On Survival of the Fittest, Square and Whole Foods

Back in August of 2012, following a much-ballyhooed announcement of a partnership with coffee chain Starbucks, we proclaimed that Square has come of age. After all, the message was inescapably clear: no longer was Jack Dorsey’s innovative, fast-growing, lavishly funded and extremely well-publicized mobile payments start-up going to be satisfied with serving Craigslist users selling their old couches and farmers market sellers of tomatoes and cucumbers. No, the processor had now entered the big leagues and everyone was being put on notice.

Of course, in time we realized that the two companies’ CEOs, Jack Dorsey and his Starbucks counterpart Howard Schultz, had merely orchestrated an elaborate publicity stunt. In retrospect, I should have been much more skeptical and I still cannot forgive myself for allowing to be taken in so easily. Just listen to what Schultz was saying about the deal at the time:

Because Square’s revolutionary technology allows anyone to accept credit and debit cards, it gives entrepreneurs an essential tool to jump-start their business while providing existing small companies access to new customers. This development can play a vital role in spurring small business growth and hiring, which remains one of our country’s most important issues.

If such language doesn’t make you cringe with revulsion, I don’t know what would. Anyway, here we are a year and a half after the announcement and Square is still not processing Starbucks’ payments and it is clear that this was never part of the deal. The only thing the two CEOs had agreed on, it is now plainly evident, was for Square’s wallet, or whatever the thing is called these days, to be accepted at the coffee chain’s stores. And I challenge you to produce two people who have done so.

And that brings me to the latest announcement of a major deal involving Square and a national retailer, which this time is Whole Foods. Refreshingly, Square’s Whole Foods partnership is presented in much more concrete terms than the Starbucks one. This time the processor explicitly tells us that the upscale grocer will install its iPad-powered point-of-sale (POS) terminals at specific locations inside “select Whole Foods Market stores”, which will serve as “lab stores”. So there is less scope this time around for Dorsey to be deceiving us, although time will be the judge of that.

But the Whole Foods episode brings up a more important, or at least a broader, issue. For, whether or not Square and its ilk are engaging in deceptive marketing campaigns (who hasn’t?), the fact is that in the course of just three years the low-risk end of the payment processing spectrum has changed beyond recognition. And anyone in our industry who isn’t adjusting to the new reality (and I think that this group includes the vast majority of the market participants) is doomed to share the fate of said Square ilk.

Square, Whole Foods, iPads and “Lab Stores”

Let’s first take a brief look at what the two companies in question are telling us they have agreed on. Here it is:

The two companies will offer new payment and checkout features that allow customers to make purchases at food venues within select Whole Foods Market stores. This is Square’s first partnership with a national grocer.

These in-store venues — including sandwich counters, juice and coffee bars, pizzerias, and beer and wine bars — will use Square Register and Square Stand, Square’s suite of simple and affordable software and hardware tools for businesses. By bridging the digital and in-store retail spaces at these venues, Whole Foods Market shoppers can skip the main checkout lines, reducing wait times for all customers.

Today, seven Whole Foods Market venues already use Square Stand, including stores in Austin, New York City, Florida and the San Francisco Bay Area.

As I said, this time the Square guys are being much more straightforward than they were in the Starbucks case. Of course, they are not disclosing any details about the specific terms of the Whole Foods deal. How could they? If they did that, all other Square users would immediately rebel against a huge injustice, as there can be no question that the grocer’s payment processing rate is not anywhere near the 2.75-percent rate Square’s regular users are getting. No, much more likely is for Whole Foods to be paying what I assumed Starbucks had gotten back when that deal was announced: “a smidgen above interchange”. And that somehow brings me to my main point: Square’s enormous impact on the low-risk end of the payments industry.

Darwin Rules Supreme

I once listened to an interview with the late Milton Friedman, which has left an indelible mark on me. In it, the great economist’s worldview was repeatedly challenged by a string of indignant opponents. “Prof. Friedman”, they would demand, “Do you really want to live in the ‘survival-of-the-fittest’-type of society you advocate, with all of its flaws and injustices?” They would proceed to list some of the injustices, using colorful language, but I won’t bore you with the details and, anyway, you get the picture, we’ve heard it all. Friedman’s reply: “We already live in a ‘survival-of-the-fittest’-type of society, the question is whether it should be a free-market-regulated one or not”. And of course he was right: we do live in just such a world, imperfect as it is, and there is not a bit anyone can do to change it. Examples abound all around us, if one were only willing to open his eyes to see them.

But what does that have to do with Square? Well, rather a lot. Square has set off a nuclear bomb right at the core of the low-risk spectrum of the payments industry and I think many processors are still oblivious to this fact. They prefer to focus on Square’s imperfections in the shape of high costs and lack of phone-based customer support, but are oblivious to the fact that none of that matters: Square is fitter for survival in the modern environment than its rivals and, crucially, we are still living in a free-market economy. You may not like such a state of affairs, indeed you may hate it, but your feelings and general worldview are just as irrelevant as your take on the survival-of-the-fittest paradigm, which rules our world.

Now, one might argue that Square is yet prove its superiority. After all, the processor’s only big deals are the ones with Starbucks (such as it is) and Whole Foods and everything else is stuff no traditional processor is interested in (like the Craigslist and farmers market sellers of my example). But ask yourself this question: “Would you have believed, four years ago, that a complete newcomer would so soon stand even a chance at signing a retailer the size of Whole Foods?” If you were an industry insider, you would have considered it impossible. And I think that anyone who dismisses the Whole Foods deal as a one-off event is living in the parallel universe inhabited by Friedman’s interrogators of my example.

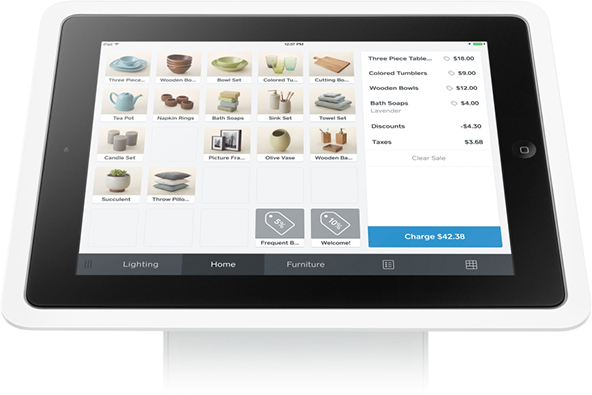

What Square brought to our industry, I believe more than anything else, was much-needed flair. For example, just put Square’s stand next to any traditional POS system. Or, for that matter, compare Square’s website to First Data’s or Chase Paymentech’s (to pick two names at random). Jack Dorsey clearly proved that you ignore beauty and aesthetics at your own peril, even in the gray world of credit cards and money. Merchants, Square’s rivals have now learned, would happily allow themselves to be persuaded that the new service is cheaper and better, whether or not that is the case (and, more often than not, it isn’t), just because they like its appearance. So, yes, Square is proving to be fitter than its opponents.

The Takeaway

So where does all that leave us? Or rather, where does all that leave the traditional low-risk processors? Well, it should be clear to everyone that, if they are to stand any chance of survival, the low-risk processors would have to address the deficiencies, which Square is exploiting so adroitly. They should start with improving the look and feel of their POS offerings, but that alone would not do the trick, because they’d be playing catch-up with a fast moving target, one that is likely to stay a step or three ahead of its pursuers for a long time to come.

I think the more important task the processors in question would have to tackle would be to make sure that the more sophisticated end of the merchant spectrum, where the real money is, gets the type of service Square cannot possibly match. And that goes beyond pricing, which is already as low as it could possibly get. Customer support is perhaps the thing that could make the biggest difference here and I would focus all my energy on making it as good as it could be — and there is plenty of improvement that could be done on that front.

So, who knows, perhaps when they combine Square-like iPad stands with the low processing costs they are already offering and the high-quality customer support that could be provided, the dinosaurs may just have a fighting chance. It would still be a long shot for most of them, but what’s the alternative?

Image credit: Square.