Does Calculating Your Debt Help Reduce It?

The CARD Act of 2009 required issuers to create a special section in their customers’ credit card statements that would provide information about the length of time and amount of interest that would take to pay off the current card balance if only the minimum monthly payments were made. Additionally, the statements had to tell cardholders what monthly payment amount was required to pay off the outstanding balance in three years. These disclosures had to include a toll-free number for credit counseling and debt management services.

I was reminded of this particular provision of the CARD Act this morning when I read that the Consumer Financial Protection Bureau (CFPB) had introduced an online tool on its website designed to help consumers estimate and compare tuition costs at various colleges across the U.S. I played a bit with it and liked it, just as I liked the afore-mentioned addition to credit card statements. Both provide valuable information that consumers could and should be using when making financial decisions. Unfortunately, the math can only help you so much. The real difference is made by grants and scholarships.

CFPB’s College Cost Comparison Tool

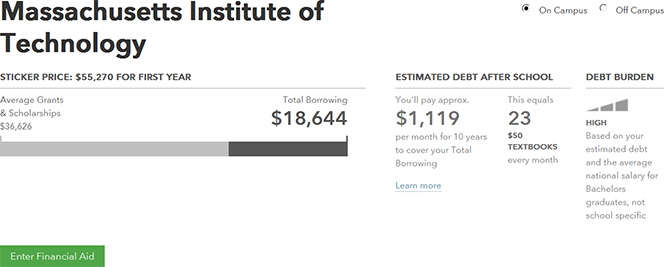

CFPB’s cost comparison tool allows you to compare costs at three schools of your choice. The initial comparison gives you the following information about each school:

- The estimated “sticker price” of each college.

- The average amount of scholarships and grants received by its students.

- The estimated debt after school, calculated as the monthly payment amount required to pay it off in ten years.

- The “debt burden,” defined rather nebulously as [b]ased on your estimated debt and the average national salary for Bachelors graduates.”

Here is, for example, what I got for the MIT:

If you clicked on the green “Enter Financial Aid” button in the lower left corner, you would be prompted to enter the data from your financial aid award letter, as applicable, and the tool will recalculate your total cost. Do that for each of your selected colleges and you would get a much more accurate comparison among them. Additionally, the tool calculates for you the cost of the average four-year public university, separately for the in-state and non-profit categories.

Does Calculating Your Debt Help Reduce It?

CFPB’s tool is really helpful, but while playing with it, I found myself wondering how much of an impact it would have. After all, cost comparison services for student loans and other financial instruments are not exactly new. And anyway, people who wanted to make such calculations have always been able to make them, although that used to be a manual and slightly more time-consuming process.

So I looked back at credit card debt for guidance, because the CARD Act, with its “minimum payment warning” provision, has been in force for about two years. Well, it is true that there has been a huge decrease in credit card debt, but the deleveraging process began immediately following the collapse of Lehman Brothers and all the available data show that it was caused by the combination of sky-rocketing charge-off rates and general consumer aversion toward debt. If the minimum payment disclosure has had any additional impact, I just don’t see it.

I think that, unfortunately, the effect of CFPB’s cost-comparison tool will be similarly non-existent. It will make life marginally easier for consumers who would have done the calculations anyway, but there is no reason to believe that it would have much of an impact elsewhere. After all, these are incredibly simple calculations that could be done in a few minutes using only a pen and a piece of paper.

The Takeaway

As CFPB Director Richard Cordray reminds us, U.S. student loans now exceed $1 trillion in total and tuition continues to rise. So the importance of the cost of financing as a factor in the choice of a college will, if anything, keep increasing. But as far as cost comparison goes, the biggest factor to consider remains financial aid.

My own cost comparison worksheet showed that all five entries (including the two average estimates) received a “high” in the “debt burden” category. However, while the sticker price for MIT ($55,270) was considerably higher than the one for the average four-year private non-profit university ($42,224), when you subtracted the average grants and scholarships, the latter category overtook the former by a wide margin ($26,694 vs. $18,644). So you should definitely do the math, but getting the financial aid is becoming absolutely necessary.

Image credit: Ibegtodisagree.com.

You are right, without the grants and scholarships no amount of number crunching will help you all that much. It is truly terrifying to see how the student debt total is exploding, but looking at these “sticker prices” it just couldn’t be any other way. I don’t know where that will take us.

Student loan debt as a total recently surpassed credit card debt as the leading type of US household debt, aside from the mortgages. So I welcome the CFPB’s effort, through this online tool, to help people get the information they need and make sure that students are not paying more than they have to.

I like this tool. It is clean and simple enough to use, but it could benefit from a bit more information on anticipated student salaries, which would impact your ability to pay down your debt once you get out of college. It could also do a better job at breaking down the public and private loans. That’s because private creditors typically charge higher interest rates than the government does. They’re also less forgiving if you are unable to repay your debt.

I used this tool to calculate the costs of two private colleges my son thinks he may want to go to someday. I also added Harvard for good measure and to see how it compared. Additionally, the results included the average cost of a four-year private university and a four-year in-state public university. The latter was the cheapest option, but it didn’t Harvard was not much more expensive. All schools had a high estimated debt burden and that was scary.

You should not pay much attention to the sticker price, but look at the financial aid packages instead. I compared Syracuse, UCONN and Notre Dame and, while Syracuse is more expensive than UCONN, it also offers better aid than UCONN. So in the end, only $10,000 separated the average debt burden, which may be worth it for some students in some degrees.

As the New York Times noted, these calculations are a rough estimate. The CFPB assumes that the sticker price of a school will be the same throughout the duration of a student’s time there, which of course has not been the trend, as the prices has gone up. Moreover, the CFPB assumes that students will borrow the same amount every year. Additionally, the debt calculations can be skewed as some students may receive more or less than the average amount of financial aid.

There is another website that does college cost comparison at the US Dept. of Education’s College Affordability and Transparency Center. Both of these sites let consumers compare the colleges of their choice and their costs. On the Dept. of Education’s site, there is also a section on what it would cost for career and technical schools and a even chart showing how much tuition has risen at the major schools in each state: private, public 4-year, public 2-year, private not-for-profit, etc. So this is a real good tool too.

This tool seems to be very useful, especially if the user goes through to the second page to enter aid, and enters the anticipated payments from the family, as well as the expected borrowing. Unfortunately, if you do the comparison based only on the first page, then the entire net cost (that is excluding average grants / scholarships) is assumed to be borrowed. This would display a misleading figure for borrowing in the first year, and would assume four years of borrowing at that level.