How We Use Our Credit Cards

We love infographics here at UniBul, even though we rarely muster the commitment to produce one ourselves. The way we see it, why should we invest the time and money to do that when so many people are doing it much better than we ever could? Instead, we prefer to stick to what we (believe) are good at — analyzing the latest events and trends in our industry, offering advice and insider knowledge on payment processing issues and, occasionally, having fun with some industry participant or other (after all, as Jane Austen once observed, “what do we live for, but to make sport for our neighbors and laugh at them in our turn“).

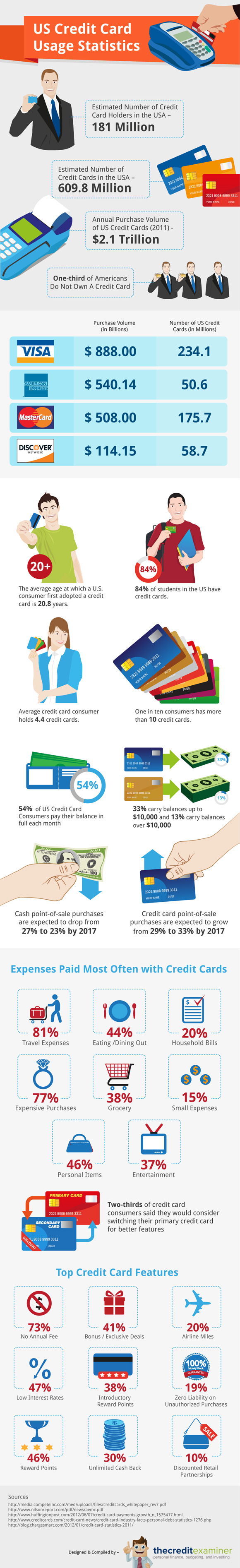

And so the latest infographic that caught my attention comes to us courtesy of the good people over at The Credit Examiner. It visualizes the current state of consumer credit cards in the U.S. and provides statistics on things like the number of cards in circulation, purchase volume, market shares of the biggest card networks, etc. It is well done and researched and I thought I should share it with you. Here it is.

How Americans Are Using Their Credit Cards

Before I show you the graph, let’s run through the main statistics, as gathered for us by The Credit Examiner. Here are the authors’ top-line numbers:

1. Estimated number of credit cardholders in the U.S. — 181 million.

2. Estimated number of credit cards in the U.S. — 609.8 million.

3. A third of Americans do not have a credit card.

4. Total annual purchase volume of U.S. credit cards in 2011 — $2,050 billion. Here is how that volume breaks down among the four largest U.S. card networks:

| Credit Cards |

Purchase Volume, in Billion |

Number of U.S. Credit Cards, in Million |

| Visa |

$888.00 |

234.1 |

| American Express |

$540.14 |

50.6 |

| MasterCard |

$508.00 |

175.7 |

| Discover |

$114.15 |

58.7 |

5. Average age at which a U.S. consumer gets his / her first credit card — 20.8 years.

6. 84 percent of U.S. students have credit cards.

7. Average number of credit cards per consumer — 4.4. One in ten Americans has more than 10 credit cards. It turns out that, the more credit cards a consumer has, the more likely she is to use it, as seen in the table below:

| Credit Card Usage |

Number of Credit Cards |

| Regularly use |

1.9 |

| Rarely use |

1.6 |

| Never use |

1.0 |

8. Credit card point-of-sale (POS) purchases are expected to grow from 29 percent to 33 percent by 2017. Cash POS purchases, on the other hand, are expected to drop from 27 percent to 23 percent by 2017.

9. 54 percent of American cardholders pay their balance in full each month, 33 percent carry balances up to $10,000 from month to month and 13 percent carry balances over $10,000.

10. The biggest item for which Americans pay with their credit cards is travel expenses. Here is the complete list:

| Expense Item |

Share of Cardholders Paying for It with a Credit Card |

| Travel expenses |

81% |

| Expensive purchases |

77% |

| Personal items |

46% |

| Eating / dining out |

44% |

| Grocery |

38% |

| Entertainment |

37% |

| Household bills |

20% |

| Small expenses |

15% |

11. Two-thirds of U.S. cardholders would consider switching their primary credit card if better features were offered.

12. No annual fee is the most sought-after credit card feature. Here is the full list:

| Feature |

Share of Cardholders Seeking for It |

| No annual fee |

73% |

| Low interest rates |

47% |

| Reward points |

46% |

| Bonus / exclusive deals |

41% |

| Introductory reward points |

38% |

| Unlimited cash back |

30% |

| Airline miles |

20% |

| Zero liability on unauthorized purchases |

19% |

| Discounted retails partnerships |

10% |

Now here is the infographic itself:

Image credit: TheCreditExaminer.com.