How to Set Up and Manage Billing Descriptors

One of the most unnecessary and easiest to prevent types of chargebacks is the one initiated when a cardholder is not able to recognize a particular transaction on her monthly statement. If the transaction is legitimate, there is absolutely no reason why it should not be easily identified in good faith.

Unfortunately this type of chargeback is not a rare occurrence. Visa has a special code to designate it: reason code 75: “Cardholder Does Not Recognize Transaction.” In this article I will show you how to make your transactions easily identifiable on your customers’ statements and protect yourself against such chargebacks.

How Does Your Business Name Appear on Your Customers’ Statements?

The way your business name appears on a cardholder’s monthly statement and transaction activity log is managed by your credit card merchant services provider through a tool called “billing descriptor.”

The billing descriptor consists of your business name and phone number. Payment processing companies typically set it up using your “Doing Business As” (DBA) name by default, usually restricting it to 25 characters, excluding the phone number. Longer names are abbreviated.

Billing Descriptor Types

There are two types of billing descriptor:

- Default billing descriptor. As the name suggest, this is the one favored by your processor. It shows the same information for all of your transactions. If you have it set up for your account, it will look something like this:

UNIBUL MERCHANT SVCS 866-749-1405 - Soft billing descriptor. This one allows for the description to provide a more detailed information about the transaction, in addition to the business name and phone number. Moreover, different types of transactions are described differently on the cardholder’s statement.

This type of descriptor may be the better option for businesses with multiple product lines or service offerings, where the product’s brand name is more familiar to the consumer than the business’ DBA name. For example:

UMS* VIRTUAL TERMINAL 866-749-1405

UMS* PAYMENT GATEWAY 866-749-1405

In these examples UMS* is the abbreviated name of the business and virtual terminal and payment gateway are the brand names of two its service offerings.

How to Set Up and Manage Your Billing Descriptor?

The first thing you need to do is decide which type of descriptor to use. For the vast majority of businesses the default type will do just fine. Remember, you have limited space to work with, so if you want to add additional information, you will have to abbreviate your business name.

Using the soft descriptor typically makes sense for large corporations, where multiple lines of product have been developed, branded and marketed independently and consumers may not be aware that there is a different legal entity behind each of them.

Whether you choose to go with the default or the soft descriptor, check with your processor to ensure that your business name is displayed correctly. It should be your DBA, which is how your customers know you, not your legal name. If abbreviated, make sure the name is recognizable or request an alternative abbreviation. Check the phone number as well and make sure it is accurate.

If your billing descriptor is correctly set up, you should never see another Reason Code 75 chargeback. Just be sure to update it every time there is a change in your DBA or customer service phone number.

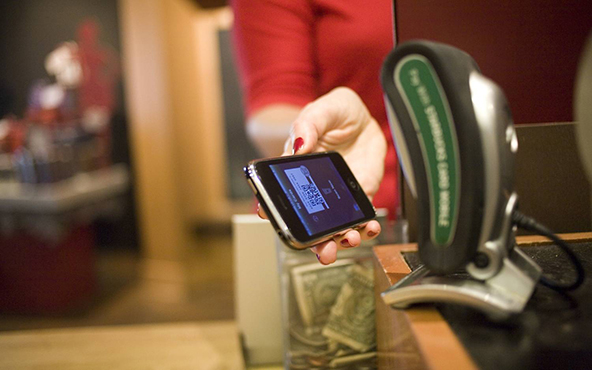

Image credit: PGwire.com.

Submitting your billing descriptor at ibddb.com is a good idea to avoid chargebacks due to customers not recognizing your billing descriptor.