LevelUp and Interchange Zero Revisited

LevelUp is in the news again this morning, reminding me that it’s been quite a while since I’ve last looked into their service. Regular readers may recall that UniBul covered the start-up’s launch of an “interchange zero” program, which was meant to turn into reality the “idea that it shouldn’t cost merchants a single cent to accept a payment”. Needless to say, it did nothing of the kind and the “inevitable payment revolution”, promised by Seth Priebatsch, the start-up’s “Chief Ninja”, is yet to materialize.

Undaunted, LevelUp’s executives — and they are just that, whatever silly titles they may choose to give themselves — have now taken their show to the SXSW shindig in Austin, TX. Once again we are treated to promises of “special savings”, “win-win” propositions, a “massive industry shift” and, of course, a “mobile payments revolution”. So LevelUp’s declared “takeover” of the SXSW is indeed every bit as highfalutin as you might expect. Yet, the substance of the start-up’s offering hasn’t changed: they offer merchants a classic two-tier pricing model and one that is not at all exceptionally advantageous to them. And merchant could do worse than acknowledge that fact.

Interchange Zero Revisited

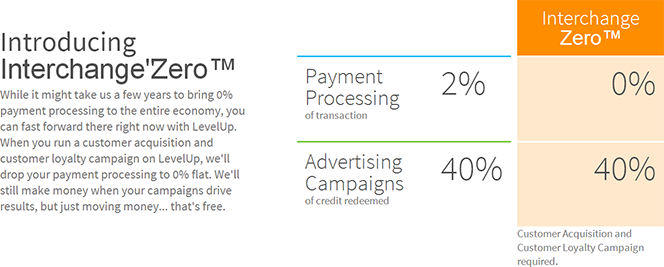

Now, what really, truly annoyed me when LevelUp announced its “interchange zero” thing last year, was the way it was presented. Merchants were promised that, if they joined the “interchange zero revolution”, they would “stop paying processing fees forever”. And the company even offered an explanation as to how exactly they were going to achieve that objective:

Interchange Zero is the revolutionary — and now, real — idea that it shouldn’t cost merchants a single cent to accept a payment. No ifs, ands, or buts. Instead of making money just for moving money, payment providers should add value above the transaction in ways that help businesses thrive and grow, such as customer acquisition and customer loyalty campaigns.

There were indeed no ifs and no buts and LevelUp brazenly went on to tell us how they were going to make money out of the whole thing:

When merchants choose to run a campaign on LevelUp, LevelUp earns 35 cents for every dollar of credit redeemed through that campaign. That means LevelUp is only making money when real value — which is determined by the merchant when they set up their campaign(s) — is created.

Since then the 35-percent campaign-related fee has risen to 40 percent, but there is something else, which LevelUp did not disclose at the time — there is actually a processing fee of 2 percent for non-campaign-related transactions. So LevelUp would charge merchants a 2-percent fee for all of their transactions, except when they chose to run an ad campaign on LevelUp’s platform, in which case regular sales would be processed at zero percent, but LevelUp would be charging a 40-percent fee on the credit redeemed during its advertising campaigns. As I said, there are no ifs and no buts here and the fact that the company calls the fees it charges not processing fees but fees to “move your money” makes as much of a difference as that its CEO is called a “Chief Ninja”. Here is a snapshot of the company’s current pricing structure:

Signs of Things to Come?

Here is what LevelUp’s “Chief Ninja” told us after his company was named the exclusive payment processor at the SXSW:

LevelUp is on a mission to force a massive industry shift where merchants stop paying money just to move money, and consumers see real value out of the act of paying with their phones. The SXSW ‘takeover’ is a great way to showcase signs of things to come in the mobile payments revolution.

Let’s just focus our attention on the part of the statement concerning merchants, although there is something to be said about consumer benefits, too (are we not getting cash back and other rewards when paying with credit cards?). So the industry shift in question would have been massive if LevelUp really delivers the zero-percent payment processing fees it promises. But it doesn’t. In real life LevelUp charges its merchants a 2-percent transaction fee, except when it charges them 40 percent of the credit redeemed during advertising campaigns. In my previous LevelUp post, I offered an alternative view of the company’s pricing structure, one in which it is viewed as a more or less classic two-tiered structure where we have a lower “qualified” rate and a higher “non-qualified” rate. Here it is once again:

In order for a transaction to be processed at the lower rate, it would have to meet certain criteria. Now think of LevelUp’s model as one where non-campaign-related transactions are qualified and so get processed at a zero-percent rate and all campaign-related transactions are non-qualified and get processed at 35 percent. To calculate the overall per-transaction cost, you should then add up all fees (qualified and non-qualified) paid over a given period, say a month, and divide them by the aggregate transaction value. A merchant may call LevelUp’s fees “processing fees,” “advertisement fees,” “cost of acquiring new customers” or whatever, but if these fees are not sufficient to cover, at a bare minimum, the interchange fees SCVNGR [LevelUp’s parent company] pays to the card issuers for each transaction, the start-up will promptly go out of business and its service will cease to exist.

The increase of the campaign-related fees from 35 percent to 40 percent clearly tells us that the initial rate wasn’t high enough to cover the interchange fees paid by LevelUp and to generate sufficient profit and so it had to be raised. Consequently, on aggregate, LevelUp merchants are also paying more than the interchange fees assessed on the transactions they process.

The Takeaway

So LevelUp continues to be leading an incredibly misleading marketing campaign and, at least for the time being, that seems to be a winning strategy — the company tells us that it now has more than a million users. But then, we don’t quite know what LevelUp means by a “user”. Is it someone who downloads the app or someone who actually uses it for payment and if so, how often? It would be much more helpful if we knew the processing volume handled by LevelUp. In any case, LevelUp’s celebration may turn out to be a bit premature.

Image credit: LevelUp.