Minimizing Credit Card Processing Fees Again

Only a few weeks ago I showed you a nicely done infographic, which did a great job at illustrating the make-up of credit and debit card processing fees — one of the most frequently-visited subjects on this blog. There is a good reason why we write about processing fees as often as we do: most merchants simply don’t understand how the fees they pay are calculated and who collects them. That lack of understanding usually leads them to make the wrong decisions about which processor to sign up with and what type of pricing plan to adopt. The upshot is that merchants end up paying higher fees than they should be paying.

Well, today I’ve run across another infographic, which deals with the issue of processing fees and this one is produced by Payment Depot — a credit card processing company. Now, the graph is full of PR language, which I strongly urge readers to disregard. But the explanation of why the interchange-plus pricing model (although the authors don’t call it by that name) is the best option available to merchants is correct, as is its favorable comparison to the flat-rate and tiered pricing alternatives. Furthermore, the Payment Depot guys have done a great job at making their presentation look visually pleasing, so I thought I’d share the graph with you.

Understanding Credit Card Processing Fees

Payment Depot has done a good job at breaking down the processing fees into their two principal components, which they call “base costs” and “mark-up costs”. A merchant’s base cost is the sum of the interchange fee, at which each transaction is processed and which is collected by the card’s issuer, and the Association’s (i.e. Visa or MasterCard) much smaller “assessment fee”. The other component is the processor’s mark-up and the sum of the base and mark-up fees gives us the merchant’s total transaction cost, called discount. The authors correctly point out that the base costs typically account for 75 percent – 80 percent of the discount.

But, following this introduction, things get a bit murky. On the one hand, Payment Depot tells us, correctly, that interchange and assessment fees are the same for all processors. But then we get the following statement: “First Data (the largest credit card processor) pays the same interchange fees and assessments as a small local bank.” Does that mean that large banks pay lower interchange fees?

And then follows a flatly misleading statement: “Big Box retailers are able to negotiate with banks to get the fees from Visa / MasterCard passed directly to them, creating an unfair advantage for larger companies.” Well, that ties in nicely with the PR exercise that follows, but is nevertheless untrue. For the record: passing Visa and MasterCard interchange and assessment fees directly on to merchants is not a matter of negotiations, nor is it only available to large merchants. Rather, it is a matter of opting for an interchange-plus pricing plan, which, as I’ve often explained, many merchants are reluctant to do, because of the uncertainty inherent in this type of pricing model.

Leveling the Playing Field Yet Again

Now let me say a few words about the aforementioned PR exercise. So we are told at the very beginning that the infographic explains how Payment Depot is “leveling the playing field”. Every time I hear this phrase, I immediately raise my guard and my caution usually proves to be well founded. This time was no exception. Here is what the authors tell us:

For the first time ever, small businesses can get the same pricing as their big box competition by using Payment Depot.

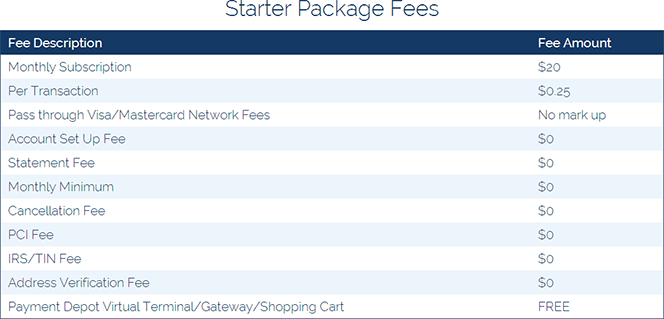

With subscriptions starting at $20 a month, Payment Depot will pass the rate from Visa and MasterCard directly to your small business.

As I already noted, through the interchange-plus pricing model, small merchants have had the option of getting the interchange fees passes directly on to them for many years. And in the case of Payment Depot we have a classic example of this pricing structure where the processor’s mark-up is 25?ó above interchange for each transaction for their $20-a-month plan. So, it’s a good pricing plan, but nothing new.

My real problem, however, is that Payment Depot tell us that they charge no mark-up over interchange, as you can see below:

Well, of course that they do — how else do you call the 25?ó they charge on top of the interchange? Of course, you can argue that the monthly fee is also a mark-up, as it is charged in addition to interchange, but let’s not go there. Now, please don’t get me wrong. I’m not saying that mark-ups are wrong or that Payment Depot’s pricing plans offer poor value. On the contrary, at UniBul we make money precisely by adding our mark-up to interchange and Payment Depot’s own mark-up is quite reasonable. However, when you start off by talking about a “credit card processing industry [which] uses confusing and deceptive pricing tactics so merchants never know how much Visa / MasterCard and the processor are making off of them”, you’d better follow up by not engaging in the tactics you claim to deplore. And Payment Depot has failed to live up to that standard.

Now here is the infographic:

Image credit: Flickr / StockMonkeys.com.