Consumer Credit Card Use Falls for 26th Consecutive Month

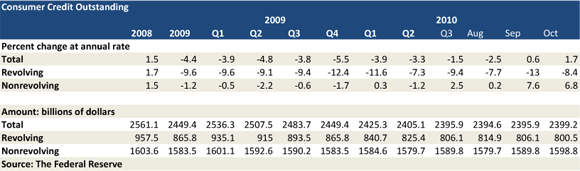

Americans cut back on their credit card spending in October, marking the 26th consecutive month of decline, according to the latest data released by the Federal Reserve. Outstanding revolving credit — comprised mostly of credit card balances — fell by $5.6 billion in October from September, a decrease of 8.4 percent at an annualized rate. This comes after a fall of $8.3 billion the previous month.

This new belt-tightening trend began with the onset of the financial meltdown just over two years ago. Overall, since its peak in August 2008, revolving credit in the U.S. has dropped by $173.1 billion, from $973.6 billion to $800.5 billion, a decrease of 17.8 percent. During this period the average U.S. family with outstanding credit card debt — 54 million by the Fed’s count — has reduced it by $3,205, according to the report.

Non-revolving credit, however, rose for a third month in a row. The increase in October was by an unadjusted $31.8 billion from the previous month and was mostly due to an increase in education-related lending by the federal government.

Overall, outstanding consumer credit rose by $3.38 billion In October after climbing by a revised $1.23 billion in September. It was its third consecutive month of increase.

Fed’s report showed that car sales jumped to their highest level in a year and holiday purchases have also improved.

A separate study, released by the Fed last week, showed that, from 2006 to 2009, the use of all types of electronic payments grew, with the exception of credit cards. Overall, the number of non-cash payments in the U. S. increased by 4.6 percent per year for the period, slightly above the rate for the previous three-year period — 4.5 percent.

In 2009 more than three-quarters of all U.S. non-cash payments were made electronically, a 9.3 percent annual increase since the Fed’s last study in 2007.

The use of non-cash payments, on the other hand, declined at an annual rate of 1.6 percent over the last three years compared to an annual growth rate of 3.9 percent from 2003 to 2006, according to the Fed’s data.

Here are some of the key numbers in Fed’s report for 2009, as compared to 2006:

- There were 21.6 billion credit card payments — a value of $1.9 trillion — slightly down from 21.7 billion.

- Debit card payments rose to 37.9 billion — a value of $1.5 trillion — from 25 billion.

- Automated-clearinghouse (ACH) payments rose to 19.1 billion — a value of $37.2 trillion — from 14.6 billion.

- Prepaid-card payments rose to 6 billion — a value of $0.1 trillion — from 3.3 billion.

- Checks paid fell to 24.4 billion — a value of $31.6 trillion — from 30.5 billion.

- More than three-quarters of all U.S. non-cash payments were made electronically, up from about two-thirds.

- The total number of non-cash payments rose to 108.9 billion from 95.2 billion.

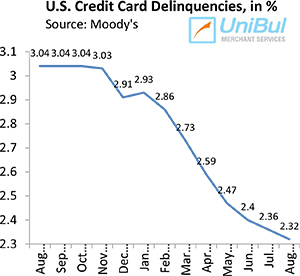

So it is clear that U.S. consumers are moving away from cash and checks, but the two reports also make it clear that Americans are becoming increasingly credit averse and their preferences are shifting towards payment methods that are less likely to push them further into debt.

4 years into the financial crisis people are still mostly interested in paying down existing debt and there is a lot more left to be repaid. So this is a process that will go on for many more months, maybe years.