Older Americans Get Deeper into Credit Card Debt

Only a short while ago a couple of researchers told us that younger Americans are taking on more credit card debt and are paying it off more slowly than their parents and grandparents. These were the results of a huge, carefully done survey that looked into data collected between 1997 and 2009 from 32,542 respondents. And that made sense to me, not least because it wasn’t the first study to show that younger consumers were much less cautious with their credit cards.

However, a new study, just published by Demos—a thinktank—which looked into data collected in 2012, paints a more complicated picture. Yes, older Americans are far less likely to rely on their credit cards to pay for basic costs of living than their children and grandchildren, the researchers have confirmed, but they do turn to plastic for protection against economic instability and stagnant or declining income, of which the Great Recession provided plenty. As a result, Americans aged 50 or more now owe more on credit cards than the under-50 population. Let’s take a closer look at the study.

How Credit Card Debt Is Racked Up

Here are the survey’s key findings:

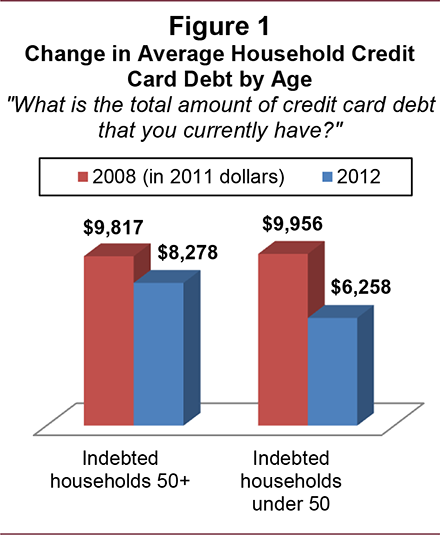

– Older Americans now have higher overall credit card debt than younger people—a reversal of the trend Demos found in its 2008 survey: Americans age 50+ have an average combined balance of $8,278 on all of their cards in 2012, compared with $6,258 for the under-50 population.

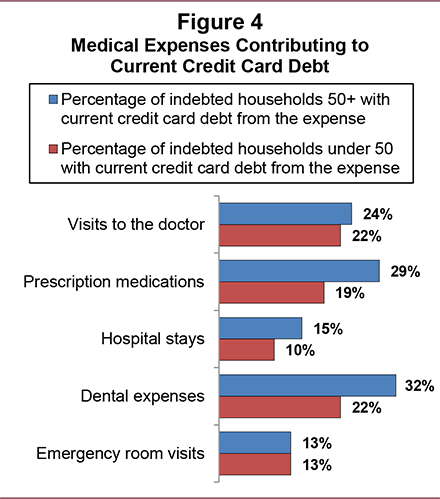

– Half of Americans age 50+ carry medical expenses on their credit cards, with an average of $893, compared with $746 among younger households; prescription medications and dental expenses were the highest contributors for the 50+ population.

– Forty-nine percent of Americans age 50+ report that car repairs contributed to their credit card debt, and 38 percent report that home repairs contributed.

– Thirty-four percent of Americans age 50+ use credit cards to pay for basic living expenses such as rent or mortgage payments, groceries, utilities, or insurance because they do not have enough money in their checking or savings accounts.

– Older Americans are significantly less likely than younger people to run up credit card debt purchasing nonessential goods and services.

– Nearly one-quarter of people age 50+ say that job loss contributed to their credit card debt; 15 percent report that it was the single biggest contributor.

– Eighteen percent of people age 50 to 64—people who are nearing retirement—report that they drew on retirement funds to pay off credit card debt.

– Older Americans are more likely to take on credit card debt in an effort to assist other family members: About 23 percent of people age 50+ report that money given to, or used to pay the debts of relatives added to the balance on their credit cards, compared to just 11 percent of those under age 50.

– Sixteen percent of Americans age 50+ used their home equity to pay down credit card debt in the past year by refinancing, obtaining a second mortgage, or taking out a home equity loan.

– The 2009 Credit Card Accountability, Responsibility, and Disclosure (CARD) Act appears to have influenced the way consumers manage their credit card debt by helping them to pay down balances faster and avoid late fees and over-the-limit fees.

– This report suggests that credit card debt among older Americans is primarily a reflection of difficult economic times, not a lack of personal financial responsibility.

Who’s Up and Who’s Down

Here is what I found to be perhaps the most revealing finding of Demos’ study. During the Great Recession, the share of both older and younger families with credit card debt decreased, with the notable exception of families headed by someone older than 75. Here is the table:

And here is what happened with the average household credit card indebtedness of the two age groups examined in the report in the post-Lehman period:

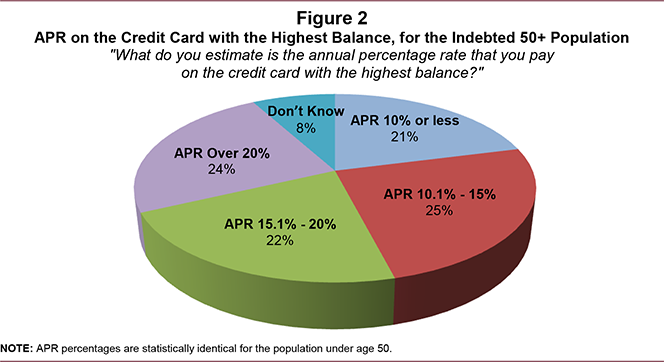

The researchers have calculated that the average annual percentage rate (APR) on a household’s credit card with the highest balance is 16.13 percent. The 50-plus households averaged a slightly lower APR of 15.95 percent, while people in the lower-age group paid an average APR of 16.27 percent. APRs are higher for all groups than they were in 2008, we are told. Here is more on the interest rates:

How Credit Cards Are Used

During hard times, people of all ages turn to credit cards for protection against economic instability and stagnant or declining income, the researchers remind us. Older Americans are less likely to use their credit cards to pay for basic costs of living expenses, such as rent or mortgage payments, groceries, utilities, or insurance, than younger consumers, but they are borrowing to make ends meet. Here is a breakdown of the expense items contributing to consumers’ current credit card indebtedness:

The rising cost of medical expenses is a major contributor to credit card indebtedness for all Americans. However, unsurprisingly, the burden on older consumers is far greater:

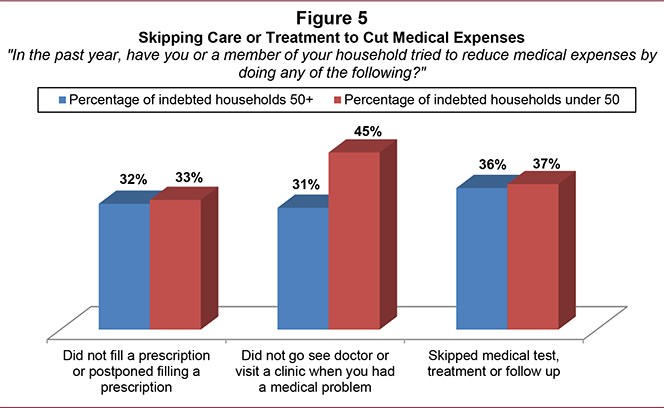

Some Americans tried to cut on medical expenses by skipping care or treatment:

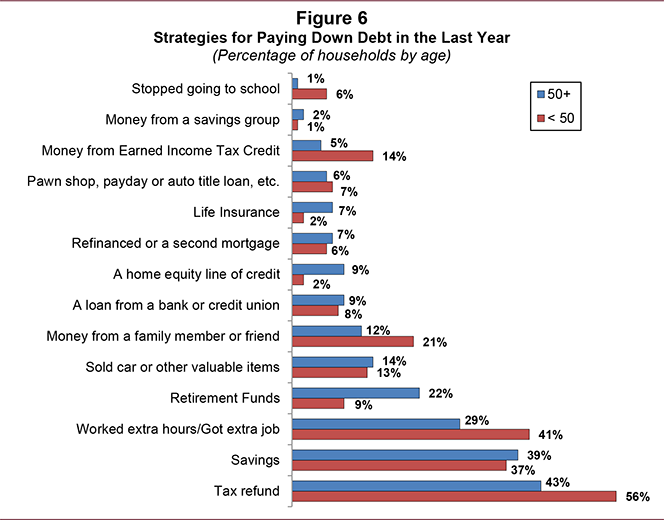

Paying Down Credit Card Debt

A surprisingly high share of consumers—62 percent—believe that they will manage to be free of credit card debt within the next year. How will they do that? Here is a breakdown of the strategies:

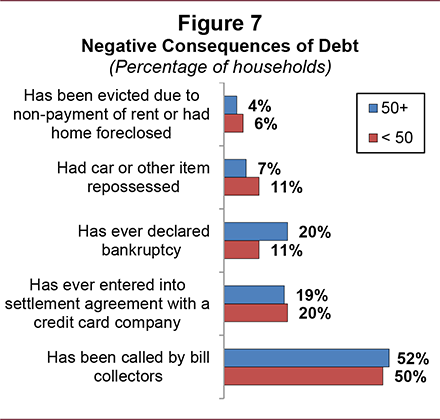

And if debt-paying strategies fail, there are real-life consequences. Here is what the respondents said happened to them:

The Takeaway

Americans have already started applying their credit-card-debt-reduction strategies, as evidenced by its steady decline. The researchers claim that part of the improvement can be attributed to the effects of the CARD Act of 2009. They have found that, since the act came into force, a third of their respondents have started paying more toward their credit card balances and about a quarter of them have been charged late and over-the-limit fees less often than they used to. Let’s hope the trend continues.

Image credit: Serveracruz.com.

Paul, I would have never guessed it was the over 50 age group that had a higher credit card balance. I do see the trend to live debt free spreading and I personally have lessoned the credit I use even to run my business. Great information and statistics.

Respectfully,

Steve Schellert