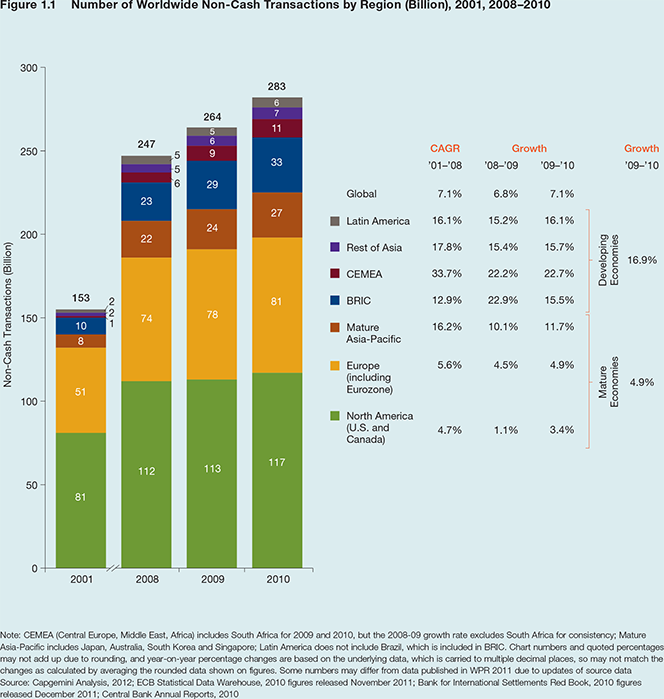

Developing Markets Drive Global Non-Cash Payments Growth

North America, Europe and the high-income Asian countries still account for more than three-quarters of the global non-cash payments volumes, but the growth rate in developing markets is more than three times higher, we learn from the latest World Payments Report from Capgemini—a big French consulting company. The BRIC countries (Brazil, Russia, India and China) are all growing fast, though each of these markets features different payments preferences.

Payment cards continue to account for a steadily rising share of the non-cash transactions in the developed world, and especially in the U.S. and the mature Asian economies, but they are growing fast in the BRIC countries as well, the report tells us. Debit cards in particular are poised to take more market share away from other payment instruments, such as cash and checks, and that process is likely to accelerate as consumers continue to increase their use of emerging instruments, such as mobile payments, and choose to settle these transactions through their debit cards (as many are doing now). Let’s take a look at the data.

Russia, China Lead World in Non-Cash Payments Growth

The global volume of non-cash payments is growing steadily, but the largest gains are occurring in developing markets. Worldwide, non-cash payments volumes increased by 7.1 percent to reach 283 billion in 2010, the most recent year for which data are available for all regions. However, in developing markets volumes grew by 16.9 percent, lifted by a spike of more than 30 percent in both Russia and China. That growth far surpassed the modest increase in volumes in developed markets, which were still feeling the effects of the financial and economic crisis. Yet, at 4.9 percent, the growth in non-cash payments volumes in developed markets still outpaced the rate of growth in gross domestic product (GDP), and developed markets still accounted for close to 80 percent of all non-cash payments transactions globally. Here is a chart of the number of worldwide non-cash transactions for the years 2001 and 2008 – 2010, by region:

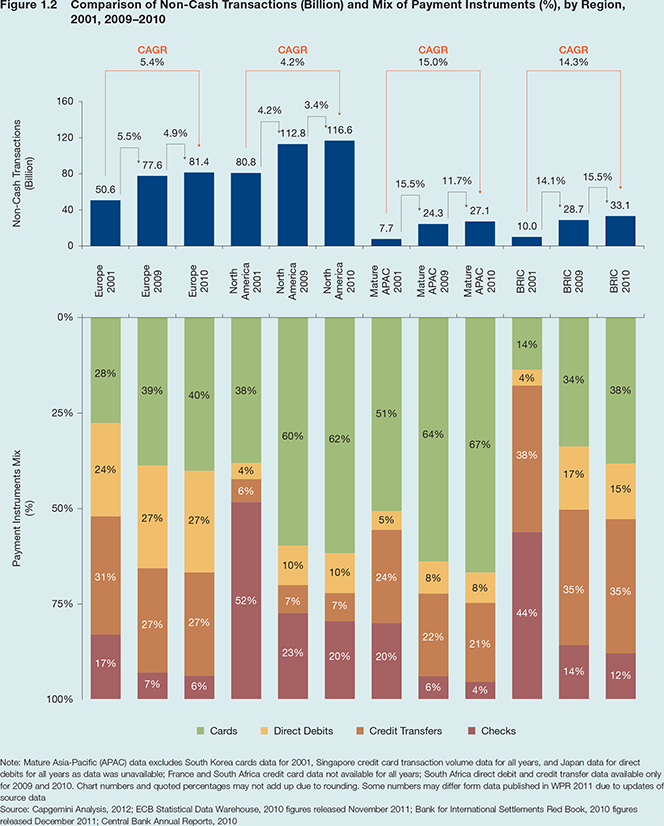

Payment Cards Drive Non-Cash Payments Growth

Debit and credit cards are still the biggest reason why non-cash payment volumes are growing globally. Cards made up 55.8 percent of all non-cash payments in 2010, up from 53.4 percent in 2009 and 35.3 percent in 2001. Debit cards alone were used in more than a third of all payments, partly because the use of cards for smaller-ticket transactions is becoming more prevalent. The use of checks continued to decline (down by 6.7 percent in 2010), whereas the volume of credit transfers and direct debit transactions continued to grow in 2010, though the relative usage of these instruments is gradually decreasing, losing ground to cards. Here is a comparison chart of non-cash transactions and mix of payment instruments, by region:

Cards’ share of non-cash transactions continues to increase in every region. In North America, for example, cards made up 62 percent of non-cash transactions in 2010, up marginally from 60 percent in 2009, and up sharply from 38 percent in 2001. Cards accounted for an even larger share of volumes in the mature Asian markets (67 percent) and are growing fast in the BRIC countries as a whole.

France, Germany and U.K. Largest European Non-Cash Markets

Western Europe as a whole (the thirteen Eurozone countries plus Denmark, Poland, Sweden, and the U.K.) remains the second-biggest payments market in the world, generating 81 billion transactions, or 28.6 percent of the world total, in 2010. France, Germany, and the U.K. are by far the largest European non-cash payments markets, each generating more than 16 billion non-cash transactions in 2010.

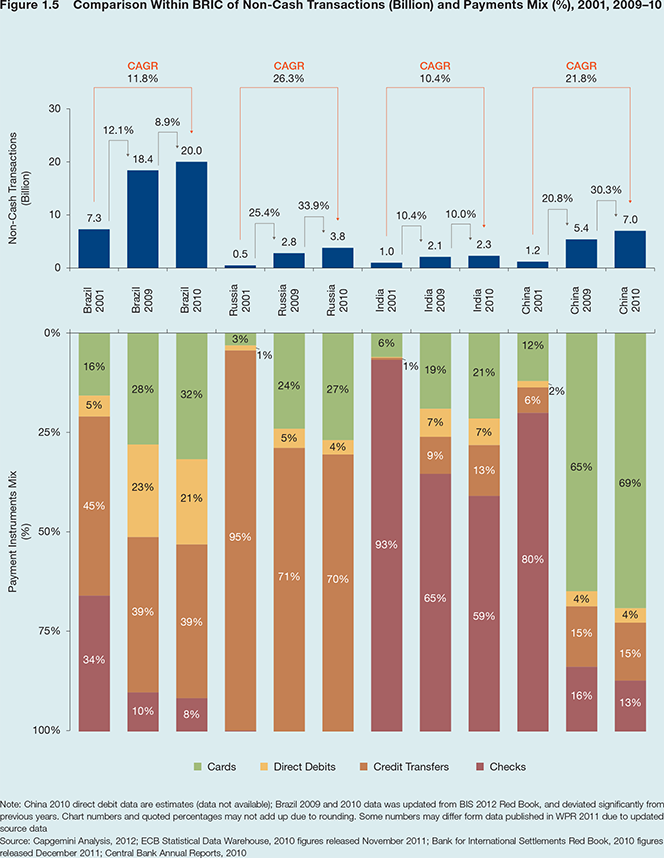

Brazil Largest and Most Mature BRIC Payments Market

Each one of the BRIC countries’ payments industries is at a different stage of maturity and Brazil’s payments market is the largest and most mature one. The number of non-cash payments in that country rose by 8.9 percent in 2010 to 20 billion, making it the third-largest payments market in the world, behind the U.S. and the Eurozone and ahead of the U.K. India’s payments industry, by contrast, is still in a nascent stage of development, while China (30.3 percent) and Russia (33.9 percent) lead the group in terms of payments growth and are now the world’s eighth- and tenth-largest non-cash payments markets, respectively. Here is a comparison chart for the BRIC countries:

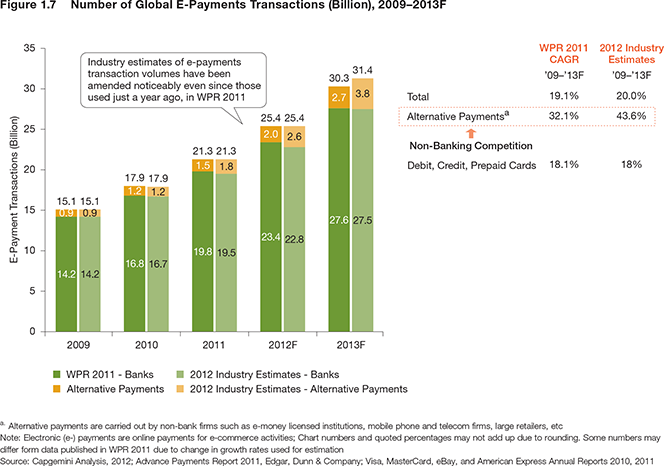

E-Commerce Payments to Reach 31.4 Billion in 2013, Mobile Payments — 17 Billion

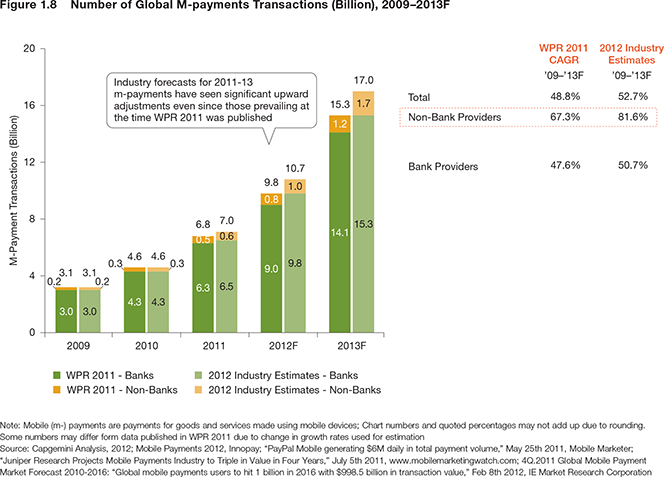

Globally there were 22.5 billion e-commerce and m-payment transactions in 2010, and an estimated 28.3 billion in 2011. Capgemini estimates that the number of online payments will reach 31.4 billion in 2013, after growing at an annual rate of 20 percent in the 2009 – 13 period. Mobile payments are expected to grow even faster—by 52.7 percent a year—to reach 17 billion in 2013. The number of m-payments users worldwide is likely to have already surpassed 141 million in 2011—a 38.2 percent increase from 2010—but that total would still represent a mere 2.1 percent of all mobile users, showing the huge growth potential. Here is a chart showing the increase of e-commerce transactions between 2009 and 2013:

And here is the chart for mobile payments:

The Takeaway

So cash keeps being squeezed out of the economy and the Capgemini report shows that this is no longer a rich-world phenomenon, but a global process. In fact, Poland and Brazil have continued to show superior performance, compared to the other developing markets, and have now joined the ranks of the world’s most mature payments markets.

Growth is especially strong in the area of mobile payments, where, as the report points out, it is “driven in particular by non-banks that have identified an opportunity to cater to niche customer needs, and leverage technology to execute successfully.” And the best thing of all is that such non-banks seem to do just as well, and often better, in less-developed countries, as they do in the developed ones.

Image credit: Dutch-tech.nl.