Facebook Partners with Carriers, Moves toward Closed-Loop Payments Platform

We did get an indication that Facebook had started developing its own direct carrier billing capabilities when the social network signed an agreement with Bango — a smallish U.K.-based direct billing specialist — a couple of weeks ago. At present, all direct billing payments transacted on Facebook are facilitated by third-party payment processors, such as BOKU and Zong. That is now about to change.

Yesterday Facebook’s Director of Developer Relations Doug Purdy told us that the social network had signed direct billing agreements with a number of mobile carriers, including AT&T, Verizon and T-Mobile in the U.S. Although it was not explicitly stated, it would not be much of a stretch to conclude that Facebook is moving toward a closed-loop payments platform in which there doesn’t seem to be any room for outsiders like BOKU. There is a lot of money at stake and Facebook is, unsurprisingly, not interested in sharing.

Facebook’s Direct Billing Ambitions

Here is how Purdy outlined his company’s vision for the place of direct carrier billing in its payments system:

We’re working with operators around the world to minimize the number of steps needed to complete a transaction in mobile web apps, which will make it easier for hundreds of millions of people worldwide to purchase apps on their device via operator billing. This will be automatically enabled where carriers support it when you integrate the Pay Dialog into your app.

We don’t know what the terms of these agreements are, but the above statement seems to indicate that direct billing transactions will in the future be circumventing Facebook Credits, the social network’s virtual currency. At present, a direct billing payment facilitated by BOKU or Zong can only be used to purchase Facebook Credits, which can then be used for payment, so the new transaction cycle, as hinted by Purdy, would indeed be a couple of steps shorter.

Moreover, cutting BOKU and Zong out of the transaction cycle would no doubt increase Facebook’s profits. We don’t know how much the social network currently pays the carriers for the BOKU- or Zong-facilitated payments, but removing the intermediaries would inevitably reduce that cost.

What about Credit Cards?

Neither Purdy’s announcement on his blog, nor Facebook CTO Bret Taylor’s at the ongoing Mobile World Congress in Barcelona, had anything to say about credit cards and their role in Facebook’s transaction cycle. That has led some commentators to lament that the social network is not being ambitious enough and wonder why Facebook isn’t taking the logical, as they see it, step of cutting credit cards entirely out of the loop. Here is, for example, Wired.com’s Tim Carmody:

What about a Facebook web app that lets you get together with friends, order takeout and go pick it up, without ever pulling out a credit card?

But would it be in Facebook’s interest to cut credit cards out of its payments system? No, it would not. There are a couple of reasons for that. Firstly, the social network’s cost of processing credit card payments must be much lower than that of processing direct billing transactions. Facebook’s S-1 filing doesn’t give us the exact details, but we know enough to be fairly certain that this is indeed the case. The average bank card processing fee (debit and credit) for a company of that size should not be more than two percent per transactions and Facebook’s is very possibly lower than that. On the other hand, we do know that carriers ordinarily charge merchants accepting direct billing payments a fee of around 30 percent of the sales amount. Facebook is of course not an ordinary merchant, but even so, it doesn’t seem probable that the social network would have been able to negotiate a rate even remotely close to what it is paying in credit card processing fees.

Secondly, direct billing is not yet nearly as widespread a payment option as bank cards. Moreover, many consumers, this blogger very much included, just don’t feel comfortable using their cell phone accounts as a line of credit. Not to mention that even if I did, I would still be using my credit card, because it gives me cash back. And anyway, at least in the foreseeable future direct billing would only be a payment option for very small amounts.

So Facebook will be sticking to credit cards for quite some time to come.

The Takeaway

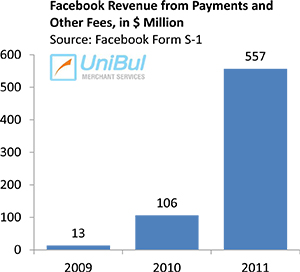

Facebook’s payments-related revenue is skyrocketing, reaching $557 million in 2011. As a share of the social network’s total revenue, payment fees grew from less than two percent in 2009 to 15 percent last year. That is a huge achievement, especially considering that Google, Facebook’s sometime rival, is yet to find a second major revenue source.

Facebook’s payments-related revenue is skyrocketing, reaching $557 million in 2011. As a share of the social network’s total revenue, payment fees grew from less than two percent in 2009 to 15 percent last year. That is a huge achievement, especially considering that Google, Facebook’s sometime rival, is yet to find a second major revenue source.

And it may not be long before payment fees overtake advertising as Facebook’s top profit maker. But the ride is unlikely to be a smooth one, as the fees at issue are rather exorbitant. Charging 30 percent of the transaction amount in processing fees may attract regulatory attention or may lead to a backlash from developers. Remember that the highly publicized debit interchange war between merchants and card issuers was fought over fees that were on average much lower than two percent. Eventually Congress ruled for the merchants, accusing Visa and MasterCard of exploiting its monopolistic status to set their fees at a higher level than an open system would produce. Wouldn’t it be ironic if Facebook found itself in the same position?

Image credit: Facebook.com.