How Can You Sell a Service Below Cost and Still Make a Profit?

That was precisely the question I was asking myself after I read a short news release about a British mobile payments start-up, which is now expanding in 16 European countries. The start-up at issue is named emu and was launched in the U.K. in September. Emu enables its users to accept cards for payment and charges precisely zero for the service. How can that be?

Now, in attempting to answer this question, I started from the assumption that emu was indeed set up to make money for its shareholders. See, I was brought up to believe, and still do, that businesses – and emu is very much a business – are incorporated with the objective to create value for their owners. On the other hand, when the objective is to provide products or services for free, the organization set up to facilitate such an operation is typically a non-profit one. I checked and confirmed that emu was incorporated as a for-profit organization. So how was emu to make a profit? But I’m getting ahead of myself. Let’s first take a look at precisely what emu does and then I will attempt to answer this bothersome question.

What Does emu Do?

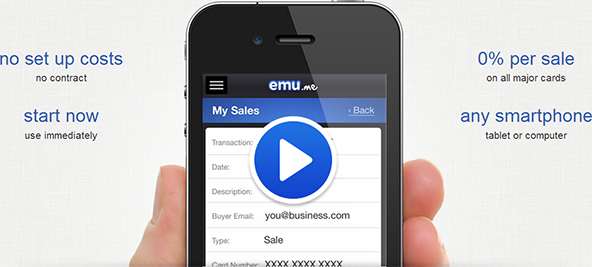

Emu enables its users to accept Visa, MasterCard and American Express cards for payment through their smart phones. Refreshingly, the start-up is not billed as a Square-killer, perhaps because it uses a different card acceptance method. Whereas Jack Dorsey’s solution was to attach a small reader to the phone through which the customer’s card would be swiped and its information “read”, emu users are asked to manually enter the card information using the phone’s keypad. Here is emu in action:

As you heard at the end of this video, the cost of accepting card payments through emu is zero. Well, that is not quite correct. When you look at the support section, you learn that

emu is free to use for your first ?ú1000 (€1,250 or $1,500) of sales. After this it’s a simple flat fee of £4.99 (€6.50 or $7.99) a month for unlimited use with 0% transaction fees.

Still, that is as close to zero as you can get and let me just say that under no circumstances can emu possibly generate enough revenue to even cover the interchange fees, never mind its operational costs. So what’s going on?

How Does emu Make Money?

In my attempt to solve the mystery, I went through emu’s gargantuan Terms and Conditions. The first thing I confirmed (I had already read about it elsewhere) was that the start-up was limiting its payment processing losses by placing an upper limit on a single user’s transaction volume. If you exceeded “an annual turnover of USD $100 000, or the equivalent in any other currency supported by the Service”, your service would be discontinued and you’d be given the “option to enter into an arrangement with emu’s designated bank on the bank’s terms and conditions”. Well, while this tells us how the start-up is limiting the downside, we still learn nothing about how it makes money.

So I kept going through emu’s T&C list and eventually made it to its longest section: “Processing of personal data”. In it the company tells us that it collects the typical information gathered by payment processors:

basic data, such as name, address, email address and telephone number; (ii) other data submitted by the User, such as logins, personal identity number or company registration no., bank account numbers, other bank information, and all other data submitted to emu websites and/or Software and/or by other means submitted to emu.

But the user also gives emu the right to process:

data collected from social networks that the User has granted emu permission to retrieve data from, such as Facebook and Twitter. Data that may be retrieved from social networks is data from the User?ÇÖs public profile or other publicly available data, data regarding the User?ÇÖs number of contacts or friends, and any profile picture on the social network representing the User.

…

Data relating to payment transactions carried out through the Service, such as amounts, description of the transactions, number of items, unit price for the commodity, any discounts, GPS position at the time of the transaction, details of the hardware used on the transaction date and other technical data associated with the transaction. Examples of technical data being processed is the device model, operating system version, IP address or other unique identifier of an Internet connected device used to use the Service.

So there is a lot of information that emu collects from its users. What does the start-up do with it? Well, here it is:

Personal Data may be disclosed to emu’s suppliers, emu’s acquiring bank and/or card networks such as Visa and MasterCard, to the authorities (such as the Financial Services Authority) and to other banks and financial institutions to the extent necessary to enable payment transactions to be carried out, handled or examined.

Personal Data may also be disclosed to the User’s contacts (“friends”) on social networks that are also customers of emu.

I have no idea who the aforementioned “suppliers” are, but I was finally able to make an educated guess about the start-up’s business model. Much like Google Wallet, emu is not interested in payment-related fees, but in data, which potentially can be monetized in a number of ways, or at least the start-up would hope so. That is the only plausible interpretation of the facts I can think of.

The Takeaway

If my reasoning is correct, the question becomes whether or not the value of the data collected by emu is high enough to make a solid business case for investment in such a project. And there is a lot of data collection already under way. The start-up tells us that in the U.K. use of its platform is “growing at over 100 percent per day and international registrations [are] increasing by more than 65 percent per day”. Well, it shouldn’t be surprising that emu is popular with end users – after all, it charges nothing for its service. The more important question is whether the start-up will ever manage to turn a profit. Time will tell.

Image credit: emu.

These guys are geniuses, if they start their own small businesses and put an umbrella over it, everyone is laughing, no personal data sale required.