How Much Are Interchange Fees Worth?

So the attorneys for the U.S. merchants in the antitrust case against Visa and MasterCard over the two networks’ credit card interchange fees are still hailing the settlement they agreed with the networks as a huge victory, despite furious opposition from retail groups, whose interest they are supposed to represent, Reuters reports this morning. Well, at this point there is not much they can say or do and this case has been quite a spectacle to behold. When the $7.25 billion proposed settlement was announced, the attorneys for the retailers declared that it would “create real price competition, leading to reduced card-acceptance fees for retailers” when it was patently obvious that it would do no such thing. Then it took about a week or so for some big-box retailers such as Wal-Mart to wake up to the reality and oppose the settlement vociferously. However, by that time it was too late, as it was then up to the judge presiding over the case to approve or reject the settlement.

I will resist the temptation to keep beating up on the merchants for the way they bungled this thing, at least for the time being, and will give you instead some data on the changes in the debit interchange fees, following the reform that took place last year, to give you a sense of what is at stake in the current fight. That reform was a greatly beneficial one for the U.S. retailers and they were hoping to replicate it on the credit card front, but if the proposed settlement is approved, that is unlikely to take place anytime soon.

Average Debit Interchange Fee Down by 45%

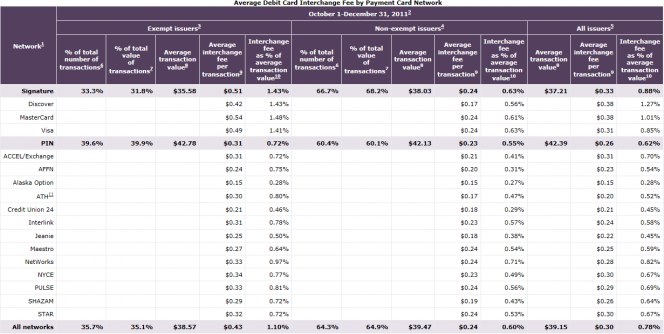

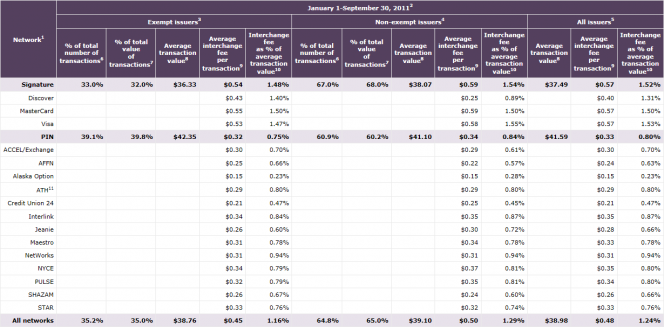

Here is what the Federal Reserve told us earlier this year about the effects of its Regulation II on debit interchange fees:

The Board’s Regulation II provides that an issuer subject to the interchange fee standard (a non-exempt issuer) may not receive an interchange fee that exceeds 21 cents plus 0.05 percent multiplied by the value of the transaction, plus a 1-cent fraud-prevention adjustment, if eligible.a The interchange fee standard became effective on October 1, 2011. As part of the rulemaking process, the Board collected 2009 data from payment card networks. The aggregate data provided by the networks indicated that the average interchange fee for all issuers was 43 cents.b Data collected after the rule took effect show that the average interchange fee per transaction received by non-exempt issuers in the fourth quarter of 2011 declined 45 percent from the 2009 level, from 43 cents in 2009 to 24 cents. The average interchange fee received by exempt issuers remained at the 2009 level of 43 cents.

Estimates vary, but a back-of-the-envelope calculation suggests that Regulation II will be saving U.S. retailers about $7 billion annually, based on 2009 volumes.

Debit Transaction Volumes Grew by 27% since 2009

However, debit transaction volumes are growing very fast. The Federal Reserve:

There were approximately 46.7 billion debit card transactions in 2011, with a value of more than $1.8 trillion. This was a 24 percent increase from the number of transactions in 2009 (37.6 billion) and a 27 percent increase from the value of transactions in 2009 ($1.4 trillion). Signature debit transactions represented about 63 percent of transaction volume and 61 percent of transaction value in 2011; the remainder were PIN debit transactions.

Now here are the Federal Reserve data in some more detail (click on images to enlarge):

The Takeaway

Whatever they may be saying now, the merchants scored a huge victory when the debit interchange fees were slashed to their present size. Naturally, once the debit end of the transaction spectrum was taken care of, the merchants trained all their guns on the credit end of it. However, having managed to botch the antitrust case whose settlement is currently being considered, the retailers may not be able to replicate their debit triumph. I, for one, do not feel bad for them.

Image credit: Calcoefcu.com.