Free Lunches, Interchange Zero and 35-Percent Processing Fees

Rarely has it been so easy for me to pick a news story to write a blog post about. And it’s not for the lack of worthy candidates. For one, we have Square issuing a cease and desist notice against rival mPowa, alleging that the British start-up, which recently entered the U.S. market, stole an image from its website (you just can’t make this up). Then you have a new development in the long-running interchange fee saga, this time involving an apparently imminent lawsuit settlement over the ability of merchants to add a surcharge every time a customer pays with a credit card. I know that I should be writing about the interchange fees; it’s the kind of thing that affects everyone and I probably will do it later this week.

But I just can’t resist saying a few words about an announcement issued by a mobile payments start-up that has been stirring the blogosphere these past couple of days. Boston-based LevelUp has told us that it will no longer charge its merchants any processing fees. As they’ve put it on the start-up’s website, “[w]hen your customers pay you $10 with LevelUp, you get $10. Period.” Well, as the late Milton Friedman once famously observed, there is no such thing as a free lunch. This time is certainly no different.

What Is LevelUp?

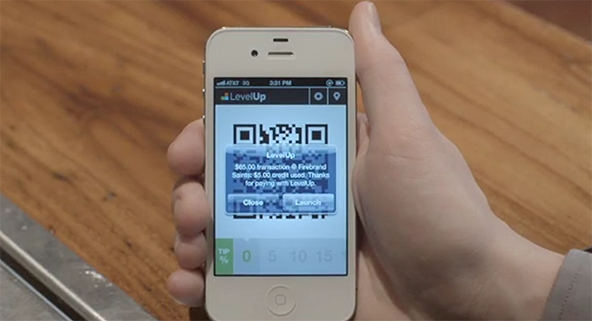

As this is the first time LevelUp is mentioned on this blog, I should take a minute to introduce its service. So the start-up (the company’s name is actually SCVNGR; LevelUp is the name of the service) has developed a mobile application that enables users to link a credit or debit card of their choice to their iOS and Android-powered phones; BlackBerry devices can also access LevelUp’s platform, but directly through the browser. Each user gets a unique QR code that is displayed on their phones at the checkout of a participating merchant. The merchant then scans the code to complete the transaction and the amount is charged to the linked card.

So LevelUp uses the same technology that powers Starbucks’ Mobile Pay, the somewhat unlikely mobile payments leader. However, while the coffee chain forces users to link their m-payment accounts to a Starbucks prepaid card, LevelUp gives them the freedom of using a card of their choice. Moreover, the Boston-based payment service can be used at any participating merchant location (we are told that there are about 3,000 of them), whereas Mobile Pay is only accepted at Starbucks. So SCVNGR’s approach is definitely more consumer-friendly than Starbucks’.

Leveling Up the Playing Field

And now SCVNGR is allegedly attempting to make its service equally friendly to its merchants. In fact, as friendly as free. Merchants are invited to join the “Interchange Zero revolution and stop paying processing fees forever.” What? Well, let’s have the SCVNGR guys explain it in a bit more detail:

Interchange Zero is the revolutionary — and now, real — idea that it shouldn’t cost merchants a single cent to accept a payment. No ifs, ands, or buts. Instead of making money just for moving money, payment providers should add value above the transaction in ways that help businesses thrive and grow, such as customer acquisition and customer loyalty campaigns.

How can anyone refuse such an offer? Oh, wait, there is one more thing:

OK this is pretty sweet. But how does LevelUp make money? When merchants choose to run a campaign on LevelUp, LevelUp earns 35 cents for every dollar of credit redeemed through that campaign. That means LevelUp is only making money when real value — which is determined by the merchant when they set up their campaign(s) — is created.

So real value is not created when a non-campaign-related purchase is made? Anyway, the point is that LevelUp is charging 35 percent of the transaction amount of all campaign-related purchases. What are we to make of that? Well, the best way to assess the value of LevelUp’s proposition to merchants is to view its pricing model as a more or less classic two-tiered structure. I’m surprised that none of the commentators who have looked into this story has made this link, which seems so apparent to me, but here we are.

So in a two-tiered pricing model, you would have a lower “qualified” rate and a higher “non-qualified” rate. In order for a transaction to be processed at the lower rate, it would have to meet certain criteria. Now think of LevelUp’s model as one where non-campaign-related transactions are qualified and so get processed at a zero-percent rate and all campaign-related transactions are non-qualified and get processed at 35 percent. To calculate the overall per-transaction cost, you should then add up all fees (qualified and non-qualified) paid over a given period, say a month, and divide them by the aggregate transaction value. A merchant may call LevelUp’s fees “processing fees,” “advertisement fees,” “cost of acquiring new customers” or whatever, but if these fees are not sufficient to cover, at a bare minimum, the interchange fees SCVNGR pays to the card issuers for each transaction, the start-up will promptly go out of business and its service will cease to exist. So far from reaching “interchange zero,” LevelUp has positioned itself firmly into the real-world interchange-plus territory and so are all of its clients.

The Takeaway

I am perfectly well aware that it’s a tough, app-eat-app, mobile payments world out there, with countless of start-ups jostling for position and trying to grab enough market share to make themselves attractive acquisition targets, before Google, Isis and the other big guys get a chance to figure it all out and muscle them out of business. So I can understand why SCVNGR would want to create just as much buzz around its offering as it can. And that’s fine, so long as the taglines are not too outrageous. “Interchange Zero” clearly crosses the line.

Image credit: LevelUp.

Good article, but slightly off, if I read my other articles correctly.

Shame on LevelUp for not being clearer on their website, but apparently the charge is not 35% (now 40%) of the transaction, but 40% of the *incentive value*. To quote from the LevelUp blurb included in Bostinno (http://bostinno.com/2012/06/07/levelup-offers-0-payment-processing-rate-making-interchange-zero-dream-a-reality/), LevelUp makes money with its campaigns in this way:

“Your Customer Acquisition Campaign drives a new customer to your business with a $2 incentive. The customer spends $10. You fund the $2. We charge an additional $0.70 for having delivered the new customer.”

Under the 40% model that fee would now be $0.80, definitely not $4.00.

The question I haven’t seen answered is whether businesses are required to use these campaigns, or whether they are completely optional.

— Dana

Hi Dana,

Actually, you’ve got this wrong. LevelUp explained quite clearly how the program at issue works and I quoted them in my article. Here it is again for you:

As you see, there is absolutely no ambiguity: a 35-percent cut, plain and simple.