How Should Debit Interchange Fees Be Set?

That is the question Tim Sablik and Zhu Wang attempt to answer in a recent paper for the Federal Reserve Bank of Richmond. The authors consider the merchants’ long-standing complaints that the fees they pay are far greater than the issuers’ costs for processing card transactions, which of course is vehemently denied by the card industry, but their stated interest is in “setting interchange fees to maximize social welfare”.

Sablik and Wang conclude that leaving Visa, MasterCard and the PIN debit networks to determine interchange fees on their own would make these fees “too high to maximize social welfare”. Therefore, in their view, setting caps on interchange fees “may help to improve market outcomes”. However, they warn, setting the cap too low “may result in unintended consequences”. Here is the full paper.

Welfare Analysis of Debit Card Interchange Fee Regulation

By Tim Sablik and Zhu Wang

Tim Sablik is an economics writer and Zhu Wang is a senior economist in the Research Department at the Federal Reserve Bank of Richmond.

Merchants pay interchange fees to card issuers when they accept credit or debit cards as payment. Many merchants have complained that the fees far exceed issuers’ costs for processing such transactions. In response to those complaints, Congress directed the Federal Reserve Board to impose a cap on debit card interchange fees. The cap lowered interchange fees for most merchants, but it yielded some unintended consequences. An analysis of the payment-card market suggests several factors to consider, in addition to issuer costs, when setting interchange fees to maximize social welfare.

All credit and debit card purchases involve two sides: the consumer who uses the card to make a purchase and the merchant who accepts the card as payment. Card networks and issuers, which administer card transactions, charge fees to both sides, in part to cover the costs of processing payments. Traditionally, most of the fees, including interchange fees, have fallen on merchants.1 Consumers, on the other hand, have been rewarded (charged a negative fee) for using payment cards. Merchants have argued that their fees are too high due to card networks’ market power. While there are many different card-issuing financial institutions, there are only a few card networks that process payments and set interchange fees on behalf of issuers. Visa and MasterCard control nearly the entire signature debit card market. For PIN debit cards, there are a dozen networks, but the top four control 90 percent of the market.2

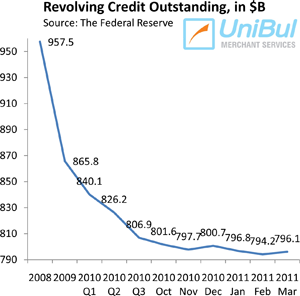

Interchange fees have been rising since the late 1990s.3 (See Figure 1 on the following page.) Merchants complain that these fees far exceed issuers’ processing costs, which have been declining as a result of technological advances. The Durbin Amendment to the Dodd-Frank Act addressed these complaints by directing the Federal Reserve Board of Governors to regulate debit card interchange fees to ensure that they are “reasonable and proportional to the cost incurred by the issuer with respect to the transaction.” Effective October 1, 2011, the Fed set a cap on interchange fees for financial institutions with more than $10 billion in assets. This cap allows for a base fee of 21 cents per transaction, plus a 0.05 percent adjustment to cover potential fraud losses, and an additional 1 cent per transaction to pay for fraud prevention among eligible issuers.

On the average debit card payment of $40, for example, the interchange fee was capped at 24 cents. This is about half the average interchange fee prior to the regulation. As a result, card issuers lost billions of dollars in annual interchange fee revenues. Based on call reports, a crude estimation shows that interchange fee revenue for card-issuing commercial banks covered by the regulation fell by as much as $5.1 billion in the year after the regulation went into effect. In contrast, interchange revenues of exempt institutions (those with assets below $10 billion) were not affected, rising slightly during the same period.

Based on this evidence, the regulation had the desired effect of reducing interchange fees. However, this effect was not uniform across transaction types. In the case of small-ticket items, debit card interchange fees actually increased following the regulation.4 For example, prior to the regulation, Visa and MasterCard charged an interchange fee of 1.55 percent of the transaction value plus 4 cents for any signature debit card purchase of $15 or less. This meant that in the case of a $5 sale, merchants were charged an interchange fee of 11 cents. Following the regulation, the small-ticket interchange fees charged by Visa, MasterCard, and most other PIN networks rose to the maximum allowed by the cap, in some cases doubling or tripling the fees small-ticket merchants had paid previously.5

This Economic Brief examines two questions. First, absent regulation, did card networks deviate from socially optimal debit card interchange fee levels? Second, why did the interchange fees on small-ticket merchants increase in response to the fee cap?

A Two-Sided Market

Economists model payment cards as a “two-sided” market with two end-user groups: merchants and consumers. Each side incurs costs and enjoys benefits from the use of payment cards, but the cards only have value if both sides agree to use them. Socially optimal outcomes in such a market depend on balancing the costs and benefits of each side through the fees that they pay.6 If consumers enjoy too many rewards for using cards (their fees are too low), then cards may be overused; conversely, if merchants are charged fees that are too high, then cards may be under-accepted. Interchange fees are one type of card fee that can be used to balance consumer and merchant demand for card usage.

In a recent article, one of the authors of this brief (Wang) examines how interchange fees are determined in a two-sided payment-card market.7 He uses a simplified version of the model developed in 2011 by Jean-Charles Rochet and Jean Tirole of the Industrial Economic Institute, a French research center.8 A key feature of the model is that consumers are charged the same price regardless of payment method.9 The model also assumes that merchants are homogeneous, that is, they have the same costs and benefits for accepting cards. Additionally, card issuers are assumed to have some market power, and the card network is a monopoly that sets interchange fees to maximize card issuers’ profits. Using this model as a benchmark, Wang considers whether the market equilibrium fee level deviates from the social optimum, where the combined benefits to consumers and merchants from card usage is greater than or equal to their combined costs.

The model predicts that interchange fees chosen by the private market will tend to be higher than this welfare-maximizing level. This is because merchants do not price discriminate based on consumer payment type. The price consumers pay for a good is the same whether they pay by cash or card, even though accepting payment by card might be more costly for the merchant. Because of this cohesive pricing structure, merchants internalize consumers’ card usage benefits when they set retail prices and accept cards. This allows networks to charge merchants interchange fees that are too high, while consumers are charged fees that are too low. As a result, payment cards are used even when the joint costs exceed the joint benefits for consumers and merchants. This suggests that regulation that reduces interchange fees, like the Durbin Amendment, may improve payments efficiency. However, the model also suggests that the socially optimal interchange fee is not determined solely by the issuers’ cost. Rather, the costs and benefits of all card users must be considered.10

Effect on Small-Ticket Merchants

While the Durbin Amendment regulation succeeded in lowering interchange fees for some merchants, small-ticket merchants paid higher interchange fees after the cap went into effect. This presents a puzzle: Why would card networks raise fees on small-ticket merchants in response to a fee cap? If each merchant sector is independent in terms of card acceptance and usage and networks find that they maximize profits by charging lower fees to small-ticket merchants, it is not immediately obvious why they would abandon this strategy in the face of a cap that is higher than the fees they were charging.

A possible explanation for this behavior is that there are “demand externalities” of payments across merchant sectors. If more merchants (such as small-ticket merchants) accept payment cards, then consumers will be more inclined to use cards as payment. This type of demand externality, sometimes called a “ubiquity” externality, can be seen in the marketing slogans for various payment cards, such as Visa’s slogan, “It is everywhere you want to be,” and Master-Card’s motto, “There are some things money can’t buy. For everything else, there’s MasterCard.”

To study this effect, Wang extends the two-sided market model to incorporate multiple merchant sectors that benefit from such ubiquity.11 He finds that prior to the regulation, card networks were willing to take a loss on interchange fees charged to small-ticket merchants in order to boost overall card acceptance and usage. In the model, a consumer’s average benefit from using cards for large-ticket purchases is positively affected by his or her ability to use cards for small-ticket purchases. Intuitively, if consumers can reliably pay for purchases with cards at more places, because of ubiquity, then they are more likely to carry and use cards. Because of this, networks were willing to subsidize small-ticket merchants by charging lower fees to encourage card usage for large-ticket purchases, where they could charge higher fees. Once a cap on interchange fees was imposed, however, networks were limited in their ability to offset subsidies for small-ticket merchants with high fees on large-ticket merchants. It was no longer profitable for networks to charge lower fees to small-ticket merchants, so those fees increased.

This outcome, however, may be socially suboptimal. Using the extended model, Wang studies which fee structure would maximize social welfare. He finds that such a structure also may charge higher interchange fees to large-ticket merchants and lower interchange fees to small-ticket merchants. While the optimal fee structure may charge lower fees overall than those determined by the market, it would maintain the differentiated interchange fee structure. Both the socially optimal fee structure and the one chosen by the private market seek to internalize the positive externalities of card usage between the small-ticket and large-ticket sectors by subsidizing small-ticket transactions.

Implications for Regulation

As Wang’s models show, interchange fees encompass more than just the costs of processing payment-card transactions. In the two-sided market, they also serve to balance demand between consumers and merchants while coordinating acceptance and usage among different merchant sectors. The models also show that privately determined interchange fees tend to be too high to maximize social welfare. Consequently, regulation that caps interchange fees may help to improve market outcomes. But regulation that only considers one-sided market logic (setting fees equal to issuers’ marginal costs, for example) or one type of market (ignoring the demand externalities between large- and small-ticket merchants, for example) may result in unintended consequences.

Wang’s research suggests several directions for improving market performance. One approach would be to cap the weighted average interchange fee instead of the maximum interchange fee. Under such a plan, regulators could set one fee cap but assign different weights to various merchant sectors. For example, the weights might require networks to set lower fees for small-ticket merchants, but allow them to offset those costs by charging higher fees for large-ticket merchants. Alternatively, instead of capping interchange fees, regulators could allow merchants to place surcharges on card usage. The economic models imply that interchange fees would be less of a problem in this scenario. However, this solution presents other difficulties. In countries that allow surcharges, few merchants choose to impose them, and those who do often charge more than their card-acceptance costs.12

Ultimately, the economic models introduced by this brief provide a theoretical framework for thinking about optimal interchange fee regulation. Successful policy intervention in the payment-card market will require additional theoretical and empirical work to fully understand the private and social costs and benefits of using alternative payment methods.

Endnotes

1 For a detailed description of the mechanics of interchange fees, see Haltom, Renee, Tim Mead, and Margaretta Blackwell, “The Role of Interchange Fees on Debit and Credit Card Transactions in the Payments System,” Federal Reserve Bank of Richmond Economic Brief, May 2011.

2 Credit cards typically provide credit or “float” to cardholders, while debit cards draw directly from a cardholder’s bank account after each transaction. Debit card payments are authorized either by the cardholder’s signature or by a personal identification number (PIN).

3 Signature debit card fees dropped temporarily during 2003 in response to a legal settlement that allowed merchants who accepted Visa and MasterCard credit cards to reject the networks’ signature debit cards.

4 For debit card transactions below $10, interchange fees set by Visa, MasterCard, and most PIN debit networks increased. See Hayashi, Fumiko, “The New Debit Card Regulations: Effects on Merchants, Consumers, and Payments System Efficiency,” Federal Reserve Bank of Kansas City Economic Review, First Quarter 2013, pp. 89-118.

5 A group of trade associations and retail companies filed suit against the Fed in November 2011, charging that it had set the cap too high by not basing its decision on the card issuers’ incremental costs with respect to the transactions, as outlined in the legislation. The U.S. District Court for the District of Columbia ruled in favor of the merchants on July 31, 2013. The Fed is appealing the decision.

6 The transaction volume of a two-sided market crucially depends on the fees that the platform charges each side of the market, not only on the overall level of the fees. See Rochet, Jean-Charles, and Jean Tirole, “Two-Sided Markets: A Progress Report,” RAND Journal of Economics, Fall 2006, vol. 37, no. 3, pp. 645-667.

7 Wang, Zhu, “Debit Card Interchange Fee Regulation: Some Assessments and Considerations,” Federal Reserve Bank of Richmond Economic Quarterly, Third Quarter 2012, vol. 98, no. 3, pp. 159-183.

8 Rochet, Jean-Charles, and Jean Tirole, “Must-Take Cards: Merchant Discounts and Avoided Costs,” Journal of the European Economic Association, June 2011, vol. 9, no. 3, pp. 462-495.

9 This price coherence can be the result of network rules, regulation, or simply the high cost for merchants to price discriminate based on payment type. In the United States, merchants are allowed to offer their customers discounts for paying with cash or checks, but few merchants choose to do so. On the other hand, card network rules and some state laws explicitly prohibit placing surcharges on payment-card transactions.

10 Regulators in the United States and other countries, such as Australia, have focused on setting interchange fees according to issuers’ costs. Rochet and Tirole (2011) suggest that setting fees equal to the merchant benefit of card acceptance may result in socially desirable outcomes. The European Commission has adopted this criterion for regulating interchange fees.

11 Wang, Zhu, “Demand Externalities and Price Cap Regulation: Learning from a Two-Sided Market,” Federal Reserve Bank of Richmond Working Paper No. 13-06, May 2013.

12 Hayashi, Fumiko, “Discounts and Surcharges: Implications for Consumer Payment Choice,” Federal Reserve Bank of Kansas City Payments System Research Briefing, June 2012.

Views expressed in this article are those of the authors and not necessarily those of the Federal Reserve Bank of Richmond or the Federal Reserve System.

Image credit: Flickr / Neil T .