Square Register and the Issue with Credit Card Processing Rates

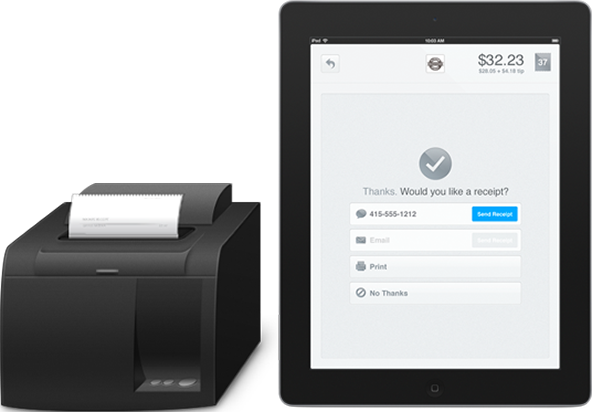

Square, the mobile payments company started by Jack Dorsey of Twitter fame, has just launched a new app that turns an iPad into a full-fledged point-of-sale (POS) terminal. Register, as the app is called, can give even the smallest of merchants credit card acceptance capabilities and business management tools that were, until now, available only through high-end, clunky and expensive POS terminals. It is a really, really cool and versatile product.

Now, before this begins to sound too much like a press release (or is it too late?), let me offer a caveat: Square Register’s pricing is not competitive for even the smallest of merchants, excluding the one- or two-person operations or for that matter any business that would only accept a couple of thousand dollars or so on credit and debit cards a month. Square of course is trying hard to convince anyone who would listen otherwise, but even a brief look at the numbers (and I can assure you that merchants will take a more than brief look at them) tells you that Square’s claim simply doesn’t hold up.

Well, I actually sympathize with the Square guys. Devising a pricing model that would appeal to the broadest possible merchant audience is a thankless task, one with which we at UniBul Merchant Services too are struggling. Let me explain.

What Square Register Does

First, though, I just can’t resist briefly going over the main features of Square Register. Here they are, in no particular order:

- Pricing: 2.75 percent for swiped transactions and 3.5 percent plus $0.15 for key-entered ones.

- Custom Inventory lets you organize and manage the items you sell by adding their pictures, names and pricing.

- Loyalty Program allows merchants to keep track of regular customers and reward them with special offers and discounts.

- Square Directory lets merchants add their profiles to the company’s list, where they can be found by users of the Square Card Case app, the company’s social shopping network.

- Analytics let merchants evaluate their business’ performance and put numbers to things (for example, what times are the busiest) they may have known, but have never been able to measure.

There are other things like wirelessly printed receipts, assigning employee permissions, setting custom tip amounts, etc. And, as I already said, it is all wrapped up in a very cool design.

The Pricing Issue

OK, now we can move on to the pricing thing. Square’s stated goal is to simplify the pricing of credit card processing services and they’ve done it. But simplicity in our industry is not easily reconciled with value. We’ve been trying to find the right balance between a pricing model that is easily understood by merchants and one that is advantageous to them for many years now and have found it to be an extremely elusive target.

As we’ve previously written, what makes it difficult to design a pricing model that is at the same time simple and cost-efficient is the complexity of the interchange fee structure, which lies at the heart of every pricing model. Try to explain to someone who’s never heard of interchange before what that is and how it affects the cost of his business’ card acceptance and you’ll quickly understand exactly what I mean. Even merchants with years of experience, who have gone through several processors and a couple of different pricing models, usually do not understand the interchange thing. Only large businesses can typically (though far from always) be counted on to have invested the time to learn what makes up the processing fees they pay.

So it made perfect sense for Square to decide on using a two-tiered pricing model (one fee for swiped and another for keyed payments) when it first opened for business and it still does, as the company’s primary target users are consumers and very small merchants. However, as Square tries to move up the ladder, it will discover what traditional processors have been up against for so many years.

The Takeaway

Coolness alone will not be enough to help you convince a restaurant processing $100,000 a month on bank cards to dump its current processor in your favor. If Square is to make its offering attractive to bigger-volume merchants, the company will eventually be forced to adjust its pricing model. But the moment it does that, simplicity goes out of the window. At that point Square will no longer be able to say “2.75% per swipe for Visa, MasterCard, Discover and AmEx.” And whatever shape the new pricing model may take, there will be a need for a lot of explaining.

It will be interesting to see how Square deals with this issue. One possibility could be to separate its offerings into a business and consumer categories, which would allow it to keep the consumer pricing structure unaffected by any changes implemented to appeal to businesses. Of course, such a division can lead to different kinds of issues, but I already said that setting credit card processing rates is a thankless task, didn’t I?

Image credit: Squareup.com.