Square Is More Than a Match for PayPal

Bloomberg’s Olga Kharif is arguing that, as the mobile payments field is getting ever more crowded, venture capitalists are being put off and the myriad of m-payments start-ups are struggling to make a buck. In their efforts to gain a foothold in the market, the newcomers to the payments industry are luring even the smallest of merchants with offers of zero-percent card processing fees, Kharif reports, quoting the CEO of one of the more prominent among these start-ups predicting that eventually processing fees will be free to merchants. If such a claim sounds like madness to you, that’s because it is.

But it is another aspect of Kharif’s reporting that I find interesting. The author makes it sounds as though the smart phone-based end of the mobile payments market is still at its infancy, with dozens of fledgling processors chaotically scrambling for the early advantage — a largely futile effort, as the start-ups are “no match for PayPal”. Well, I don’t think that anyone who’s been following closely the developments in this sub-industry would agree with the author’s view on its maturity and a great many of them — this blogger very much included, would quarrel with her prediction of PayPal domination. So, for the record, the phone-based card acceptance market is no longer virgin territory; it has a champion and its name is not PayPal, it is Square. Moreover, irrespective of whether or not Jack Dorsey and co. are currently making money, once they’ve consolidated their hold on the sub-industry, they’ll be minting it.

101 Mobile Payments Processors

Kharif quotes a consultant who’s counted “more than 100 competitors” vying for supremacy in the mobile payments market and names a few of the smaller contestants — Front Desk, Flint Mobile, LevelUp and PayClip — which are squaring off against the big guys, of whom PayPal, First Data and Square are named. Judging by the number of start-ups we’ve reviewed on this blog over the years, that headcount is probably correct.

The particulars vary, but conceptually the start-ups are doing essentially the same thing — enabling merchants to use a mobile device — a phone or a tablet — to accept credit and debit cards for payment. Most of them, including Square and PayPal Here, achieve the feat with the help of a piece of plastic, which merchants stick into their smart phones and use as a card reader. Others, like LevelUp and Starbucks, encode the transaction information into 2-D barcodes displayed on the customers’ phones, which are read by scanning devices linked to participating merchants’ point-of-sale terminals. Yet others, like Flint, which is mentioned by Kharif, and before it Card.io, which a year ago was acquired by PayPal, enable sellers to accept payments by taking photos of their customers’ cards and then use software to “read” the relevant card information from the pictures to be used during the transaction process.

Technical differences aside, though, all of these processors are competing for the same market — very small sellers ranging from individuals through sole proprietors or mom-and-pop operations to coffee shops or similarly-sized retailers. Realizing that most of them look the same to merchants, many start-ups have seen price competition as the only way to beat out their rivals, as documented by Kharif. The CEO of LevelUp goes as far as calling it a “commodity business”. His company, he tells Kharif, “doesn’t expect to make money from the 2 percent transaction fees it charges merchants”. Instead, he hopes “to reach profitability in the next four or five quarters by letting businesses send ads and offers to the more than 1 million consumers who use the product”. With such a game plan, LevelUp’s view of the industry’s present and future won’t surprise you, I suspect:

Payment processing is a break-even affair… Eventually costs will be free for merchants.

Well, I think that this view is wrong and, to understand why, all you have to do to is look at Square.

Mobile Payments Processing Is a Money-Making Business

It seems a long time ago, but it is actually not even three years since Jack Dorsey announced, in a now-famous tweet, that “[t]he doors are (finally) open @Square & we’re going big”. Square was launched and a market was created out of nothing. More importantly, however, and to his full credit, Dorsey fully realized just how big of a bomb he was detonating. He had a hugely ambitious game plan, which revolved around spending hundreds of millions of dollars on marketing. More importantly, he has been able to raise all this cash and as a result, we have all been treated to what must be the biggest marketing campaign ever launched by a start-up.

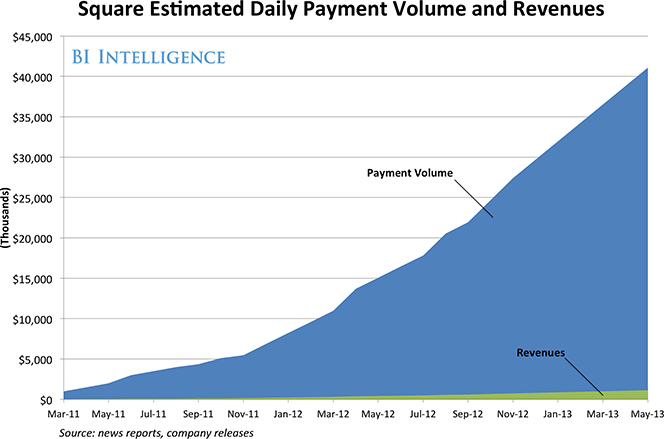

Crucially, although Dorsey must have expected his business model to be quickly copied by a host of rivals, large and small, some of whom surely would attempt to undercut his pricing, he would never compete on price. Instead, Square would focus on improving the product, adding new features and, of course, marketing the whole thing mercilessly on the unsuspecting public. It has worked. Merchants, by and large, have been ignoring other start-ups’ lowball offers and have flocked to Square. Here is Business Insider’s latest estimate of the company’s processing volume and revenue.

This is serious growth and, which is its most striking feature, it is not slowing down as the volume grows — on the contrary, it accelerates. We don’t know how well PayPal Here’s (eBay’s processor’s Square clone) numbers stack up against Square’s, but I don’t think PayPal would be keeping them private if they were comparable. But looking at this chart, I can’t help but see a repeat of Amazon’s early history — Square’s objective very clearly is to become the dominant player in the industry it created and do it as quickly as possible, before others have the time to come up with a plausible counter-strategy. If achieving that goal means carrying losses for years on end, so be it. There will be plenty of time to make serious money once the competitors have been eliminated.

The Takeaway

I would challenge Kharif’s contention that the increasingly crowded m-payments field is putting off venture capitalists. Overall volumes invested in the sub-industry may well be lower than they were a year or two ago, but that is probably because fewer start-ups believe they stand a chance against an ever more powerful Square and the VC guys have fewer hopefuls to invest in. Yet, put something cool in front of them and they would still jump all over it, even if it is invisible.

But more importantly, mobile payments processors can make money, especially as the interchange rates are falling (because most of them are using flat-rate pricing structures, which ensures that the processor alone pockets the difference between the old and new rates and none of it is passed on to the merchant). As it happens, though, most of them are playing in the hands of Jack Dorsey, slowly suffocating under the weight of absurdly low pricing structures. PayPal hasn’t done anything quite as stupid, but even it hasn’t been able to make much of an inroad, as far as I can tell. So yes, Square is proving to be more than a match for PayPal and, once the dust has settled, it stands to reap huge windfalls. And deservedly so.

Image credit: Square.