Heavier U.S. Credit Card Users Live on the Coasts

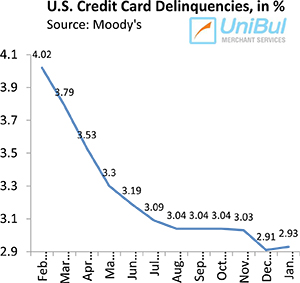

That is what data highlighted in an article on the SmartBlog on Finance tell us. The author — marketing consultant Pam Allison — has used data from multiple sources, but for the distribution analysis she has relied on statistics from Esri — a supplier of Geographic Information System (GIS) software and geodatabase management applications.

This is the first time I’ve seen such detailed maps of credit card usage patterns in the U.S. and find them fascinating. It turns out that, whereas the heavy credit card users are more likely to live on the coasts, the distribution of light users is fairly even across the country. It should come as no surprise, then, that another Esri map shows that the distribution of American Express cardholders closely matches the one of the heavy card users, while Discover’s does not. There is another parallel to be drawn, too. Let’s take a look at the data.

What Where You Live Tells Us about How You Use Credit Cards

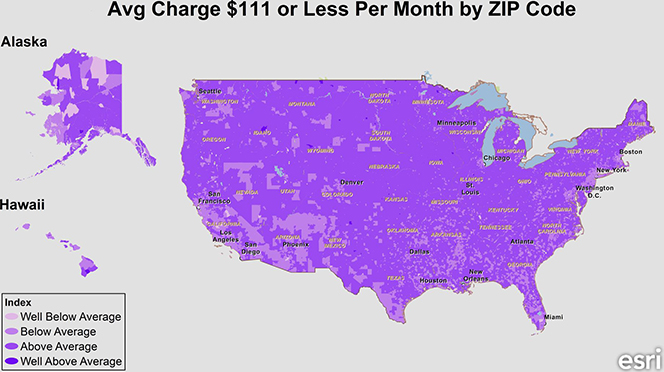

Allison has given us two of Esri’s maps: one that shows the distribution of Americans charging less than $111 on their credit cards per month and another — of those charging more than $700 per month. Here is the first map:

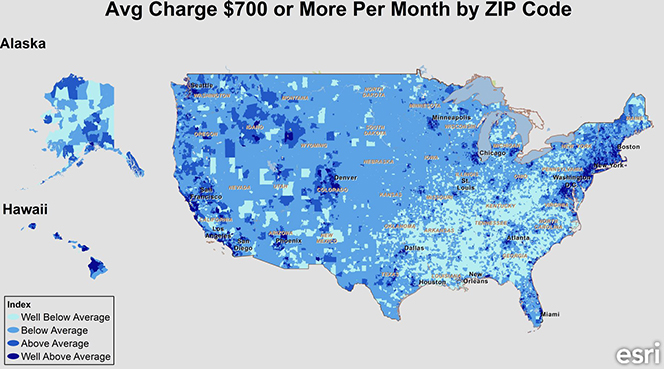

As you see, the distribution is fairly homogeneous. However, there is no homogeneity to be found in the placements of the higher spenders. Here is the map:

So, with rare exceptions — like Phoenix and Denver — Americans who charge more than $700 dollars on their credit cards each month tend to live in California and in the North East.

But there is more to be learned from the data. Allison tells us that Esri has developed the so-called Tapestry Segmentation system, which divides the country into 65 market segments “based on socioeconomic and demographic characteristics.” Here is what that segmentation tells us about the lower spenders:

Consumers that charge $111 or less per month are most likely to be in neighborhoods dominated by Tapestry’s Rustbelt Retirees segment. These residents are 1.5 times more likely than the average American to charge $111 or less per month on their credit cards. Rustbelt Retirees neighborhoods are the foundation of older, industrial cities in states bordering the Great Lakes. Most residents are married couples with no children or singles who live alone. They own and live in modest single-family houses. Although many are still working, more than 40% receive Social Security.

And here is what the Tapestry system tells us about the higher spenders’ distribution:

Consumers that charge $700 or more per month most likely live in neighborhoods dominated by Connoisseurs, Military Proximity, Silver and Gold, Suburban Splendor and Top Rung [these are names of segments]. Residents are two times more likely than the average American to charge $700 or more per month on their credit cards. Affluence is the commonality for all of these segments except Military Proximity. Differences occur in location, age and family types. Connoisseurs, Suburban Splendor and Top Rung residents are usually in their 40s, well-educated, hold professional or management positions, and live in large, luxurious single-family homes in established suburban neighborhoods. Military Proximity residents are young, married and just beginning parenthood. Median household income is low for these residents on active duty or civilians employed on military bases.

Where American Express and Discover Are Used the Most

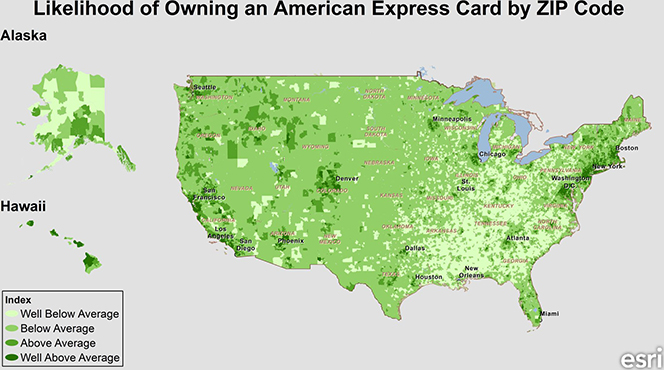

The Esri data show, unsurprisingly, that American Express users — a wealthier, higher-spending lot — live where those spending more than $700 per month live. Here is the map:

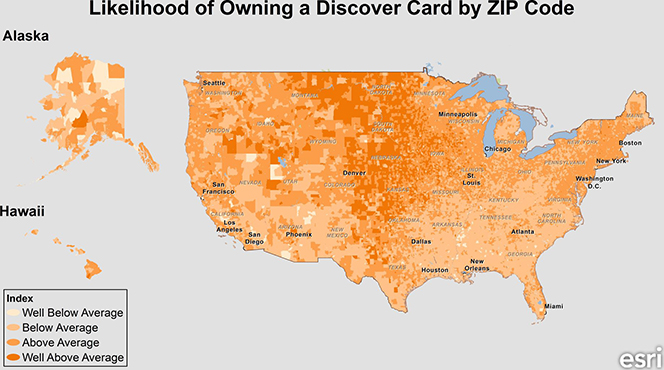

The Esri guys might as well have just changed the colors of the $700-plus map and called it “Likelihood of Owning an American Express Card by ZIP Code”. Now here is where Discover card users live:

So we can immediately see that Discover cardholders tend to live in the middle of the country, but Esri gives us a much more detailed description of the typical Discover user. Here is how Allison has summarized it:

Discover Card holders have a very different profile from American Express cardholders. Residents in neighborhoods dominated by Prairie Living, Rustbelt Retirees, and Silver and Gold Tapestry segments are most likely — 1.5 times — to have a Discover Card. Many Prairie Living residents live on small, family-owned farms in the Midwest. Rustbelt Retirees are a mix of settled, married-couple families, single parents and singles in neighborhoods of older, industrial cities in states bordering the Great Lakes. Silver and Gold residents are wealthy seniors most of whom have retired from professional careers and moved to sunny climates.

The level of detail is truly amazing. Allison also gives us data on the total numbers of credit cards in the U.S. and the shares of each of the top four brands. However, I think that these data are a bit old and are showing higher numbers than the ones we currently have. According to the latest Household Debt and Credit quarterly report, issued by the Federal Reserve Bank of New York, the number of active credit card accounts in the U.S. at the end of the third quarter of 2012 was 382 million, 23 percent below the 2008 Q2 peak of 496 million.

The Takeaway

Being a marketing professional, Allison sees Esri’s data as a tool to help credit card companies gain “a deeper understanding of consumer preferences” and “improve their marketing strategies, increase market share — and ideally increase profits over time”. And that is surely what the issuers use such statistics for. My main takeaway, however, was quite different. I couldn’t help but being struck by just how accurately the $700-plus map painted the country’s political landscape. I can offer no immediate explanation. Can you?

Image credit: Pozyczkaonline.info.