Sinking Deeper into the Debt Hole

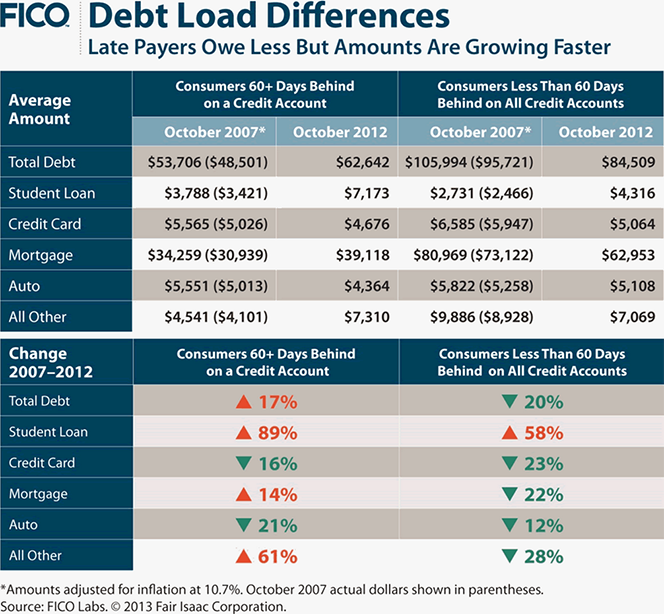

Even as the U.S. population as a whole has been deleveraging continually since the onset of the financial crisis, the total amount of debt owed by consumers who have been late paying their bills has increased quite significantly, we learn from a new analysis by FICO, the provider of the most widely used consumer credit scores. On average, consumers who were behind on at least one of their credit accounts owed about $9,000 more in 2012 than they did in 2007, we learn.

You may not be surprised to learn that the main driver of this increase has been the skyrocketing student debt. In fact, student loans are the only category, in which indebtedness has increased for consumers who are behind on at least one of their credit accounts, as well as for those who are current on all of them — and the increases are huge for both groups. Among the other examined categories, indebtedness among late payers has decrease only for credit cards and auto loans. Let’s take a closer look at FICO’s findings.

Debt Among Late Payers up by 17%

FICO has calculated that the average amount of debt held by consumers who are late paying at least one of their credit accounts has risen by 17 percent between 2007 and 2012. The mean total amount of debt for consumers who were delinquent by 60 days or more increased from $53,706 (adjusted for inflation) in October 2007 to $62,642 in October 2012, with student loan debt (primarily) and mortgage debt being the main drivers.

Student loans have been far and away the fastest growing debt component for late paying consumers, rising by 89 percent between 2007 and 2012. But the average amount of student debt also increased by 58 percent for the rest of the American population, and, as already noted, it was the only type of credit to rise for the non-late-paying group of consumers. For delinquent consumers, the amount of student loans owed in October 2012 was also 66 percent higher than the total for non-delinquent consumers in the same time period.

The average amount of mortgage debt was 14 percent higher in 2012 for late paying consumers, but it fell by 22 percent for their non-delinquent counterparts, we learn. The discrepancy in the category of all other credit (not including student loans, credit cards, mortgages or auto loans) was even greater: the average debt amount increased by 61 percent among late paying consumers, but it fell by 28 percent among non-delinquent ones.

In each of FICO’s samples (2007 and 2012), about 19 percent of the population were delinquent by 60 days or more on at least one of their credit accounts. Here is a table with FICO’s findings:

The Bigger Picture: Debt, Delinquency Levels Down

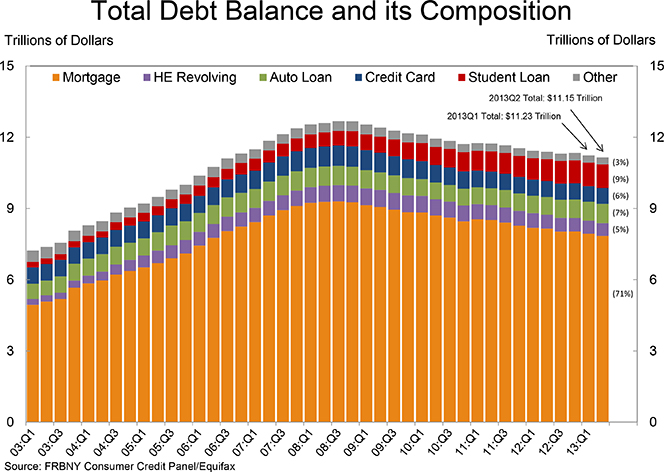

It’s worth putting FICO’s findings in perspective. The latest Household Debt and Credit quarterly report from the New York Fed told us that the overall indebtedness of U.S. households at the end of the second quarter of this year was $11.15 trillion. That total was lower by $78 billion (0.7 percent) than the one measured at the end of the previous quarter and was lower by $1.53 trillion (12.1 percent) than the all-time record-high of $12.68 trillion recorded in the third quarter of 2008, at the end of which the collapse of Lehman Brothers set off the financial crisis.

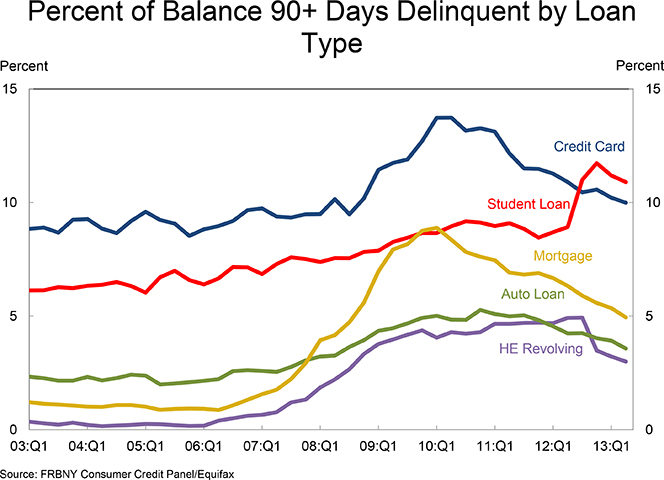

The NY Fed report also told us that the overall delinquency rate fell considerably in the second quarter, the seventh consecutive quarter of improvement. As of the end of June, 7.6 percent ($845 billion) of all outstanding household debt was in some stage of delinquency, down by half a percent from the 8.1-percent rate ($909 billion) recorded in 2013 Q1 and by 1.4 percent from the 9.0-percent rate (1.02 trillion) at the end of 2012 Q2. About three-quarters — $635 billion — of that total was “seriously delinquent”, which the NY Fed defines as overdue by 90 days or more — down from the total of $678 billion in the previous quarter and from $765 billion a year ago. As seen in the chart below, the delinquency rates of all types of consumer loans tracked by the NY Fed, including student debt, have declined in the second quarter.

There is every reason to believe that there is still room for both the overall debt total and aggregate delinquency rate to fall further.

The Takeaway

So what are we to make of FICO’s findings? Here is how Andrew Jennings, a Chief Analytics Officer at FICO, interprets the results:

This is a tale of two Americas… Most Americans have deleveraged, bringing their total debt down, but debt loads have risen for the one in five Americans who have problems making payments. Ultimately it is up to the lenders and debt collectors to tailor their approaches to different consumers in order to increase their yield, and help customers get back on track.

I guess this analysis mostly tells you who the report was made for. Anyway, this is just the latest report to illustrate just how big of an issue student debt has become. At the end of 2013 Q2, its total was up by 63 percent from the $611 billion level of Q3 2008 and is still increasing. Yet, we’ve seen a slowdown in its growth rate since the beginning of this year, so maybe things are beginning to improve. But it’s too early to tell.

Image credit: Flickr / Jagz Mario.