Saving for College in 2013

We’ve been writing quite a bit on this blog about the student debt problem in our country and for good reason — the total is growing faster than a college kid can type on her smartphone and shows no sign of slowing down. Something will eventually happen to bring things back to normal, but I have my doubts that normality will be achieved without first plunging the system into a mini-Lehman style crunch. I guess we should take some comfort in the assurances of economists who have looked into the issue that the burst of the student loan bubble could not possibly do as much damage as the collapse of the housing market a few years ago.

But this morning I came across a study just published by Sallie Mae and Ipsos, which has looked into the financial choices Americans make long before their children enter college and in particular their behaviors related to saving for college. Given the poor state of the economy and an unemployment rate that is still sky-high all these years after the crisis broke out, you might not be surprised to learn that fewer Americans are preparing to meet their children’s college expenses than just a couple of years ago. But let’s take a look at the results.

How America Saves for College 2013

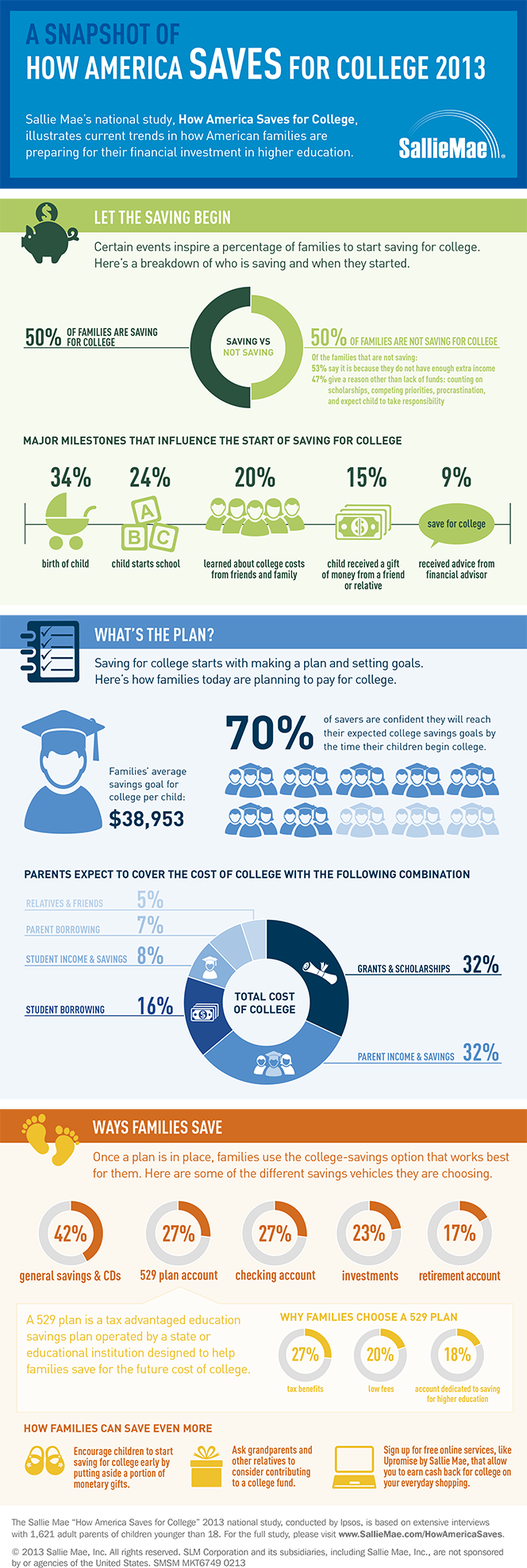

The study found that 50 percent of American families with children under the age of 18 save for college, down from 60 percent just two years ago. Here are the highlights of the study:

- Even as nearly all parents believe that college is an investment in their child’s future, only a third of them have a plan to pay for it.

- Unsurprisingly, given the huge and skyrocketing costs, when asked about their feelings about saving for college, parents’ top answers are overwhelmed, annoyed, frustrated, scared, or that they don’t like thinking about it at all.

- Interestingly, just about half of the parents who are not saving (47 percent) cite a barrier other than money for their decision. Among the top reasons are thinking that their children would be awarded enough financial aid to cover the cost of college, that children are too young or too old, uncertainty about which savings option to use, procrastination and feeling it is the child’s responsibility to save and pay for college.

- Families are usually prompted to start saving for college by major milestones such as a child’s birth (34 percent), starting school (24 percent) or learning about college costs from friends and family (20 percent).

- Just over a quarter (27 percent) of parents who do save for college use a 529 college savings plan. The top reasons for their decision are tax benefits, low fees, the fact that this is an age-based investment, which can be cashed out when the child enters college, and having an account dedicated to college savings. However, more parents save for college using general funds or CDs (42 percent) and may miss out on tax incentives offered by a 529 account.

Needless to say, if college costs continue to rise at the present rate, the lack of planning and saving could severely limit the opportunities for low-income families to send their children to college. But then, at this rate, even the best of planning might not be nearly enough.

Let the Savings Begin

The study’s authors have created an excellent infographic to illustrate their results. Here it is:

Image credit: Mytitaniumlacrosse.com.

The combination of increasing tuition and the decline in jobs available is making the idea of getting a college degree seem unrealistic to some high school students and their families. I agree that the recent economic crisis has forced some parents to use money they would have otherwise saved for their child’s education on more immediate expenses. However, parents should keep in mind that helping their children, with any amount, may put them in the right position to land a better job down the road. Starting to save for a child’s college education when they are born is smart. This gives parents, relatives, and students an ample amount of time to put away the appropriate funds for higher education, leaving wiggle room to postpone saving money during times where money is running thin. Reducing outstanding student debt needs to be a priority in this country, and saving early can help to solve this issue.