Issuers Brace for Lower Profits from New Rules on Debit Card Fees

As the Federal Reserve is mulling the new rules on debit card fees, which it was tasked to create by the recently passed financial overhaul legislation, issuers are bracing for lower profits. The deadline for the rules to take effect is April 2011 and proposals are expected in November, with a comment period of 90 days prior to enactment.

Even though a lot has already been written about the debit card fee rules, there seems to be some confusion regarding exactly who will be affected the most once they take effect next year.

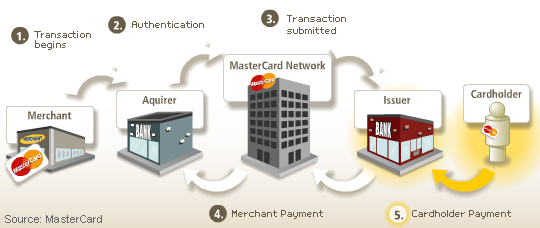

Just yesterday, for example, the AP ran a story about the “uncertainty” faced by Visa and MasterCard ahead of the enactment of the debit card fee rules. But the payment networks are not the ones who have the most at stake here, not by a long shot. The biggest threat posed by the new rules is to the issuers of debit cards.

Let’s take a quick look at the composition of the fee paid by a merchant each time a debit card transaction is processed. We will examine the most widely used type of debit card in the U.S. – the Visa debit card – but the numbers are almost identical with MasterCard. Let’s say that a retailer is paying for what Visa terms as a “CPS / Retail Debit – All Other” transaction the sum of 1.39% + $0.20 of the transaction amount. Here is what each participant in the transaction cycle gets from this amount:

- The card issuer gets 1.03% + $0.15 of the transaction amount. This fee is known as interchange rate and it is set bi-annually by Visa and MasterCard.

- Visa gets 0.11% of the transaction amount. This rate is also set by the payment network (in this case Visa) and is called an assessment fee.

- The payment processor gets 0.25% + $0.05 of the transaction amount. This fee is set by the payment processor and is stated in the retailer’s merchant agreement.

The above example may be fictional, but the only fee that can actually differ from a real-world case is the one charged by the processor. The two others will be the same.

The Fed’s new rules, when enacted, will regulate the interchange fees. It is not yet clear whether the assessment fees will be affected, but even if they are, the effect will be negligible, given their low current levels.

The debit card rules are not expected, however, to place any limits on the rates charged by processing banks. The reason is that, unlike interchange and association fees, fees charged by processors are negotiable.

The end result, once the rules are finalized, will be that card issuers will be profiting less from payments with their debit cards and retailers will collect the difference. What is not at all certain at this point is whether retailers will be as good as their word and pass the savings on to their customers, on whose behalf they claimed to be waging the debit card war.

Image credit: VK.com.