Student Debt: Who Has It and Who’s Worried about It?

One of every five Americans aged 20 or older and about two-thirds of college seniors who graduated in 2011 carry student debt, the Urban Institute reminds us in a newly-published report. Members of the latter group of recent college graduates owe close to $27,000, on average. Unlike credit card and mortgage debt averages, which fell in the aftermath of the financial crisis and the subsequent recession, student debt just kept on rising, and at an accelerating rate. At the same time, weak labor market and stagnant wages have made it increasingly difficult for borrowers to keep up with their payments, which has led to skyrocketing delinquencies — 17 percent, according to one measurement, cited in the report — and defaults. Moreover, as we’ve reported before, more than half of all student loan accounts in the U.S. are now in a deferred status. Yet, as we’ve also reported, perilous as student loans may be, the alternative — not having a college degree — is not worth contemplating in today’s economy.

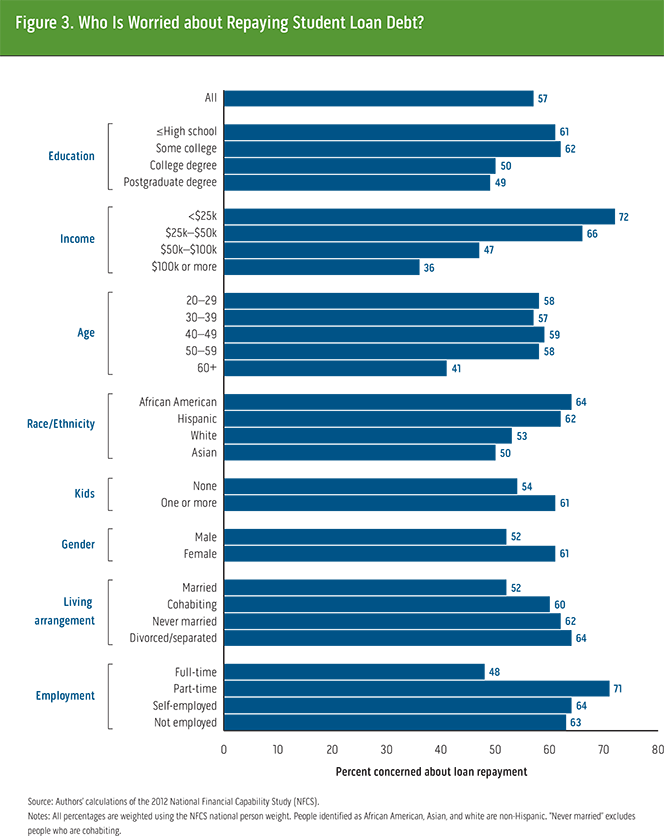

The Urban Institute paper examines who has student debt and who is worried about their ability to pay it back. To do that, the researchers segment the booming student debtor population into groups by age, income, ethnicity, gender and other factors. Over half of all borrowers — 57 percent — are concerned that they may not be able to repay their student debts, but there are variations among groups and I thought I’d share the researchers’ findings with you.

Who Owes Student Debt?

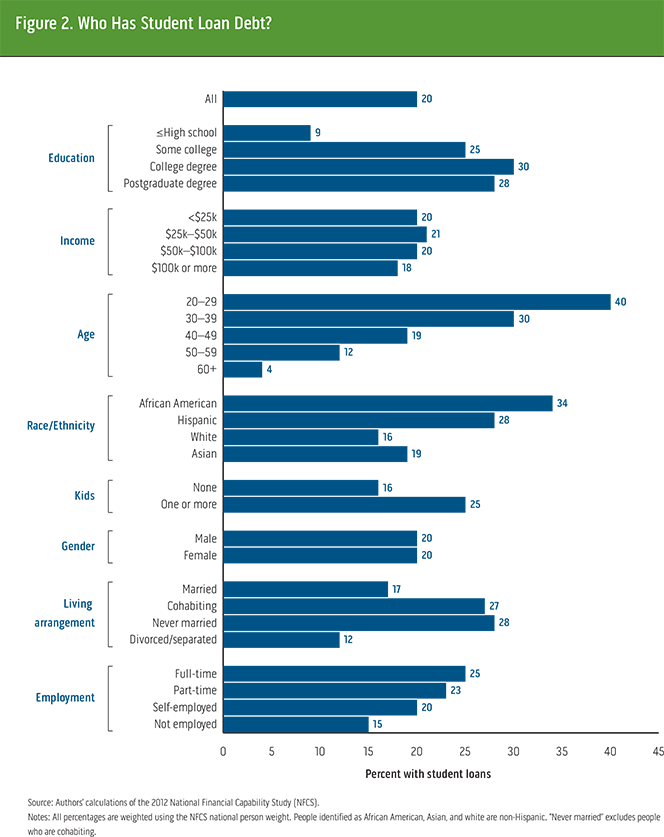

The probability of owing student debt varies significantly across the examined subgroups. Perhaps most unfortunate are the debtors who have not actually managed to obtain a college degree. We learn that nine percent of people with no more than a high school degree have student debt, which could be incurred for a non-degree training certificate or by funding a child’s education. For people with some college education, but no college degree, that fraction increases to 25 percent.

Interestingly, there is little variance across the four examined income groups, we learn. At the ends of the spectrum, 20 percent of consumers in households with income below $25,000 have student loan debt, as do 18 percent of those in households with income over $100,000.

As one would expect, the probability of having student debt diminishes sharply with age. Whereas 40 percent of people in the 20 – 29 age group have student debt, the ratio falls to 19 percent for people in the 40 – 49 age bracket and to 4 percent for those in the 60-and-older group. The ratios are substantially higher for Americans with at least some college education, but the trend is the same. Overall, 27 percent of consumers with at least some college education have student debt, with the shares ranging from 56 percent for 20 – 29-year olds to 6 percent for those 60 and older.

African Americans (34 percent) and Hispanics (28 percent) are about twice as likely to carry student debt as whites (16 percent). This is not surprising, we are reminded, considering that white families have six times the wealth of African American and Hispanic families. Greater family wealth enables whites to finance at least a portion of the cost of their education.

Also unsurprisingly, student debt is more likely to be held by people with financially dependent children (compared to those with no financially dependent children), who are employed (versus unemployed), and who are never married or are cohabiting (versus married or divorced / separated).

Who Is Worried about Repaying Student Debt?

Whereas, as already noted, concern about paying back student debt is pervasive among the debtor population as a whole, it is nevertheless more common among some groups. For example, you may not be surprised to learn that income and concern over repayment are locked in an inverse relationship. While 36 percent of student debt holders with household incomes above $100,000 are concerned about their ability to repay — a substantial ratio — the share is twice as high (72 percent) among borrowers with household incomes of less than $25,000.

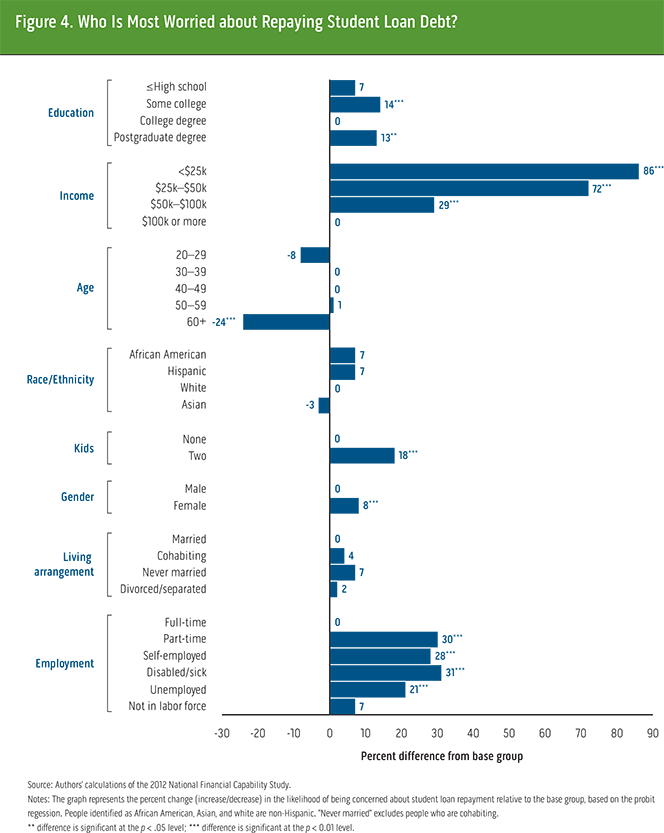

Then the researchers attempt to understand who are most worried about student debt. They find that people with some college but no degree and graduate degree holders are 13 – 14 percent more likely than people with college degrees only to be concerned about repaying student debt. Graduate degree holders, we are told, could have loans for both college and graduate school, making them more indebted and, therefore, more concerned.

Unsurprisingly, borrowers from lower-income households are substantially more likely to be concerned about their ability to repay their student loans. Compared with borrowers from households with incomes above $100,000, those from households with incomes below $25,000 are 86 percent more likely to worry about paying back their student loans and those with incomes between $25,000 and $50,000 are 72 percent more likely to worry. However, borrowers with incomes between $50,000 and $100,000 are only 29 percent more likely to worry about student loan repayment than their counterparts with incomes above $100,000.

Age, it turns out, is not a significant factor when it comes to debt repayment concerns, with one exception: people in the 60-and-older age group are, on average, significantly less likely to be concerned about their ability to repay student debt. As these are people who are either already retired or nearing retirement, we might expect them to have greater concerns about their ability to repay debt. Then again, they are also less likely to have student debt, making repayment less of a concern.

Having financially dependent children is, of course, strongly related to concerns about student debt repayment. Compared with people who have no financially dependent children, adults with two financially dependent children are 18 percent more likely to be concerned about repaying their student loans.

Interestingly, whereas women are no more likely than men to have student debt, they are more likely (by 8 percent) to worry about paying it back, even controlling for household income and structure and number of financially dependent children. The researchers speculate that, as women are more likely than men to pay family bills, they may be better informed of the monthly student debt installments and their impact on family finances.

Needless to say, borrowers who are not employed full time are more worried, even when controlling for household income. On the other hand, race and ethnicity are found not to be significantly related to concerns about student loan repayment.

The Takeaway

So what do we do with this research? Well, the report’s authors talk about reducing anxiety about student debt repayment through reducing reliance on student loans and making college more affordable, but that sounds more like wishful thinking. Relatively few students have the ability or good fortune to fully finance their education using their own money or scholarships and student aid. And there is no indication as of yet that the trend toward skyrocketing college tuition is about to end anytime soon. I think one way to deal with the issue is to place at least some qualifying standards for federal loan applicants. Once these get more difficult to get, colleges may become more reluctant to keep raising costs quite as rapidly. Of course, the downside is that many would-be college students would find themselves unable to pay their tuition. But if someone has a better idea, let’s hear it.

Image credit: Flickr / Saint Huck.

I still have a $40,000 student loan debt. The government ripped me off and so did Brandon University. I have only had two years of employment since graduating in 2003.