Going Bankrupt Does Scare Lenders Away

That is what a new paper just published by two economists from the Federal Reserve Bank of Philadelphia — Julapa Jagtiani and Wenli Li — has confirmed. Now, to me — and I’m sure to many of you — this sounds like a perfectly reasonable reaction — wouldn’t you think twice before lending to someone who has a record of not paying back her loans? But that is not how the authors interpret their results. To them, the reduced supply of fresh credit to bankruptcy filers is a sign that “the current bankruptcy system does not appear to provide much relief” to them. Unfortunately, the authors don’t tell us what they think a sufficient amount of relief should look like, although presumably it would involve a much easier access to new credit.

But that is not what a bankruptcy is intended to provide! In America, the bankruptcy law provides consumers who are unable to pay back their loans with protection from their creditors and, following a successful resolution of the bankruptcy procedure, the opportunity for a fresh financial start. Note that a bankruptcy is not intended to turn the clock back to some arbitrary point in the past in which the filer enjoyed a ready access to credit at the most advantageous terms. That is why a discharged bankruptcy remains on a debtor’s credit file for 7 – 10 years, so that future prospective lenders can take it into consideration when reviewing that person’s credit applications. So the bankruptcy law gives the filer a chance to wipe the slate clean and start afresh. And as is the case with every start, it takes time to get to full speed. Still, the researchers’ findings are interesting and I thought I’d share them with you.

Chapter 7 vs. Chapter 13

As the researchers are focused primarily on the difference in performance between the filers of Chapter 7 and Chapter 13 bankruptcies, let’s begin by identifying the key features of each one of them. Here they are in the authors’ own words:

Chapter 7 filing is often called “liquidation.” Under Chapter 7, a debtor gives up all his assets above a certain exemption level. In exchange, the debtor gets almost all of his unsecured debt discharged. The exemption level varies by states. A debtor cannot file for bankruptcy for eight years under Chapter 7 or four years under Chapter 13 after the last Chapter 7 discharge (the time gap, however, is calculated between two filing dates).

Chapter 13 filing is also called a “wage earner’s plan.” Under Chapter 13, a debtor gets to keep all of his assets. However, he must repay some of the unsecured debt out of future earnings through a repayment plan over three to five years. Only after the completion of the repayment plan will the debtor obtain a legal discharge of his remaining debts. A debtor cannot file for Chapter 7 bankruptcy for at least six years if the Chapter 13 payment made was less than 70 percent of the confirmed Chapter 13 repayment plan and cannot file for Chapter 13 bankruptcy for at least two years after the current Chapter 13 filing.

Furthermore, a Chapter 7 filing stays on the filer’s credit report for 10 years and a Chapter 13 filing remains there for seven years.

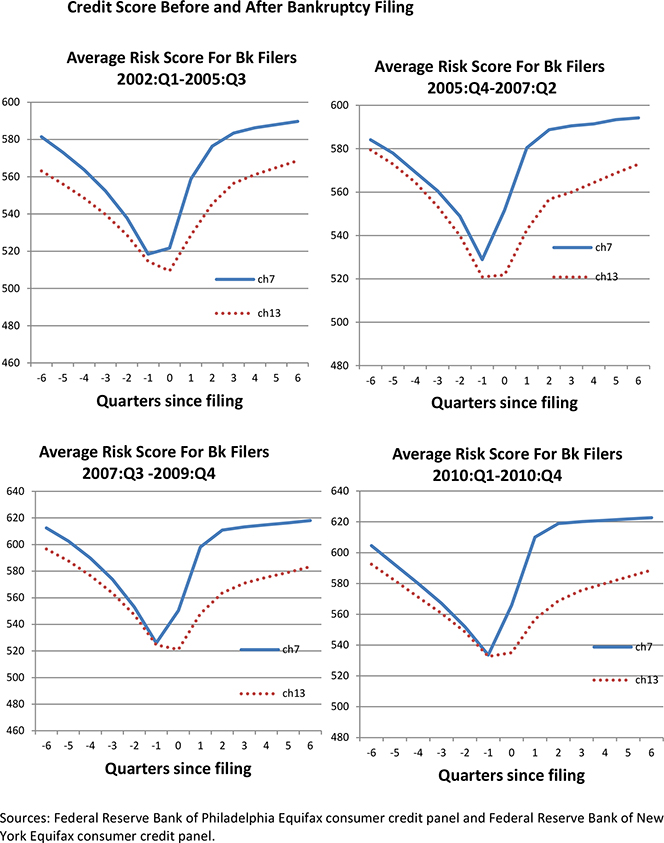

Credit Scores Rebound Quickly after Bankruptcy

That is the authors’ first finding. It turns out that credit scores begin to recover immediately after a bankruptcy filing and get back to their pre-bankruptcy level about six quarters after the filing.

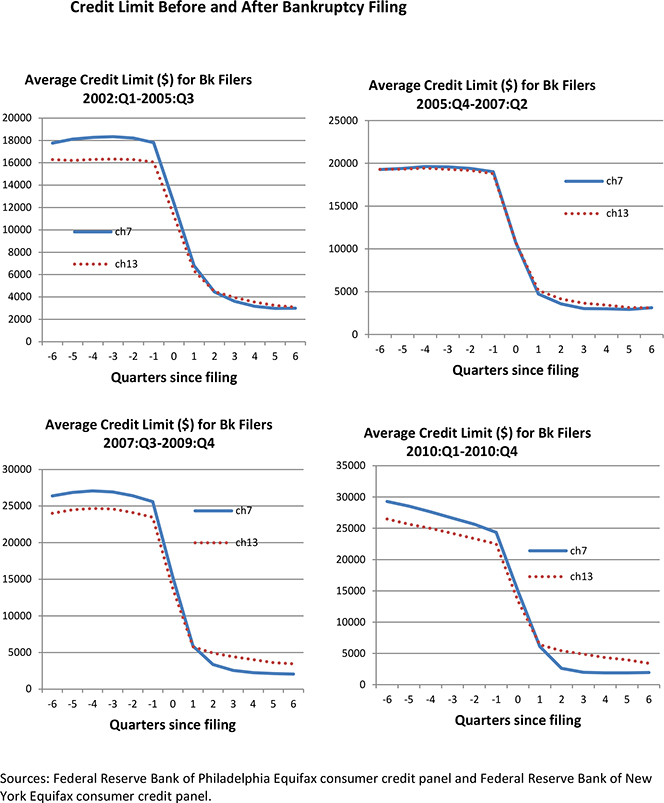

Yet, the authors also find that the improved credit scores do not translate into an easier access to the credit market. In fact, we are told, that access is reduced, which reflects a reduced credit supply, as lenders cut substantially the credit limits they offer to borrowers after a bankruptcy filing.

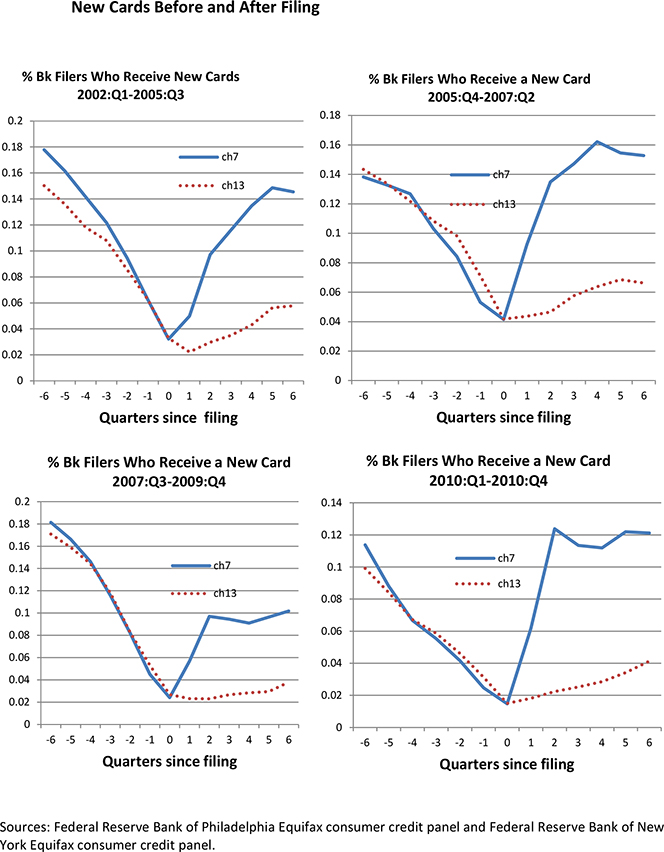

Chapter 13 Filers Get Fewer Credit Cards

Somewhat surprisingly, lenders do not treat Chapter 13 filers more favorably than Chapter 7 filers, even though the former have made an effort during the bankruptcy proceeding to pay back at least a portion of their debt. On the contrary, we are told, Chapter 13 filers are much less likely to receive new credit cards than Chapter 7 filers, even after the researchers control for borrower characteristics and economic environment.

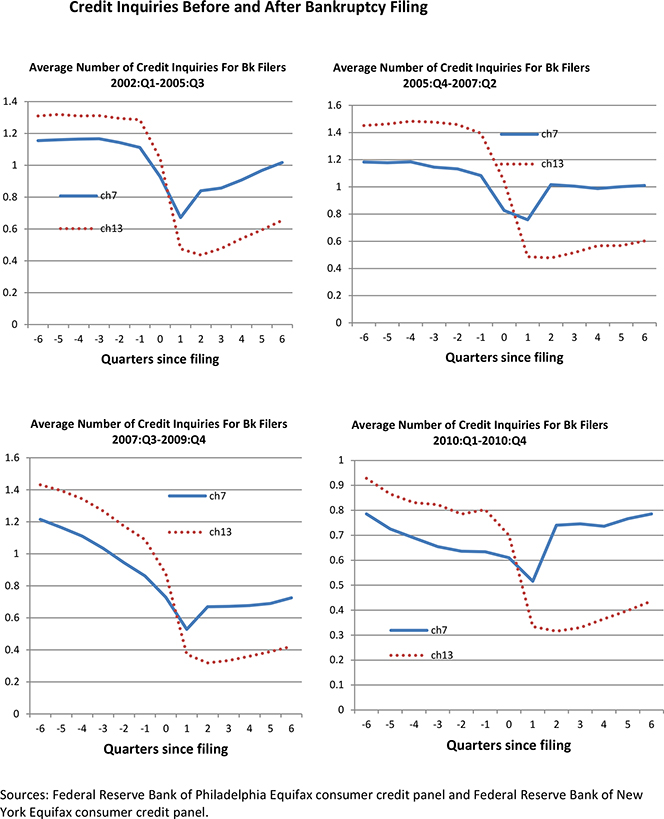

Yet, the data also show that Chapter 13 filers are much less actively looking for new cards than Chapter 7 filers, which must be pushing down the ratio of members of the former group who are getting new cards.

Chapter 13 Filers Have Larger Credit Limits

Even though they get fewer new cards, Chapter 13 filers still have slightly larger overall credit limits, as they are able to maintain more of their credit from before the filing, we learn.

The Takeaway

So the researchers find that “both Chapter 7 and Chapter 13 filers suffer a significant reduction in their credit limits after the filing and that the impact seems to be long-lasting”. But the funny thing is that they seem to be surprised with their finding, which leads them to suggest that “the current bankruptcy system does not appear to provide much relief to bankruptcy filers — both Chapter 7 and Chapter 13 filers”. OK, here is where I get lost: how exactly is the system not providing much relief to bankruptcy filers? After all, they do get their debts discharged and a clean slate to start all over again. What else could be done? Treat bankruptcy filers as having the same risk of default as non-filers? And if lenders refuse to do so, passing legislation forcing them to do it? Jagtiani and Li wouldn’t elaborate.

Image credit: Flickr / taberandrew.