Checks Still Dominate P2P Payments and Other Facts

Despite the highly-publicized arrival of various new forms of person-to-person (P2P) payments in the U.S. over the past decade and a half, paper checks still dominate the niche, we learn from a recent paper by Terri Bradford and William R. Keeton from the Federal Reserve Bank of Kansas City. What is more, the number of checks written for P2P transactions is still on the rise.

Bradford and Keeton are giving us a brief overview of the pre-1990s history of P2P payments and then go on to evaluate the recently emerged digital alternatives to the check-based P2P payments. Their conclusion is that “the new P2P methods improve on paper checks in a number of ways but leave important gaps, suggesting a need for further innovation”. In this post I will highlight the researchers’ findings on the three new P2P methods, which I thought might be of interest to many of you.

PayPal’s Domination

There is no universally-accepted definition of P2P payments, but here is how the two Kansas City Fed researchers define the term:

P2P payments include payments by individuals to friends and family members and to other individuals for goods and services. The latter group is often referred to as “micro-merchants.” They include gardeners, babysitters, independent repairmen and individuals selling goods through classified ads or online auction markets such as eBay.

Up until the late 1990s of the last century, P2P payments were conducted “almost entirely by cash and check”, we are reminded. Then things started to change very fast:

In the late 1990s, the spread of the Internet and growth in online auctions gave rise to new nonbank-centric payment methods. In such payment methods, the payer initiates the payment with a nonbank company, and that company acts as a middleman between the payer and the payee. Nonbank-centric P2P payment methods had been offered since the previous century by companies such as Western Union. To make a payment, however, the payer was required to visit a brick-and-mortar branch of the company. With the spread of the Internet, it became feasible for consumers to make such payments from their personal computers. In addition, the spread of the Internet led to rapid growth in online auctions such as eBay. These online auctions increased the demand for a new P2P payment method that better satisfied the needs of buyers and sellers who did not know each other and lived in different areas.

While several nonbank intermediaries competed for the payments business in online auctions, PayPal quickly emerged the clear winner. PayPal’s success was due partly to its first-mover advantage and partly to the fact that it offered payment services below cost to build business. Growth in accounts was also facilitated by the fact that recipients had to set up a PayPal account to receive their funds. These factors allowed PayPal to widen its lead over its competitors, helping induce eBay to acquire PayPal in 2002.

PayPal’s growth has indeed been spectacular:

PayPal’s is the only non-bank centric P2P service to gain “significant traction among consumers”, the researchers tell us.

Bank-Centric and Card-Centric P2P Services

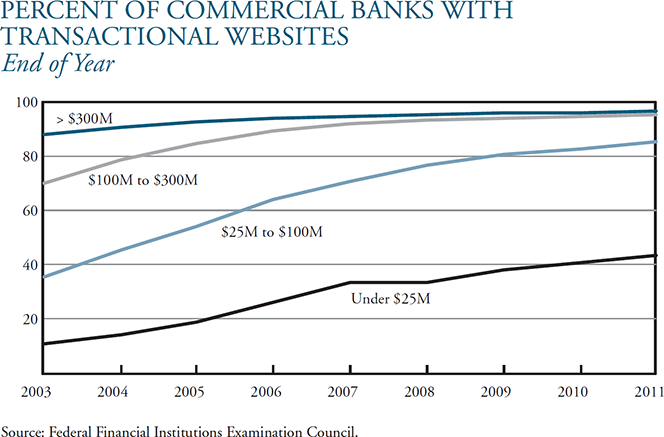

Lately, PayPal’s P2P dominance has been challenged by the emergence of two new models. The first is what Bradford and Keeton call “bank-centric” method where PayPal’s intermediary has been dispensed with. As the name implies, in a “bank-centric” transaction the user would transfer funds from her own bank account directly to that of another individual at another bank. At the end of 2011, 90 percent of U.S. commercial banks facilitated such transactions for their customers (see chart below).

Then last year Bank of America, Wells Fargo, and J.P. Morgan Chase formed clearXchange — a P2P payment platform that enables users to send money from their own checking accounts to these of other customers of the participating banks. As the Kansas City Fed researchers point out, that was an important development because, even though in its initial version the consortium was made up of only three banks, these banks “account for 29 percent of total U.S. bank, thrift, and credit union deposits”. Moreover, the platform is open for other banks to join in and it is very likely that many will do just that.

Finally, the researchers highlight the “card-centric method” where P2P payments are “processed entirely over a debit card or credit card network”. This is by far the most lightly used of the three new P2P methods and it is very likely that the services given as examples will be unknown to you. One of them is Visa’s Money Transfer (VMT), which at present is only supported in the U.S. by U.S. Bank.

The Takeaway

So what does the future hold for P2P payments? Here is the two Kansas City Fed researchers’ view:

While many new P2P payment methods have been introduced over the last decade, cash and checks remain the primary methods for making such payments, with checks occupying an especially important role. In other types of consumer payments, such as bill payments and purchases from stores, the number of payments made by check has declined sharply as electronic payment methods have become more popular. In the case of P2P payments, however, the number of payments by check has continued to grow moderately.

Bradford and Keeton proceed to give us more data and analyze the reasons for the slow adoption of the new P2P payment methods, concluding that “ample scope remains for innovation in P2P payments”. The researchers suggest that the Federal Reserve could take a more central role in promoting P2P adoption “because it has secure electronic links to all U.S. banks and a clear mission to promote a safe and efficient payment system.” That sounds logical, but somehow I just can’t imagine the Fed embarking on such a project.

Image credit: Banking4tomorrow.com.