Reversing Trend, Americans Value Mortgages More than Credit Cards

TransUnion has just released the third update to its 2010 Payment Hierarchy study, which has been monitoring the changing consumer debt repayment preferences following the financial crisis of 2008. It shows that, in a reversal of the post-Lehman trend, Americans are increasingly placing more value on paying their mortgages than their credit cards. The opposite has been the case in each of TransUnion’s three previous studies on the subject.

This latest result indicates a return to traditional payment patterns, which held up until the financial meltdown. TransUnion interprets its findings as validating the proposition that the shift — rising or declining — in home prices correlates strongly with consumer payment preferences. It should be added, however, that the increased consumer attention to mortgages in the past year hasn’t done any damage to the health of Americans’ credit card accounts. On the contrary, both credit card delinquency and charge-off rates are at record-lows and Americans are paying back more of their outstanding card balances at the end of each month than they have ever done. But let’s take a look at TransUnion data.

The Data: Mortgage Delinquencies Are Falling Fast

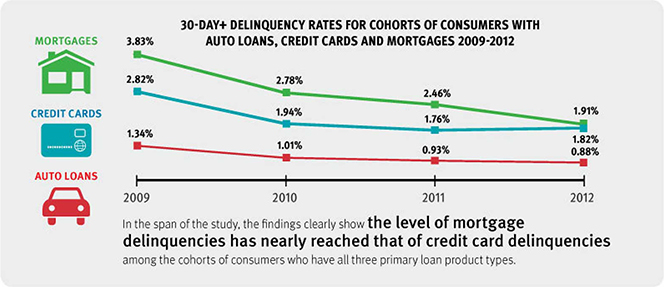

TransUnion’s study examines the responsiveness of Americans’ payment behavior to periods of both home price depreciation and of significant appreciation, in the period from January 2008 to December 2012. Included in the sample were consumers who had at least one open credit card account, one open mortgage and one auto loan, all in good standing as of January 2008. The study measured the share of these consumers who were delinquent by 30 days or more on one of these three debt categories, while being current on the other two as of January 2009. Here are the national averages:

As you can see, among consumers who have all three loan types on file with TransUnion, the level of mortgage delinquencies has now nearly reached that of credit card delinquencies and it’s on a downward trajectory. According to Steve Chaouki, a TransUnion vice president and a co-author of the study, it’s all about the health of the housing market:

The results of previous TransUnion research showed that, beginning in 2008, consumers with both a credit card and a mortgage had a higher propensity to go delinquent on their mortgages than on their credit cards — a reversal of traditional payment patterns… This occurred in an economic environment marked by the build-up and bursting of the housing bubble. In fact, it is broadly believed that the shift in payment preferences was largely derived from the struggles of the housing market. Our latest study indicates that, for the first time since the housing bubble, consumers with constrained liquidity are making their mortgage payments about as much as their credit card payments, though auto loan payments remain the top priority.

I agree with Chaouki’s analysis. Furthermore, as Ezra Becker, another TransUnion vice president and a co-author of the study, observes, consumer delinquency behavior appears to be driven by the movements of the home prices and is going through three phases: rapid increase, stabilization, and rapid decrease. We are now going through the third phase.

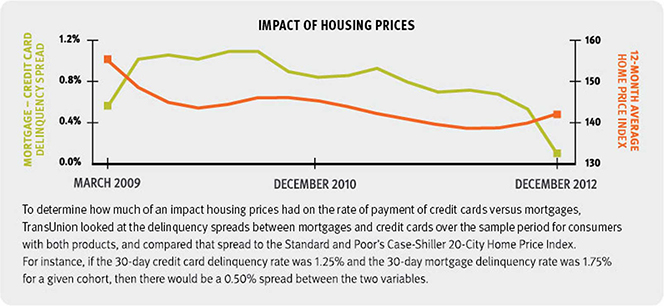

To determine the size of the impact home prices have had on credit card delinquencies, the authors have looked at the delinquency spreads between mortgages and credit cards over the sample period and have compared that spread to the Standard and Poor’s Case-Shiller 20-city Home Price Index. Here is how that comparison looks:

A State-by-State Comparison

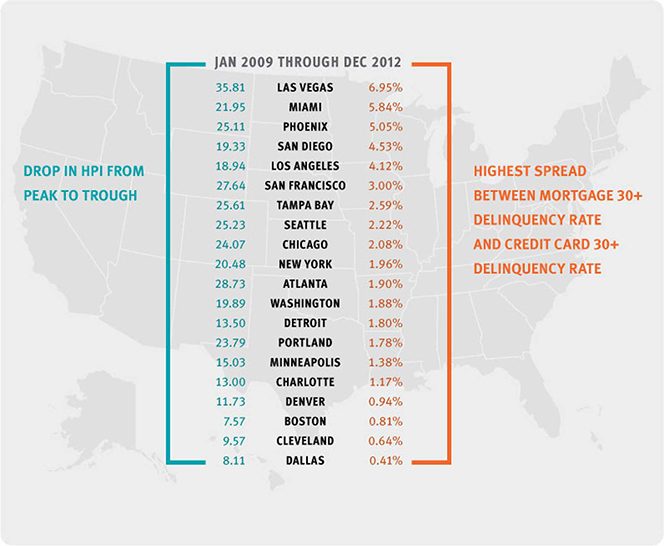

TransUnion’s study found great variances in the way the major U.S. markets experienced the housing bubble. For example, the authors tell us, Los Angeles, Chicago and Dallas experienced markedly different dynamics, which resulted in different payment hierarchy experiences. While the delinquency spread between mortgage and credit cards for the United States as a whole peaked at just over 1 percent, the hardest-hit markets had much higher spreads.

In the case of Los Angeles, which experienced significant home value depreciation followed by a period of stable prices and a recent period of home price appreciation, the delinquency spread between mortgages and credit cards peaked early on at above 4%. However, the spread declined continuously until reaching near-parity levels by the end of the sample period.

Chicago also experienced a significant home value correction, but in contrast to Los Angeles Chicago experienced sustained price decreases and no significant rebound in the recent period. Chicago’s delinquency spread peaked at 2% a year later than Los Angeles and hovered between 1% and 2% through the end of the period.

Dallas, mostly insulated from the housing crisis, had stable price conditions throughout the sample period. As a result, its delinquency spread experienced little change over the sample period, starting and ending below zero and moving within a narrow band.

Looking at the table, I can’t help but notice that the numbers for my home market of Boston are much closer to the ones for Dallas than they are to L.A. or even Chicago. Amazingly, even though Boston went through a period of a huge home price appreciation, the drop in the market’s Home Price Index (HPI) is the lowest among the examined markets, lower even than Dallas’, which, as TransUnion reminds us, experienced almost no bubble. Well, I am here to confirm that Boston’s home prices never really come even close to collapsing, far from it.

The Takeaway

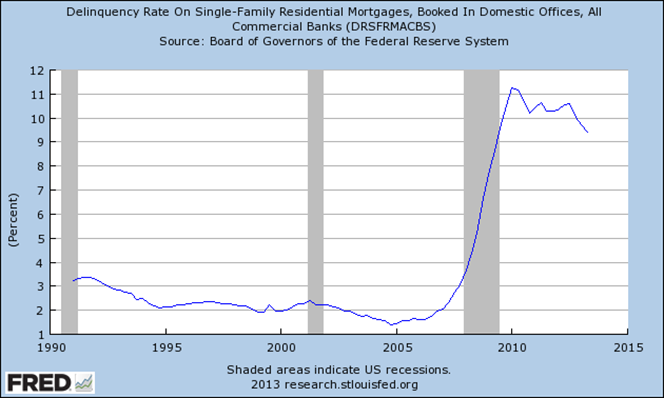

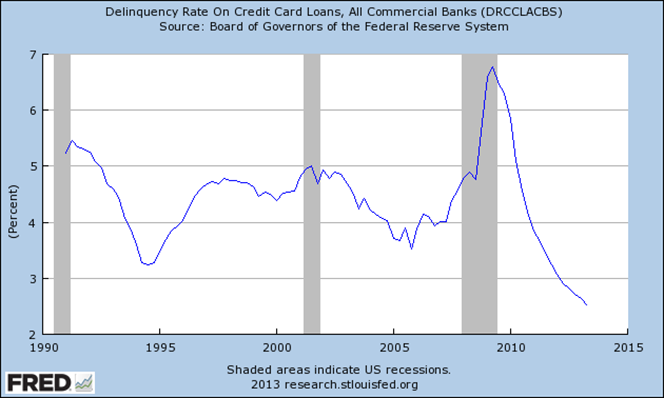

There is another way to illustrate the evolution in American consumers’ payment priorities. The fact is that both mortgage and credit card delinquency rates have now fallen well below their post-crisis peaks. However, whereas credit card delinquencies are now at a historically low level (and, amazingly, are still falling), mortgage delinquencies are still very high by historical standards. The two graphs below drive the point home (source). First, mortgages:

And here is the credit card delinquency graph:

So, as you can see, even though much progress has been made, mortgage delinquencies still have a long way to fall before they catch up with credit cards.

Image credit: Wikimedia Commons.