Mobile Money Remains Largely Confined to Developing Markets

That is the inescapable takeaway from the latest State of the Industry Report, just released by the Mobile Money for the Unbanked (MMU) program, run by the GSM Association (GSMA), an organization for the promotion of the GSM mobile telephone system, and supported by the likes of The Bill & Melinda Gates Foundation and MasterCard. The mobile money industry continues to grow very fast and is expanding across more regions, with 52 markets now boasting two or more mobile money services.

And yet the majority of services remain in Sub-Saharan Africa. The researchers tell us that, in 2013, airtime top-up and person-to-person (P2P) transfers, which are the domain of Kenya’s M-Pesa — the biggest mobile money success to date — have remained the most adopted services.

And there is nothing particularly inexplicable about Africa’s continuing dominance of the mobile money’s market. As we’ve noted many times before, consumers in the U.S. and other developed markets never really warmed up to M-Pesa-like money transfers, simply because we have too many other payment options, which are either more convenient, cheaper or otherwise preferable. That, however, is not the case in most of Africa, where people in rural villages are cut off from even the most rudimentary of banking services. This is why M-Pesa has been so successful in Kenya and in other developing countries. In essence, M-Pesa has brought basic banking to people who’ve never had it.

Small surprise then that MMU’s report is now telling us that mobile money services are spreading through the developing world like wild fire. Let’s take a look at it.

Africa still Leads the Way

First, though, let’s make sure we are on the same page. There are many definitions of mobile money and it is easy to get confused. So, to the MMU mobile money services are the ones that:

- Offer at least one of the following services: P2P transfer, bill payment, bulk payment, merchant payment and international remittance.

- Rely heavily on a network of “transactional points” outside bank branches that make the service available to unbanked and underbanked people. Perhaps the best example is M-Pesa’s huge agent network, which is predominantly comprised of small retailers, where M-Pesa users would go to purchase virtual credit (e-float) that is loaded onto their phones and can then be transferred to other M-Pesa users or to cash the e-float they themselves have been sent.

- Offer an interface for facilitating transactions for agents and / or users that is available on basic mobile devices.

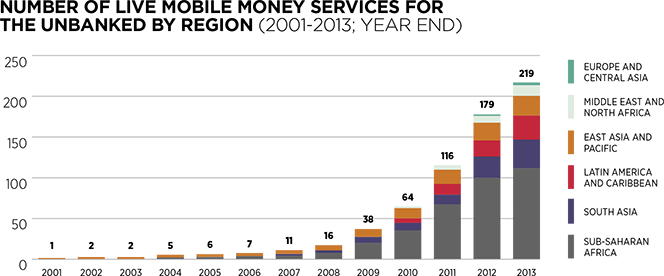

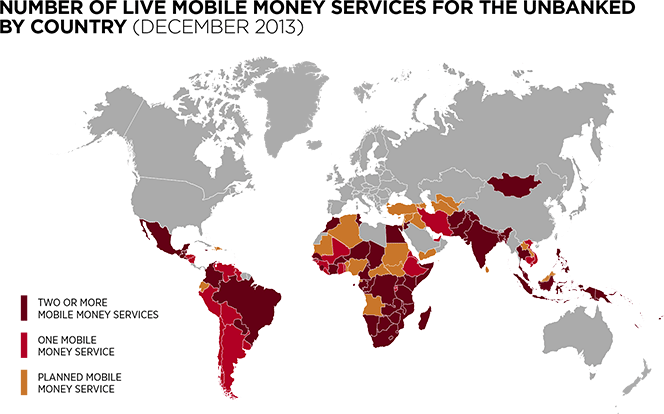

Mobile money services that comply with this definition are now available in most developing and emerging markets, we learn. At the end of 2013, there were 219 services in 84 countries, up from 179 services in 75 countries at the end of 2012. Latin America experienced the strongest growth in number of new mobile money services — an annual increase of 53 percent. Yet, at the end of 2013, 52 percent of all live mobile money services were still located in Sub-Saharan Africa.

Competition Is Increasing

The mobile money industry is becoming increasingly competitive, we learn, and this is particularly true in Sub-Saharan Africa, as one would expect to be the case. This, after all, is the leading mobile money region where various such services are now available in 36 of 47 countries.

The majority of new service launches in 2013, we are told, took place in markets where mobile money services were already available. There are now 52 markets with two or more mobile money services, up from just 40 at the end of 2012 and 33 at the end of 2011. Twenty-seven markets had three or more such services and nine countries had their first taste of these alternative financial services: Bolivia, Brazil, Egypt, Ethiopia, Guyana, Jamaica, Tajikistan, Togo and Vietnam.

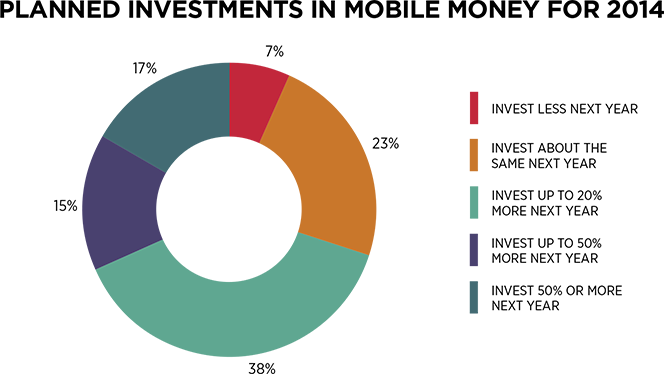

Stronger competition should translate into more options and mobile money providers are already increasing their investments, as illustrated in the figure below.

Mobile Usage on the Rise

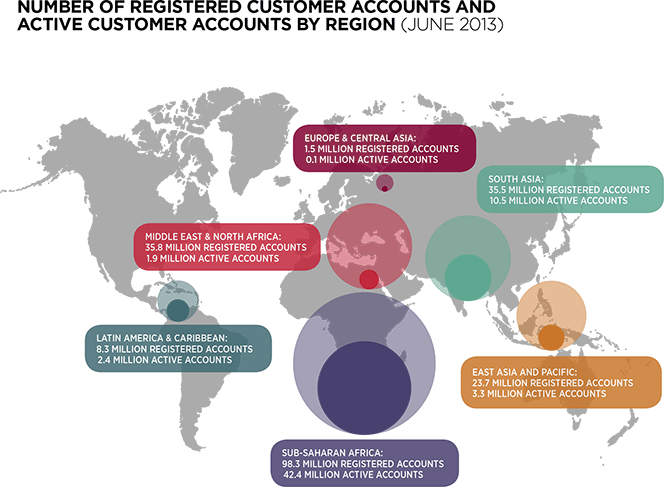

In June 2013, we learn, there were more than 203 million registered mobile money accounts worldwide. Almost half of that total (98 million) were in Sub-Saharan Africa — more than twice the total number of Facebook users in the region. East Africa alone — M-Pesa’s stronghold — accounts for 34 percent of total registered accounts.

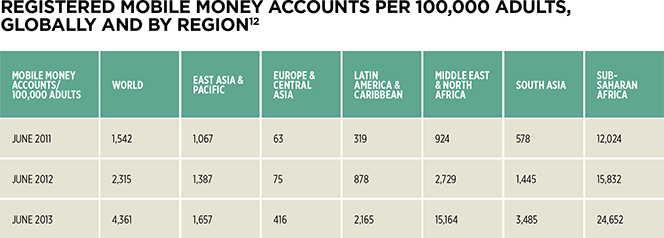

Furthermore, at least nine markets — Cameroon, the Democratic Republic of Congo, Gabon, Kenya, Madagascar, Tanzania, Uganda, Zambia and Zimbabwe — already have more registered mobile money accounts than bank accounts, up from just four last year. In these countries, the researchers remind us, the mobile money industry has made financial services accessible to more people than the traditional banking industry ever has. Here is how the number of newly-registered mobile money accounts has grown globally since 2011:

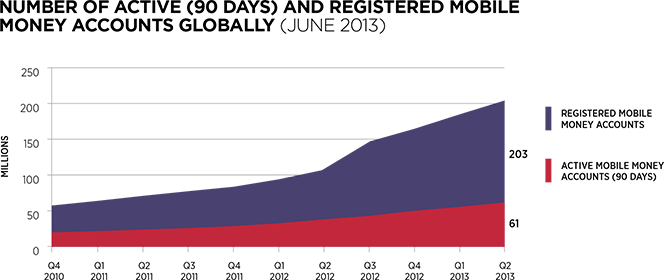

However, less than a third (61 million) of the total of 203 million registered accounts had been active, meaning used in at least one transaction within the last 90 days (see chart below).

And here is a breakdown of the numbers of registered and active accounts by region:

How to Increase Activity?

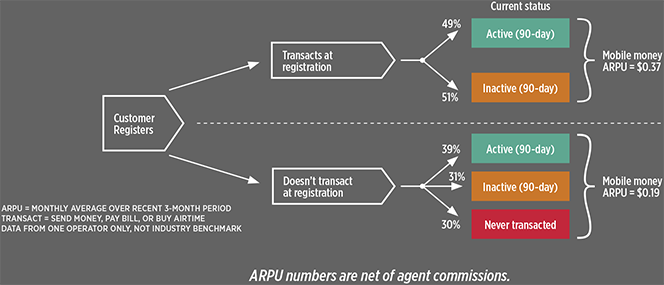

Low customer activity rates, we are told, have been a persistent challenge across the mobile money industry. So how do you increase customer activity and therefore mobile money average revenue per user (ARPU)? Well, the researchers suggest, with reason, that the most important interaction may be at the time of registration. This is when a customer learns (or is supposed to) about how the service in question might fill a specific need.

Customers with positive experiences during the registration process — perhaps because a sales agent took the time to thoroughly explain the service — might be encouraged to actually use that service on that same day. To test their hypothesis, the researchers have looked at data from “one anonymous operator”. Here is what they saw:

So the data reveal a huge difference in future activity between customers who transact at the point of registration and those who do not. The former are more likely to become future active customers (26 percent more likely) and have a significantly higher mobile money ARPU (95 percent higher) than consumers who walk away after registering, but without transacting. Accordingly, the authors proceed to offer operators some specific ideas on how to increase the probability that a customer transacts at the point of registration, but these need not concern us here and you can review the suggestions in the report.

The Takeaway

So, once again, mobile money remains a largely developing world phenomenon, for the reasons I’ve already touched on. That state of affairs is unlikely to change, even as the number of users — both of the registered and active variety — continues its rapid increase. For the affected markets, this is a hugely beneficial process.

Not only do the new mobile money services bring basic banking to people who would otherwise remain trapped in a cash-only world, but they can also bring other, sometimes unexpected, but nevertheless positive, side effects. In Afghanistan, for example, M-Paisa (as M-Pesa is called there), helps fight corruption in one of the world’s most corrupt countries and has even effectively increased policemen’s salaries. Let’s hope that every other developing country shares the same fate.

In developed countries, in contrast, mobile money services are likely to remain mere extensions of traditional banking services. And that is all right.

Image credit: Safaricom.co.ke.