Credit Card Delinquencies Fall in Every U.S. State

Both the 90-day credit card delinquency rate and the average credit card debt per U.S. borrower fell on an annual basis during the third quarter of 2013, credit reporting agency TransUnion tells us in its latest quarterly analysis of credit-active U.S. consumers. Moreover, the late payments rate has decreased in each one of the 50 states and only two states have seen a minimal increase in their residents’ average debt load, the agency reports. On a quarterly basis, however, both the delinquency rate and the average debt amount have increased, although in the latter case the growth has been nominal.

As TransUnion is fond of pointing out, what makes its Industry Insights Report valuable is the fact that it gives us a quarterly overview of (anonymized) credit data from virtually every credit-active consumer in the United States. The agency tells us that, as of 2013 Q3, it had 334.23 million credit card accounts in its database, up from 327.69 million in 2012 Q3. It is a huge number, but it is way down from the record-high of 408.39 million, measured in 2008 Q3, at the end of which the fall of Lehman Brothers set off the financial crisis and initiated the debt deleveraging process. Well, as the latest Household Debt and Credit quarterly report from the NY Fed indicated earlier this week, that process may have finally run its course, five years later, and now TransUnion offers more data to support that conclusion. Let’s take a closer look at the numbers.

Credit Card Debt Falls in Every State but Two

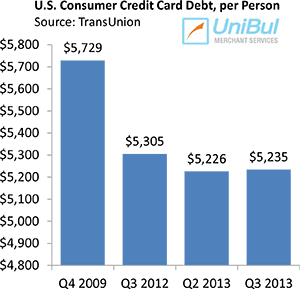

The average amount of credit card debt owed by U.S. borrowers in the third quarter of 2013 was $5,235, down by 1.3 percent from a year ago ($5,305) and virtually unchanged from the level recorded in the previous quarter—$5,226. In fact, this is the second quarter in a row, in which the debt average has remained virtually flat on a quarterly basis. The current total is still substantially lower—by $503 or 8.8 percent—than the peak of $5,729, reached in 2009 Q4.

The average amount of credit card debt owed by U.S. borrowers in the third quarter of 2013 was $5,235, down by 1.3 percent from a year ago ($5,305) and virtually unchanged from the level recorded in the previous quarter—$5,226. In fact, this is the second quarter in a row, in which the debt average has remained virtually flat on a quarterly basis. The current total is still substantially lower—by $503 or 8.8 percent—than the peak of $5,729, reached in 2009 Q4.

Unlike in previous quarterly reports, this time TransUnion is not giving us the rankings of the U.S. states whose residents have the highest and lowest average credit card debt. I guess the authors may have gotten tired of Alaska leading the table every single quarter. What we get instead is the numbers for “selected states”, which, by the way, happen to be the most populous ones in the country. Here they are:

- California — $5,332.

- Florida — $5,265.

- Illinois — $5,295.

- New York — $5,386.

- Texas — $5,478.

The biggest annual declines, we learn, were registered in the following states:

- Arizona — 3.1%.

- Nevada — 2.7%.

- California — 2.6%.

The only two states where the average went up were Vermont and Rhode Island and in both cases the increase was a fifth of one percent.

Credit Card Delinquencies Fall in Every State

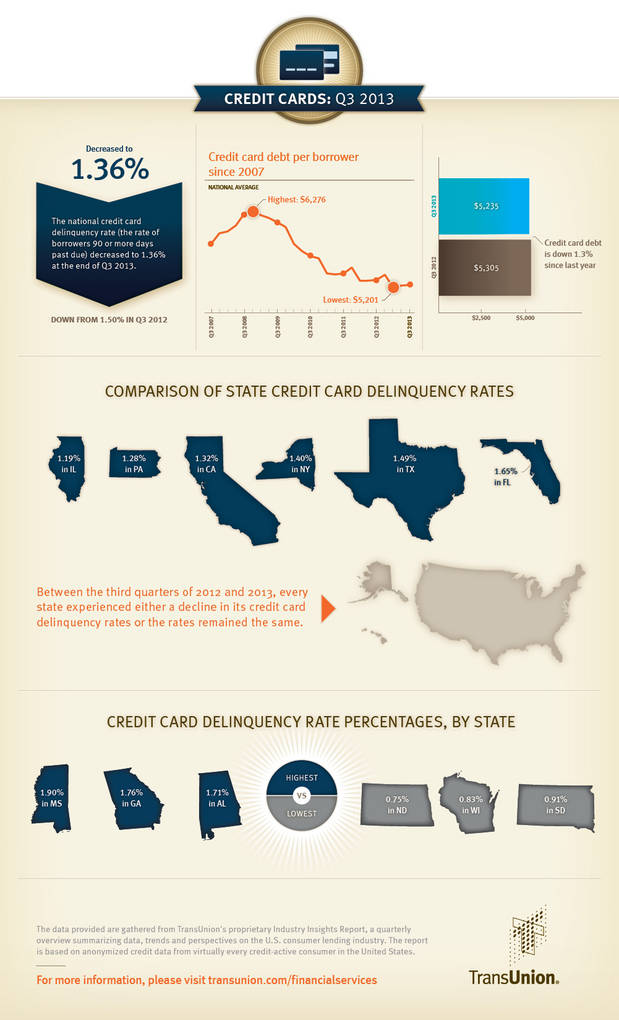

TransUnion reports that the national credit card delinquency rate fell to 1.36 percent in the third quarter, down by 14 basis points (9.3 percent) from the 1.5-percent level measured in Q3 2012, but up from the 1.27-percent level recorded in the previous quarter. Every state registered either a decrease in its residents’ credit card delinquency rate between Q3 2012 and Q3 2013 or it remained flat.

TransUnion’s quarterly report gives us a different look at the U.S. credit card delinquency landscape than what we get from the big issuers’ monthly regulatory filings, because the credit agency tracks the debt repayment behavior of American consumers, rather than changes in individual credit card accounts, which is what the issuers do. As some consumers are late on more than one of their credit card accounts at any given time (in fact, this is usually the case), the average rates reported by the issuers are higher than the one reported by TransUnion. Unlike the issuers, the agency’s database contains data for all of a consumer’s accounts, which allows it to calculate the share of consumers who are late on a payment to any one (or more than one) of their credit cards.

Furthermore, whereas TransUnion defines an account as delinquent if a payment is late by 90 days or more, the issuers use two shorter time periods: early-stage delinquencies for payments late by 30-59 days and late-stage delinquencies for the ones overdue by 60 days or more. The upshot is that the agency’s delinquency rate falls somewhere between the card issuers’ delinquency and charge-off rates (accounts are typically charged off as losses at 180 days after the last payment on the account was received).

Now here are the delinquency rates released, once again, for “selected states” in 2013 Q3:

- California — 1.32%.

- Florida — 1.65%.

- Illinois — 1.19%.

- New York — 1.40%.

- Texas — 1.49%.

The biggest year-over-year delinquency decrease was recorded in Massachusetts—19.1 percent (down from 1.62 percent to 1.31 percent). The smallest decline was measured in North Dakota where the delinquency rate in fact remained unchanged at 0.75 percent.

Americans Ask for, Get More New Credit Cards

TransUnion reports that originations of new accounts increased to 11.05 million in the second quarter of 2013, up from 10.41 million in 2012 Q2 (they’ve looked one quarter in arrears “to ensure all accounts are included in the data”). Yet, as the authors note, this number is nowhere near to the highs of six years ago when there were 17.74 million new account originations in a single quarter.

Moreover, TransUnion also finds that the non-prime U.S. population (consumers with a VantageScore credit score lower than 700) continues to account for a much smaller share of all credit card loans. At 29.06 percent in 2013 Q3, that ratio is actually down from the 29.82 percent recorded in the same period last year. Here is how Ezra Becker, the vice president of research and consulting in TransUnion’s financial services business unit, explains the issuers’ ongoing reluctance to re-enter non-prime territory:

Both the demand for and the supply of credit cards appears to be rising. It’s a good trend for consumers and lenders alike, particularly as delinquency rates remain low… Yet despite low delinquency numbers, card lenders have remained cautious in their underwriting, as can be seen by the differences in originations from the recent past in terms of both overall volume and the portion of new cards going to non-prime consumers.

Well, I wouldn’t be at all surprised if caution remains a defining feature in credit card underwriting policies for some time to come.

The Takeaway

Here is how Becker interprets his report’s findings:

While consumer credit card delinquencies increased on a quarterly basis, they continued an overall trend of strong performance as evidenced by the yearly decline… Our data show that consumers continue to deleverage, with balances dropping in the past year and remaining near historical lows. It appears that, with continued strong credit performance and relatively low debt levels, consumers may be in a strong position to receive more attractive, feature-rich offers from credit card lenders.

Well, for my part, I read TransUnion’s data as providing another indication that the post-Lehman consumer debt deleveraging process may have now ended. Both credit card debt and delinquency levels have remained virtually flat for several months now and all other consumer debt categories (save the home equity lines of credit) have expanded by healthy amounts in 2013 Q3. Of course, that may be an aberration, but we will see.

Here are TransUnion’s findings presented in an infographic:

Image credit: Flickr / 401(K) 2013.