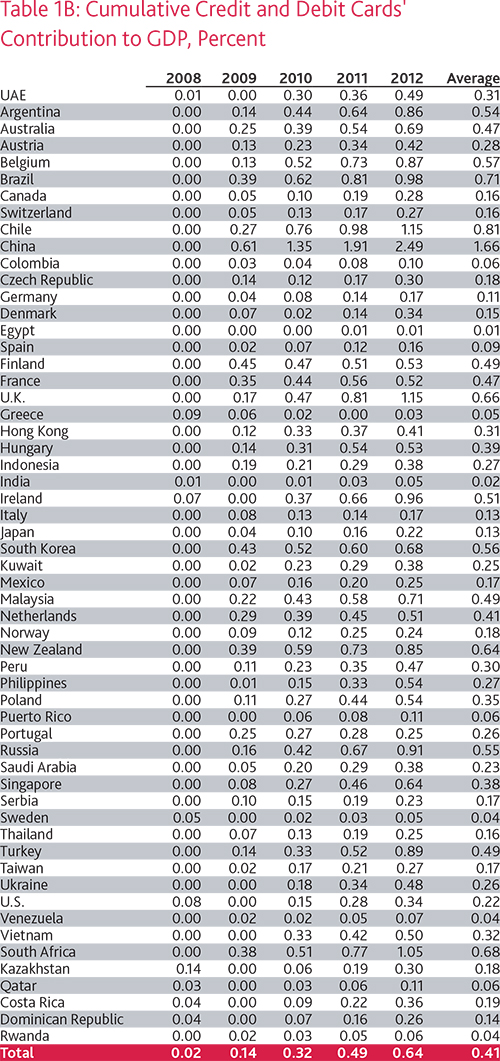

The increase in consumption added $983 billion (2008 US$) to global GDP cumulatively from 2008 to 2012, a yearly average of 0.4 percent in additional GDP over the five-year period, we learn. As you can see in the table below, China alone accounted for $375 billion — 38 percent — of that total.

Real GDP grew at an average of 1.8 percent during the examined period, of which 0.17 percent is attributable to increased card penetration.

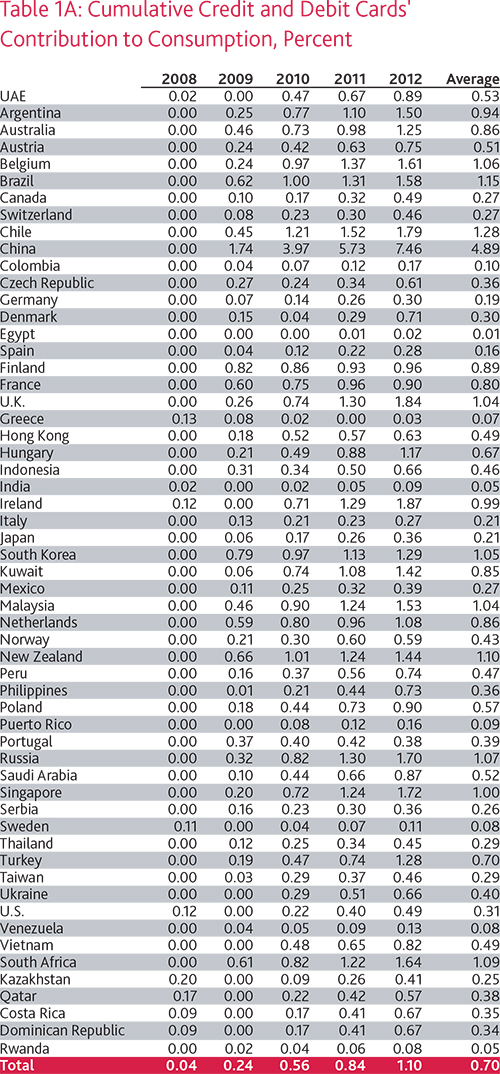

Card Usage Increases Consumption in China by 4.89%

As the table below illustrates, the impact of payment card usage on GDP varied greatly among the 56 countries, due to “differing growth rates, higher penetration in some countries, and the consumer reaction to a more robust card infrastructure.” China was far and away the leader in this category — card usage increased consumption in the country by 4.89 percent, whereas card-induced growth in second-place Chile was only 1.28 percent and in third-place Brazil — 1.15 percent. On the lower end of the table we have Egypt with 0.01 percent and Greece with 0.04 percent. As the researchers note, this is a result of the “political strife in Egypt and ongoing economic depression in Greece”.

Emerging Markets Outperform Developed Countries

A larger share of consumers in wealthier countries use payment cards than in lower-income, emerging markets. However, as the researchers remind us, emerging countries are able to achieve much faster growth in card use by “merely copying the retail infrastructure of developed economies”. So it should come as no surprise that the increased card usage added 1.6 percent to consumption in emerging markets, compared to only 0.4 percent in developed countries. The effect of card usage on GDP growth was 0.8 percent and 0.3 percent, respectively.

However, there was a surprise in the shape of the U.K., which recorded one of the highest effects with 0.7 percent of additional GDP resulting from increase in card use. Yet, even that respectable figure was dwarfed by China, which experienced a GDP impact of 1.7 percent. Here is the full table:

The ongoing explosion of retail spending in China is the result of the country’s swelling middle class, the researchers remind us. As they become more affluent, Chinese consumers, like their counterparts elsewhere, demand more efficient payment methods. Consequently, China’s payment card penetration rate (defined as spending on cards as a percentage of overall consumer expenditure) soared from 31 percent in 2008, to an estimated 56 percent in 2012. Moreover, the researchers have observed that “card usage begets further card usage” — “[a]s more cards are issued and more merchants accept cards, transaction volume grows exponentially”. Considering that this is true even for mature markets, we should expect card usage to maintain its high growth rate in China and elsewhere in the emerging markets for years to come.

The Takeaway

Here is the researchers’ conclusion:

Increased credit and debit card usage contributes to economic activity by reducing transaction costs and improving efficiency in the flow of goods and services. All cards — credit and debit — reduce transactional and opportunity costs by eliminating the need to carry cash, which can be particularly burdensome in developed and emerging markets. Encouraging the adoption of electronic payments, and policies that support their adoption will continue to enhance economic growth and reduce friction in the global economy.

It doesn’t seem as if consumers and governments in emerging markets need much convincing.

Image credit: Dailymessenger.com.pk.