Requirements for Merchant Account Providers

The service that enables businesses and non-profit organizations to accept credit and debit cards (bank cards) for payment is called a merchant account. Merchant accounts cannot be set up for individuals. Sole proprietorships are acceptable, provided they first register a “Doing Business As” (DBA) name with their local municipality. The providers of this service connect the merchant’s point of sale payment acceptance device with the bank that acquires the merchant’s transactions (called an acquiring or processing bank) and funds the merchant’s account. Whether the point of sale is at a physical store or online, the process is the same, just the tools are different.

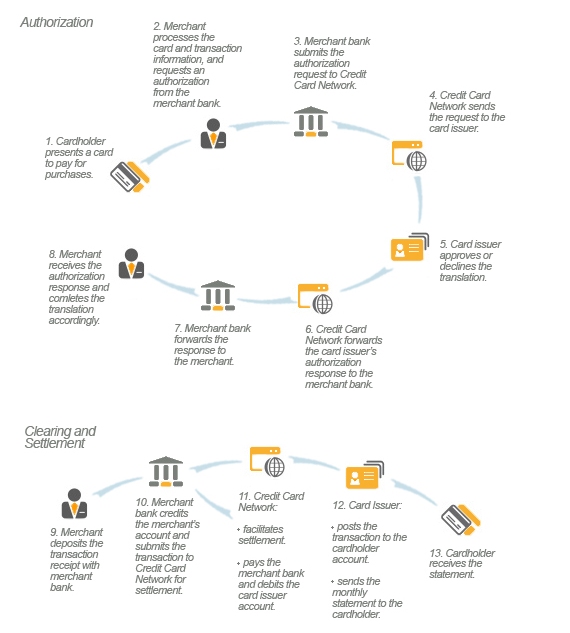

The transaction process goes through the following stages:

- A customer presents a card for payment.

- The transaction information is securely transmitted to the acquiring bank.

- The acquirer sends the information on to Visa or MasterCard.

- Visa or MasterCard send the information on to the card issuing bank for verification.

- The issuer then verifies the information and sends back an authorization response (a decline or approval) through the same channel.

- The merchant accepts the payment and settles the transaction with its acquirer.

- The acquirer funds the merchant’s account for the transaction amount, after subtracting the card issuer’s fee (the interchange), the Association fee (Visa’s or MasterCard’s fee) and its own service fee. The acquirer then submits a payment request to the card issuer.

- The card issuer funds the acquirer’s account, after subtracting the interchange fee and bills its cardholder’s account for the full transaction amount.

- The cardholder receives his or her monthly statement and makes a payment to complete the cycle.

Merchant accounts can be provided by banks that are members of Visa and MasterCard, but more often they contract with third parties to provide the service while the banks do exclusively the acquiring of card transactions and settlement of the funds.

Before offering merchant account services, third party organizations must first be sponsored by a member bank and licensed and registered with Visa and MasterCard. The registration process includes a thorough examination of the credit histories of both the business and its principals, a review of the applicant’s business and marketing plans and the payment of registration fees which amount to $5,000 for each Association.

Third-party merchant account providers are known as Independent Sales Organizations (ISOs) when they are registered with Visa and as Member Service Providers (MSPs) when they are registered with MasterCard. Businesses apply for both registrations at the same time, through their sponsoring bank. When an ISO / MSP begins to sign up merchants, the card transactions generated by the merchant are acquired by the sponsoring bank, which at this time becomes an acquirer for the merchant. What this means is that the bank acquires the sales receipts for the merchant’s transactions and it is then responsible for funding the merchant’s account. ISOs and MSPs are obligated to display the name of their acquiring bank on every page of their website and other promotional materials. Usually this sign is placed in the footer of the website. Every year the ISO / MSP registration is reviewed and, upon renewal, a registration renewal fee is charged, in the amount of $2,500 per Association.

Registered ISOs and MSPs can sign up sales agents to source merchants for them. The sales agents, however, cannot advertise themselves as merchant account providers. They are only authorized to represent the ISO / MSP and must identify themselves as agents to these organizations. Visa and MasterCard are very strict in enforcing this requirement and violators can be fined a very substantial fee.

Image credit: Brewed.nl.