How Small Businesses Use Credit Cards in the U.S.

Susan Herbst-Murphy from the Federal Reserve Bank of Philadelphia has published a paper on the effects of the Great Recession and its aftermath on the use of credit cards by small businesses in the U.S. As expected, following the widely documented huge run-up in the years immediately preceding the Lehman Brothers’ collapse, the availability, size and usage of business credit card lines of credit have all taken a big hit, albeit perhaps not quite as big one as some of us might have anticipated.

Herbst-Murphy’s study on the subject is the first one I have come across and I thought some readers might be interested in her findings. So let me give you what I thought were the paper’s highlights.

Businesses Use Credit Cards as a Borrowing Vehicle

That is one of the author’s main takeaways. Here is the summary of her findings:

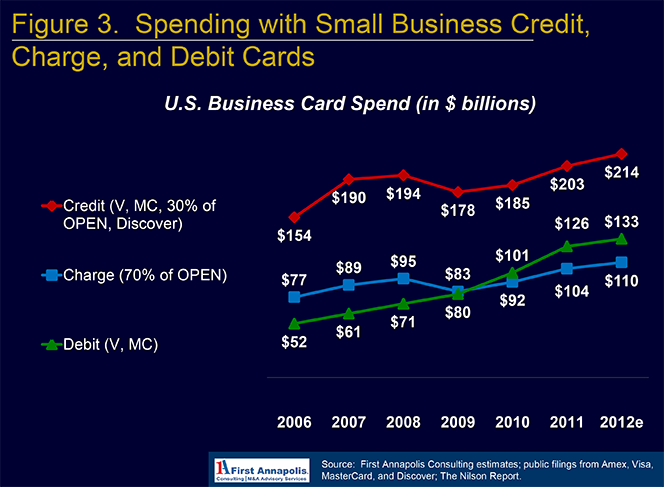

America’s small businesses have adopted credit cards as both a payment method and a borrowing vehicle. The segment also uses other payment card products, including debit, charge, and prepaid cards. The dollar volume of spending with cards designed for small businesses increased by 230 percent over the five-year period from 2003-2008. But the recession of 2007-2009 and contemporaneous changes in the regulatory environment had effects on both the supply to and demand of small businesses with respect to credit cards.

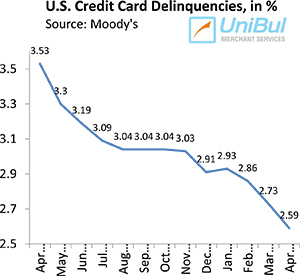

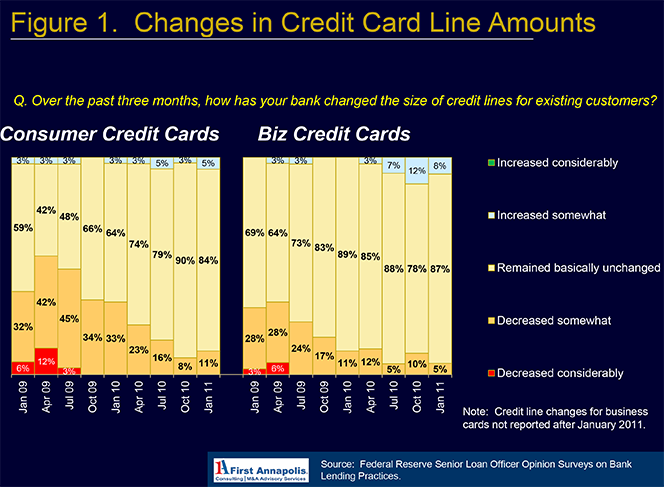

At the beginning of 2009, issuers were slashing credit lines on both consumer and business credit cards, helping to cause a decline in the use of business cards, which lasted until the end of 2010 and then started to rise again, Herbst-Murphy tells us. By the end of 2010, increases of payment card lines of credit were “considerable”. Here is the chart:

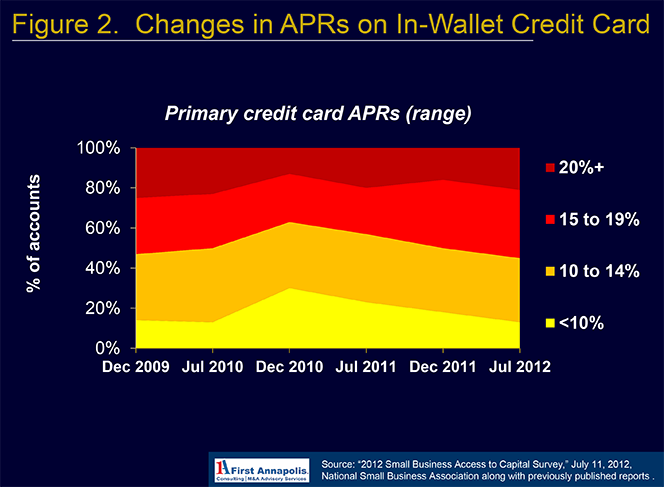

Credit Card APRs Rose Post-Crisis

Business credit card interest rates were to be found in the 13-13.5 percent range in 2009, Herbst-Murphy tells us. However, by the end of 2010, the average offer came with a rate of about 14.5 percent. Offer rates then remained stable for some months and some declines in APRs were being observed by late 2011. Yet, the author cites a survey, according to which, in May 2012, the average interest rate on the credit cards, which respondents considered to be their “primary card” was calculated at 15.6 percent. Here is the chart:

Business Credit Card Use Dipped in 2009, Resumed Growth in 2010

The recession’s effects on payment card use were predictable and spending declined in 2008 and 2009.?á However, as the chart below illustrates, by 2011 small business credit and charge card spending had surpassed pre-recession levels, as had debit card use.

Credit Cards Are the Most Easily Obtainable Form of Credit

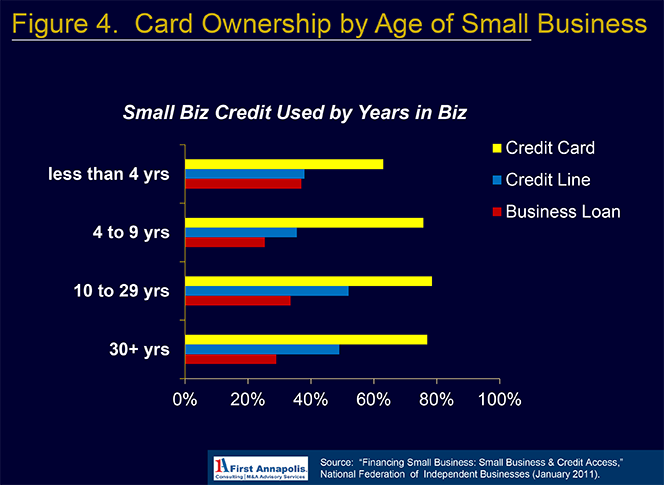

About 60 percent of small businesses have opened up a credit card by their fourth year of operation. By the ninth year the ratio rises to nearly 80 percent and then stabilizes, as seen in the chart below.

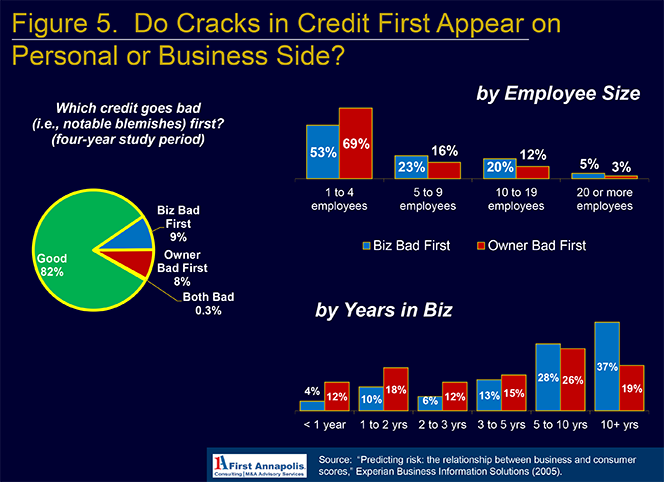

Credit Flaws as Likely to Appear on Business Credit Files as on Owners’

Prior to the crisis, among small business owners with “notable credit flaws”, these flaws first appeared on the owner’s personal credit file nearly as frequently as when they first showed up on the business credit file. However, as seen in the chart below, more substantial differences are seen when the business’ size and age are considered.

The Takeaway

To me, perhaps the biggest takeaway from Herbst-Murphy’s paper was just how similar business credit card trends are to consumer ones in the post-CARD Act world. As you may recall, the CARD Act placed the issuance and management of consumer credit card accounts under much stricter rules, but left business credit cards untouched. Yet, evidence piles up showing that issuers seem to treat the two card types much the same.

Image credit: Wikimedia Commons.