Dissecting $1.2T of Student Debt

The Consumer Financial Protection Bureau (CFPB) estimates that, as of May 2013, the total of the outstanding student debt in the U.S. was about $1.2 trillion. Of that amount, the portion that is guaranteed or held by the federal government is slightly more than $1 trillion. The rest is private student loans. These are big numbers and, as we keep hearing, student debt now represents the second largest form of consumer debt in the U.S., behind home mortgages and ahead of credit cards.

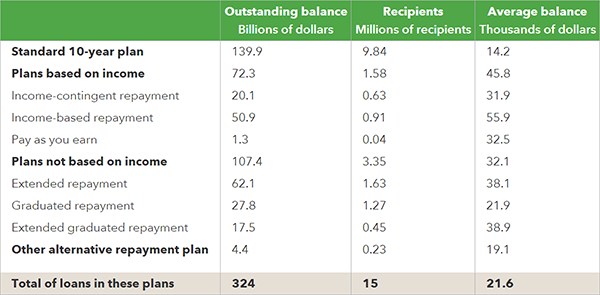

Rohit Chopra, the CFPB’s Student Loan Ombudsman, has taken a close look at the federal component of the total and finds, unsurprisingly, that the numbers paint a disturbing picture: the levels of default, deferment and forbearance are unsustainably high. He then looks at the data for debt repayment plans available to borrowers and finds that about two-thirds of them are enrolled in the standard 10-year repayment program, whereas just over 10 percent are participating in an income-based repayment program, which, he believes, could help lower default levels. Here is the data.

$1.2T in Student Debt, $1T in Federal Loans

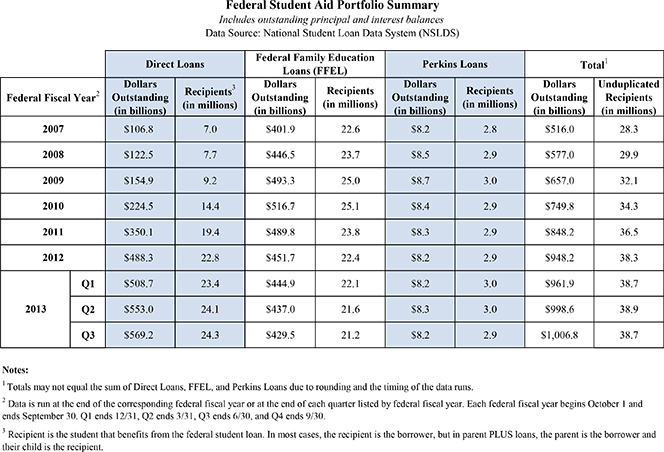

At the end of June of this year there were 38.7 million recipients of federal student loans, which totaled $1,006.8 billion. The respective figures at the end of fiscal year 2007 were 28.3 million and $516 billion. Here is a breakdown by type of federal student loan:

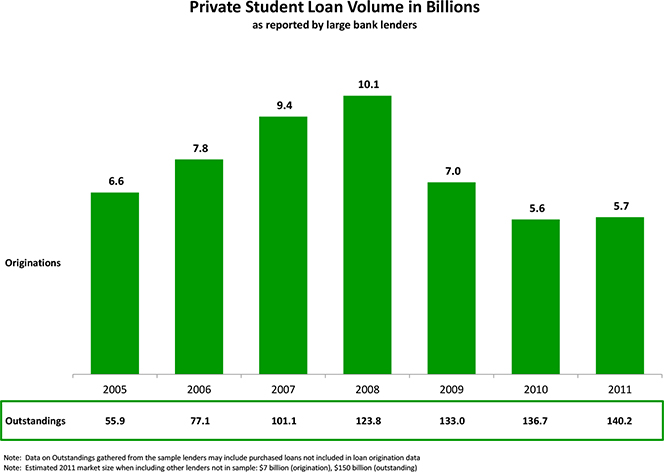

These numbers dwarf the private student loan (PSL) volumes. The PSL market grew rapidly during the boom years — from less than $5 billion in 2001 to over $10 billion in 2008 — and then contracted just as rapidly following the bubble’s burst, to less than $6 billion in 2011. However, as you can see in the chart below, the volume of outstanding private student loans never stopped growing.

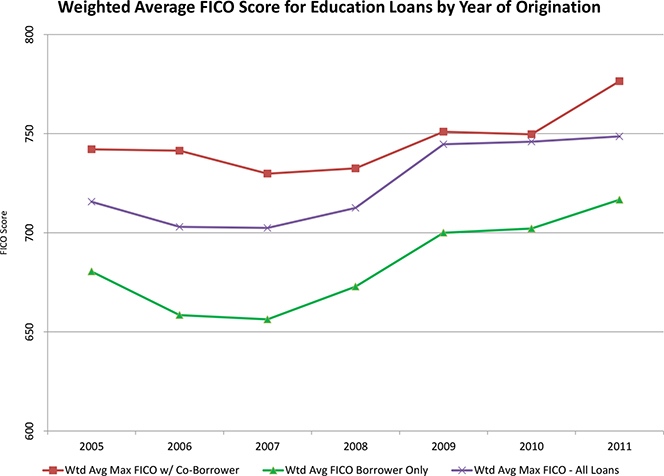

The reason the PSL total grew during the boom years, the CFPB tells us, is that, similarly to sub-prime mortgages, a large portion of the student loan volume was funded by asset-backed securities (ABS). A high demand for student loan ABS (SLABS) allowed SLABS issuers to create debt instruments with very low collateralization ratios, so that $100 in student loans could generate immediate cash proceeds from securitization of $105 or more. As the buyer typically assumed the risk of default, a PSL lender had an incentive to increase the loan volumes made for such a sale, but didn’t care all that much about the creditworthiness of the borrowers — a point made clear by the dip in the average FICO score of PSL borrowers in the years leading up to the financial crisis.

You will note that, as was the case with the sub-prime mortgages, private student loan lenders have learned their lesson and are now extending credit only to borrowers with high FICO scores. However, that did not happen with the origination guidelines for student loans backed by the federal government.

Paying Back Federal Student Loans

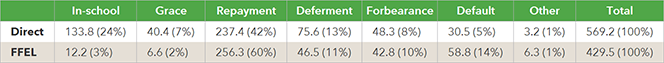

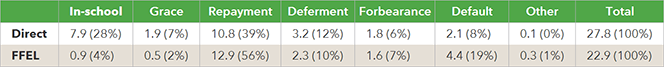

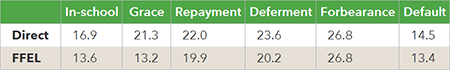

The table below shows the total outstanding balances (in billions of dollars), including accrued interest, for the Federal Direct Loan and the Federal Family Educational Loan (FFEL) programs, which, combined, account for more than 99 percent of the total outstanding (as you can see in the first chart above). Also shown are the shares of the outstanding balances that are in deferment, forbearance and default.

And here the same calculations are made in respect to the number of recipients (in millions):

And here is a breakdown of the outstanding balances, including accrued interest (in thousands of dollars):

As Chopra drily notes, a “noteworthy number of borrowers are in default”.

Finally, here is how federal student loan borrowers are paying them back:

Now, Chopra suggests that borrowers looking to reduce their payments can opt for a plan where their monthly payments are tied to a portion of their income. Under the new Pay As You Earn plan, for example, payments are set to roughly 10 percent of the borrower’s income above the poverty line. After 20 years, any remaining balance is forgiven. Other plans allow for payments to be extended over a longer period (extended repayment) or to have them increase over time (graduated repayment). The downside of these options, however, is that they will incur more interest over the life span of the loan.

The author estimates that a third of all direct loan borrowers in repayment, deferment, or forbearance are enrolled in an alternative repayment plan and most of these borrowers are enrolled in plans that don’t require income documentation (and so payments cannot be tied to income). Enrolling in income-based plans could help prevent many defaults, we are told.

The Takeaway

More than seven million borrowers are in default on either a federal or private student loan. As we are once again reminded by the CFPB analysis, defaulting on a federal student loan has serious consequences, much more serious than defaulting on a credit card. Unlike other types of consumer credit, if you default on a federal student loan, you might see your tax refund taken and wages garnished, without a court order. And not even a bankruptcy can save you. The trouble is that it is difficult to see a solution.

Image credit: Flickr / Kate Raynes-Goldie.