Should Federal Student Loans Be Tied to Creditworthiness?

Over the past few years, the United States government has been spending more than $170 billion in financial aid annually in an effort to encourage young Americans to go to college, Rajeev Darolia reminds us in a new paper for the Federal Reserve Bank of Philadelphia. The huge increase in funding has been prompted by research that consistently finds growing economic benefits of college, such as higher wages and lower unemployment rates. Furthermore, college graduates are more likely to engage in civic activities and charitable giving, less likely to be involved in crime and are generally contributing to more productive communities.

However, as regular readers are well aware, there is another side of that coin, which is that, in recent years, there has been a huge and ongoing rise in student loan borrowing and default rates. That, in turn, has caused concern about the financial risks associated with loan defaults on such a scale and the financial challenges faced by many students. So what, if anything, should be done to reverse or at least slow these trends? Well, Darolia makes a couple of recommendations. First, he suggests that policymakers might want to consider taking creditworthiness into account when decisions related to the amount students can borrow are made. Second, he recommends that more information is made available to students to help them make better informed decisions about where to go to college and how much to borrow. I am all for implementing the former suggestion, but am quite skeptical that the latter would make much difference (in fairness, the author himself concedes that information access is “not a panacea”). Let’s take a closer look at the paper.

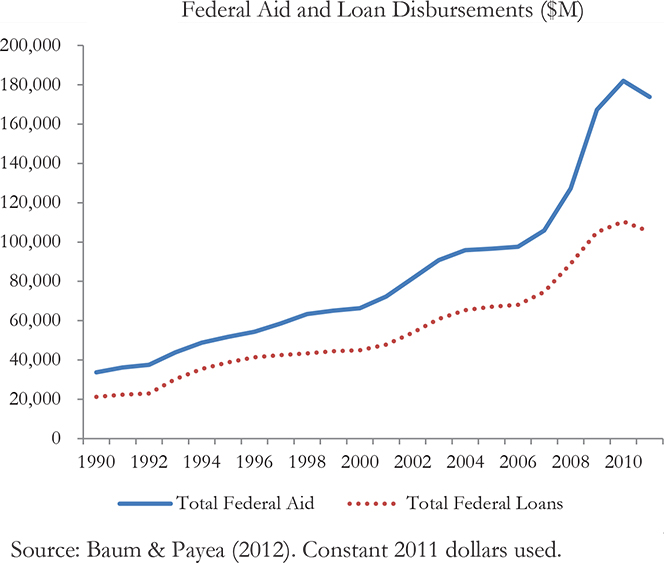

Federal Student Aid Exceeds $170 Billion Annually

Since 1990, federal student aid, including grants, loans and other aid used to encourage college enrollment, has increased about fivefold, both because more students are getting aid and because the amount of aid per student is increasing. As a result, in recent years that total has exceeded $170 billion annually.

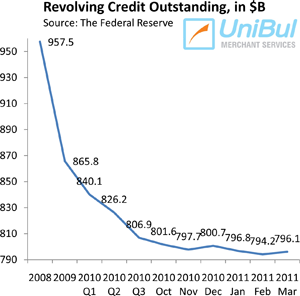

The increased availability of student financial aid has, in turn, improved college access by lowering the direct cost of post-secondary education for students. However, a side effect of that policy has been the skyrocketing of the outstanding student debt in the United States, whose total has now exceeded $1 trillion, making it the second largest consumer debt category in the country behind housing.

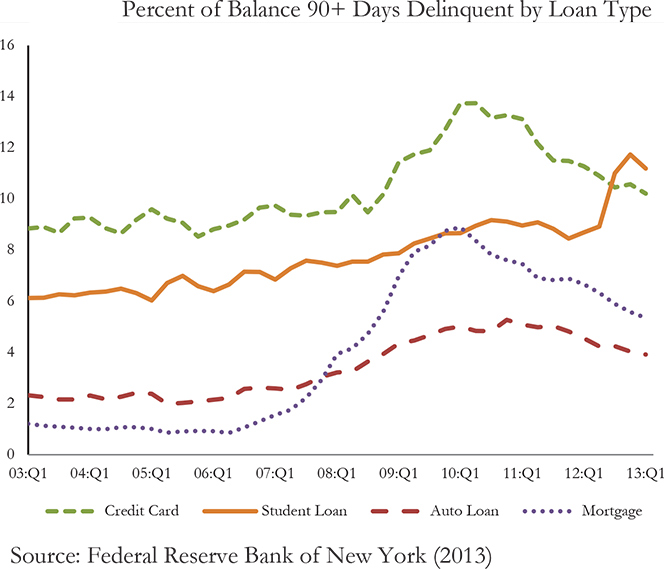

The author contends that the huge recent spike in the student debt total is not as big a concern as “some media reports” claim. Yet, he concedes that extremely high student loan default rates are “troubling”, as defaults “can limit students’ future access to the credit market and impair their ability to finance future purchases”. Here is a chart comparing student loan delinquencies to those of the other major consumer credit categories:

Is College Worth It?

So, given those trends, is college worth it or, as Darolia puts it, “are particular colleges worth it for certain students“? The “particular colleges” in question are for-profit colleges, which, the author tells us, “disproportionately serve students that are more likely to default, such as those that come from low-income backgrounds or are financially independent”.

Why focus on for-profit colleges? Well, to begin with, they account for “nearly one-quarter of federal aid disbursements, exceeding the proportion of enrollment”. But there is more: “recent studies indicate that for-profit students generate earnings gains that are lower than those of students in other sectors.”

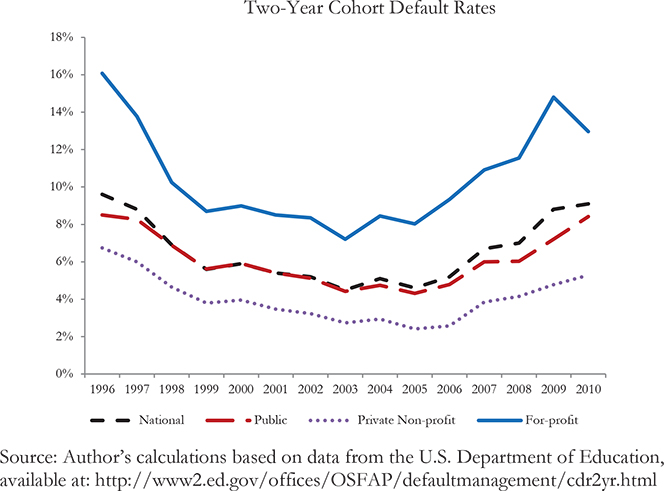

The chart below shows the annual federal loan programs cohort default rates (CDRs) — a measure for the share of former students who default on their student loans after starting repayment. CDRs have increased since the beginning of the decade nationally and across school types. However, for-profit sector default rates are highest in all years and the for-profit sector has the largest increase in CDRs between 2003 and 2010.

Naturally then, newly-proposed regulations aim to tighten student loan eligibility even more, with a particular focus on for-profit institutions and the author goes through the details. At present, as long as a student attends an eligible program, she can borrow federal student loan money without an assessment of her creditworthiness. So decisions to approve and price loans are not based on individual risk of default. Unsurprisingly (at least to me) then, default rates have been skyrocketing.

Darolia then goes through the factors, which have direct bearing on student debt defaults, such as unemployment and socioeconomic and demographic characteristics. Unsurprisingly (I’m using that word quite often today), he finds that students with a higher default risk include “older students, financially independent students, students with dependents and students from less advantaged socioeconomic backgrounds who expect little financial help from family members”.

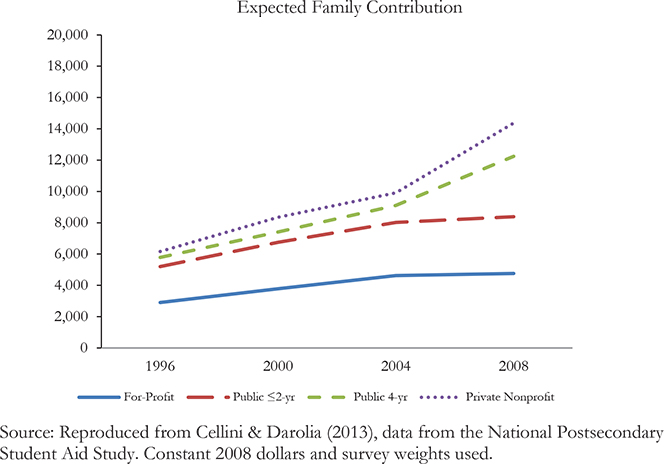

When he examines the financial resources available to students across sectors, the author finds that while students at for-profit colleges are borrowing more, they also have the fewest financial resources available and the difference is getting larger over time. The chart below shows the trends in expected family contribution (EFC), a common estimate of students’ and their families’ financial resources available to pay for college costs. As you can see, not only do for-profit students have by far the lowest EFCs across sectors, but they also had declining or flat EFCs in 2008, compared to increasing EFCs in the public, four-year and private, non-profit sectors.

Yet, having reviewed the evidence, the author concludes that the type of college is not a determinant of student loan default, but that for-profit colleges simply “enroll students who are most likely to default”. The propensity of default on student loans is a “pre-existing condition”, we are told, where high default rates are a function of students’ characteristics and not an indictment of the educational offerings of schools.

The Takeaway

Here is what seems to be the author’s main conclusion:

[I]nstitution-level eligibility policies should be recognized as not only influencing at which schools students enroll, but also higher education access. If limiting some individual access to higher education is believed to be acceptable in return for reducing student loan defaults, then there may be some merit in exploring policies that consider creditworthiness and manageable debt standards as part of decisions related to the amount individual students can borrow. Debt-to-income ratios are commonly taken into account before credit is offered in other contexts (e.g., housing) to determine whether borrowers can obtain credit and how much they can borrow. While we typically do not know students’ post-graduation incomes prior to college entry when students obtain most loans, Gainful Employment proposals are already asking for average program-level debt-to-income ratios to be calculated based on outcomes of completers. Consideration of prudent borrowing amounts prior to matriculation may proactively limit students’ unmanageable debt burdens and lower risks of default.

Darolia also recommends that we “enhance the information available to students so they can make informed decisions about where to attend and how much to borrow”, but, as already noted, even he is skeptical about how much difference that would make.

Image credit: Flickr / jjinsf94115.