Payday Loans Get a Facelift, or Do They?

I’ve been reading about various new-age payday loan alternatives for some time now, but never quite got around to actually take a closer look at one. Well, I just did that and what I saw certainly looked better and more transparent than what a traditional brick-and-mortar payday loan provider would offer. But then, the new service is actually designed to be used by a different customer group than the one served by the traditional players—the unbanked.

The start-up I looked at is called BillFloat, which recently raised quite a bit of venture money. The company has operated for the past three years and its CEO told Bloomberg that he “expects its network to drive more than $400 million in loans this year and become profitable”, but no information was disclosed about how much BillFloat loaned in 2012. Let’s take a look at the start-up.

What Is BillFloat?

BillFloat gives out microloans, which borrowers can only use to pay their recurring bills on the start-up’s website. You could use BillFloat to make payments to utilities, cable companies, wireless carriers, insurers, etc. The start-up tells us that it works with 2,531 of such recurring service providers and a glance at the list indicates that the big names all seem to be supported. Bill payment amounts are limited to $200 and the payee has 30 days or so to repay the loan.

BillFloat’s co-founder and chief executive officer Ryan Gilbert summarized his company’s operations as providing “a viable alternative to payday loans and overdraft protection”. However, that is not a completely accurate description of what the start-up does. There is a major difference between BillFloat and the traditional payday loan operators, which has to do with the types of consumers who have access to these lenders’ services.

Who Is BillFloat For?

On the one hand, BillFloat requires that its users have a bank account, which is understandable, for two reasons. Firstly, a bank account provides the lender with a fast and simple way to verify the borrower’s identity. Furthermore, not having a bank account on file would have made it very difficult for BillFloat to set up straightforward loan repayment arrangements with its borrowers. In fact, the only alternative that I can think of would have been repayments by money orders, which would add to the debt servicing costs and greatly increase the risk of default. After all, the company has no physical locations where its customers can go to hand their cash.

But whatever BillFloat’s reasons for requiring that their users have a bank account, the fact remains that the start-up is not designed to serve the unbanked—consumers with no bank account and or credit cards—who are precisely the type of borrowers payday loan providers specialize in servicing.

Incidentally, Gilbert will not be happy to learn that a recent FDIC report revealed that fewer Americans are using bank accounts. The FDIC told us that in 2011—the latest year for which data are available—8.2 percent of all U.S. households were completely unbanked. That is 10 million households in total, in which live about 17 million adults. Since 2009, the share of unbanked households in the U.S. has increased slightly—by an estimated 0.6 percent, or 821,000 households. Even more households—10 percent of the total—did not have a checking account in 2011. And these are the consumers who have the greatest need of the type of services provided by BillFloat.

How Much Does BillFloat Cost?

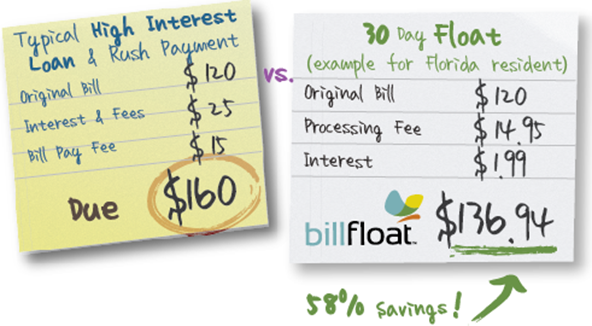

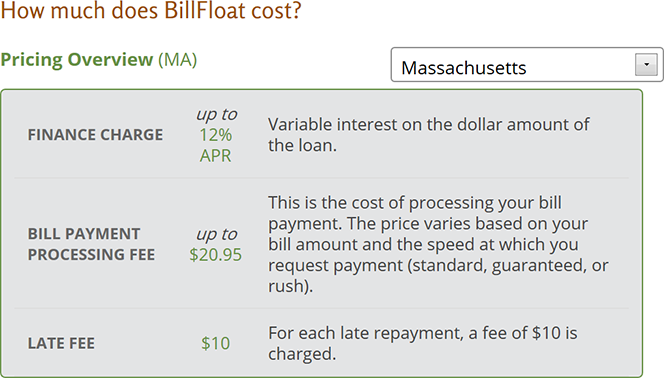

The best thing about BillFloat is the transparency of its pricing structure. The company tells us that users can calculate the ultimate cost of each bill payment before making it by using a fee calculator located on the start-up’s website. The fees listed on the website vary depending on the bill amount and the payment type—standard (5-7 days), guaranteed (4 days or money back) or rush (same or next day). Additionally, the interest rate varies from state to state, as does the amount of the late payment fee. Here is the pricing sheet for Massachusetts:

Note that, whereas the “bill payment processing fee” is always listed as up to $20.95 for all states, both the interest rate and the late payment fee can range quite widely. For example, in Utah the former charge can be up to 36 percent, whereas “[f]or each late repayment, the greater of a flat fee of $30, or 5% of the remaining floated amount is charged”. In some states, for example Texas, New York and New Mexico, no late fee is charged. Based on what BillFloat’s website tells us, borrowers would be given precise figures for each of the three fee categories prior to making a payment.

The Takeaway

I think it should be clear that BillFloat is not a real competitor to payday loan providers, because it cannot serve the type of consumers who are most dependent on their services. Rather than lending to the unbanked, the start-up is better suited to serve consumers who have access to the traditional banking system, but lead paycheck-to-paycheck-type of lifestyles, either because of temporary financial difficulties or because of poor management of their finances. Yet, while it is better not to get to the point of needing a loan to pay your phone bill, BillFloat is a better option than many of the alternatives.

Image credit: BillFloat.com.

As the majority of the Western world is gripped in a recession, the popularity of pay day loan companies is growing, especially on the high street. In our area whilst high street shops are shrinking and closing we are getting pay day loan and cheque cashing businesses opening in their place, it’s a pretty solid industry to be in but does prove the old adage, the rich get richer whilst the poor get poorer, unfortunately. But that’s business for you!

Yes, the payday loan industry is thriving; otherwise we wouldn’t have so many start-ups pushing in.