On Square’s ‘Run Rate’ Trouble, Na?»vet?? and PayPal

Regular readers will not be surprised to learn that I love data and statistics. So much so that every time I look at an issue, the first thing I do is to try and put numbers on the various pieces under consideration. I feel very uncomfortable when such numbers cannot be found or are of dubious reliability. Fortunately, we live in an age when data are usually freely available and easily accessible, so I am seldom frustrated.

And that brings me to the subject at hand: Square has reportedly postponed its Initial Public Offering (IPO) indefinitely. The reason, according to FOX Business, which broke the news, is that “the company has run into problems with its “revenue run rate,” a key projection of future performance”. The rate in question is merely an estimation of a company’s annual revenues, made by extrapolating current trends. So, if a company brought in $100 million in revenues in its latest quarter, its run rate would be $400 million.

This is big news! And, if the report is correct, it certainly sounds as though Square is in real trouble — and it is not that the processor is not making money. It is unprofitable, yes, but that is neither news nor is it, on its own, a reason for Square’s investors to run for the hills: they know and accept that the start-up’s immediate objective is not to make money, but to grab as big a share of the market it created, as possible. If this goal is successfully accomplished, and the opponents are consequently defeated, profits will follow.

No, the cause of the trouble is much scarier: Square seems to have lost the confidence of its own employees. FOX tells us that the processor has “recently released one million secondary shares, meaning that many Square employees have opted to sell their stake in the company”. And if Square’s own employees see no brighter prospects for the start-up’s future, why should the rest of us be any more excited about it?

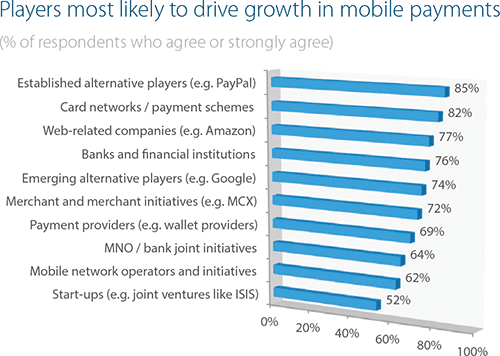

Incidentally, this news came at a time at which I was still making my way through American Express’ Advanced Payments Report, which tells us that start-ups are ranked last by consumers among the “players most likely to drive growth in mobile payments”. What’s going on? Well, let me offer a couple of observations.

Youthful Na?»vet?? and All That

The aforementioned AmEx report recounts an oft-repeated fairy tale about a certain glorified route to entrepreneurial success. In this particular case, the stars are Stripe‘s founders — two Irish brothers in their very early twenties — who, when starting their payment processing business, asked themselves “how hard could it be?” And then there is this:

This lack of knowledge or youthful na?»vet?? may have been a blessing, thought Peter Thiel, one of the founders of PayPal and an investor in Stripe. “If you knew how hard it is to break into these industries, you wouldn’t even try,” Thiel was quoted as saying in a recent Fortune magazine article.

Surely, similar fables have also been told about Jack Dorsey when he was getting Square off the ground. I believe that such stories are doing a huge deal of harm, because success, when the odds are stacked enormously against you, if it could be achieved at all, would be the result of meticulous planning, tenacious work ethic, steely discipline and perfect execution. And no, na?»vet?? will not do you any good. I mean, does anyone really believe that the likes of Steve Jobs and Bill Gates were na?»ve? Does anyone really believe that they were in even the minutest amount short of any of the requisite qualities I’ve just mentioned?

Yet, I confess to being hugely surprised to discover that the respondents in AmEx’s survey are appreciating just how steep of a climb lays on a payment processing start-up’s path. As you can see in the chart below, start-ups are ranked last in a long list of likely mobile payments drivers.

And, by the way, PayPal certainly deserves to be at the very top of that list. Not only is eBay’s payments arm the behemoth of web-based payment processing, but it is the only payments start-up since the invention of credit cards, which has managed to grow big enough to be able to challenge Visa and MasterCard on their own turf. More importantly, at least for the purposes of our present exercise, PayPal knows exactly what it takes to succeed in a brand new payments niche and it now has enough resources to back its hard-earned knowledge and see off any upstart, however well capitalized.

What Does the Future Hold?

So where does all that leave us? Is Square doomed? Well, I have not the slightest idea. I still think that Jack Dorsey has done a great job at Square’s helm and firmly believe that he is the right man to lead the company in the foreseeable future. His investors appear to agree with me — FOX tells us that one of them (a Saudi prince) has purchased $200 million-worth of the secondary shares Square’s employees were reportedly selling. At the same time, we don’t know what goes on in the processor’s board room.

But I should also say that, in my opinion at least, Dorsey did make some rather big strategic errors of judgment, which now appear to be coming back to haunt him. Both of them have to do with Square’s pricing structure. The first one came very early in Square’s existence, barely three months after the start-up went live. Back then, in February 2011, Jack Dorsey decided to scrap the per-transaction fee of $0.15 from his company’s pricing. That made absolutely no sense, as I explained at the time:

Square’s pricing change may seem quite insignificant to a non-industry observer, but it is not, far from it. If you are a payment processor devising a pricing model, there are a couple of things that you have to keep in mind when you set your per-transaction fee:

- The per-transaction amount of the interchange fee. The interchange fee is the rate that a card issuer charges the processing bank for transactions involving their cards. For the vast majority of the transactions, the per-transaction component of the interchange fee is set at $0.10. So if the processor charges less than $0.10 per transaction, they will be losing money.

- The weight of the per-transaction fee in the discount rate. As the per-transaction fee is a constant, its weight in the discount rate is determined by size of the transaction amount. The smaller the amount, the greater the weight of the per-transaction fee and vice versa. So for any given per-transaction fee level, the processor would be making more money from smaller transaction amounts.

So you can see that Square will be losing money from the per-transaction component of the interchange fee. Of course in most transactions that loss will be made up for by the revenues from the percentage portion of the interchange. Most, but not all transactions, which is why very, very few credit card processing companies would ever consider using such a pricing model.

A very rough calculation told me that Square’s break-even threshold would have been at about $8.50, meaning that the processor would be losing money on transactions smaller than $8.50. More importantly, however, Square was under no pressure at all to make such a drastic move. People were used to paying fixed per-transaction fees and there was no pressure coming from Square’s rivals at the time.

The other error was, of course, the introduction of Square’s flat monthly pricing, which gave merchants processing up to $250,000 per year the option of paying $275 per month, rather than being charged on a per-transaction basis. That was extremely generous — so much so that none of Square’s competitors, not even mighty PayPal, adopted it. As it turned out, it was too generous — the processor scrapped the monthly plan just over a year after it had introduced it, burying the humbling announcement deep within its website, but of course not deep enough for the Square users who had already signed up for it.

The point is that both of these decisions were very costly — it may well be that they were more costly than the start-up could have afforded — we don’t yet know.

The Takeaway

So, let me reiterate: I am not saying that Square is breathing its last gasp and is about to collapse. I have no idea what is going on inside that company. But on the outside, things surely look bad: it is a very ominous sign that a vaunted start-up’s magic has lost its spell over its own employees. The coming months will be very, very interesting. And I would say that a very plausible scenario is that, at the end, PayPal emerges as the undisputed champion of yet another payments industry niche.

Image credit: Square.