How to Manage Chargeback Reason Code 74

Most merchants deposit credit card transactions with their processors just as early as they can, so that they can get paid as soon as possible. In fact, some retailers process many of their transactions earlier than they should. These are sales where the purchased item has to be delivered to the customer, in which case the transaction should not be deposited before the merchandise is shipped. Yet, more often than not, the transactions are processed immediately. But while improper, this practice is not surprising.

What is surprising is that some transactions are deposited late, in fact so late that they can be automatically charged back. There is a special reason code that designates this type of chargeback and in this article I will examine the specific circumstances that cause it and the possible actions that can be taken in response to it.

What Is Reason Code 74

Chargeback Reason Code 74 can be initiated in one of the following circumstances:

- The transaction was not deposited within the required time limits and the cardholder’s account was not in good standing on the processing date, or

- The transaction was processed more than 180 calendar days from the transaction date.

So you need to know what your processor’s time frame for depositing transactions is and in any case, you should not wait longer than 180 days (well, you should not wait longer than anything remotely close to 180 days, but this is the threshold, beyond which transactions are automatically charged back).

How to Respond to Reason Code 74

As is the case with all other chargeback types, your response to Reason Code 74 will be determined by the particular circumstances, the most typical of which I have reviewed in the table below:

|

If: |

Then: |

| The sales receipt was deposited on time. | Contact your processor and ask them to forward a copy of the receipt to the card issuer. |

| The sales receipt was deposited late. | If you did not deposit the sales receipt within 10 to 180 days (or 20 to 180 days for some merchant types) of the transaction date and the cardholder account was closed, accept the chargeback. |

| The sales receipt was older than 181 days. | If the sales receipt was deposited more than 181 days after the transaction date, the chargeback is valid, irrespective of the cardholder’s account status. |

How to Prevent Reason Code 74

There are good reasons for setting time limits for depositing sales receipts. When you hold transactions beyond the limit stated in your merchant agreement (typically one to five days), you lose money and negatively affect customer service, as your customers expect to see transactions on their card statements within the same monthly cycle and even on the same day. Next month they may have already forgotten about it and file a dispute with their issuer.

With that in mind, here are some guidelines you should follow when depositing your sales transactions:

- Deposit your sales receipts with your processor as soon as possible. Ideally, you should deposit transactions on the day of the sale or within the time frame specified in your processing agreement. Keep in mind, however, that for sales involving a late delivery, the transaction date is the shipping date and you should never deposit transactions before it.

- If depositing paper sales, do it on a regular schedule. Make sure deposits are done within the time frame specified by your processor.

- Use transaction data capture point-of-sale (POS) terminals. These devices allow you to electronically deposit your sales receipts at the end of the day. Alternatively, you could consider electronic cash registers, which can be set up to automatically deposit your transactions in batches or in real-time.

The Takeaway

Reason Code 74 should not be occurring in properly managed businesses. If you can’t remember to process your sales on time, you probably have a problem that I can’t help you solve. After all, making money is your business’ primary objective and you can’t really do it if you aren’t collecting your payments. It is possible that one or two transactions may be deposited past the deadline (especially if they were late-delivery sales), but if that keeps happening, it speaks of a lack of motivation, which is an issue outside of this blog’s purview.

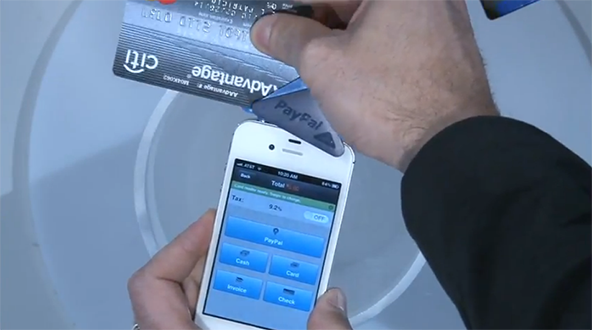

Image credit: Capital.com.pa.